Westjet 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

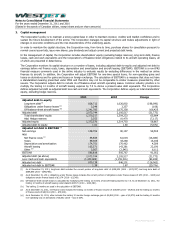

3. Capital management

The Corporation’s policy is to maintain a strong capital base in order to maintain investor, creditor and market confidence and to

sustain the future development of the airline. The Corporation manages its capital structure and makes adjustments in light of

changes in economic conditions and the risk characteristics of the underlying assets.

In order to maintain the capital structure, the Corporation may, from time to time, purchase shares for cancellation pursuant to

normal course issuer bids, issue new shares, pay dividends and adjust current and projected debt levels.

In the management of capital, the Corporation includes shareholders’ equity (excluding hedge reserves), long-term debt, finance

leases, cash and cash equivalents and the Corporation’s off-balance-sheet obligations related to its aircraft operating leases, all

of which are presented in detail below.

The Corporation monitors its capital structure on a number of bases, including adjusted debt-to-equity and adjusted net debt to

earnings before net finance costs, taxes, depreciation and amortization and aircraft leasing (EBITDAR). EBITDAR is a non-IFRS

financial measure commonly used in the airline industry to evaluate results by excluding differences in the method an airline

finances its aircraft. In addition, the Corporation will adjust EBITDAR for one-time special items, for non-operating gains and

losses on derivatives and for gains and losses on foreign exchange. The calculation of EBITDAR is a measure that does not have

a standardized meaning prescribed under IFRS and therefore may not be comparable to similar measures presented by other

issuers. The Corporation adjusts debt to include its off-balance-sheet aircraft operating leases. Common industry practice is to

multiply the trailing 12 months of aircraft leasing expense by 7.5 to derive a present-value debt equivalent. The Corporation

defines adjusted net debt as adjusted debt less cash and cash equivalents. The Corporation defines equity as total shareholders’

equity, excluding hedge reserves.

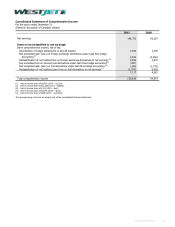

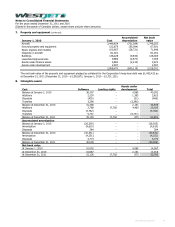

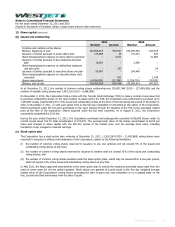

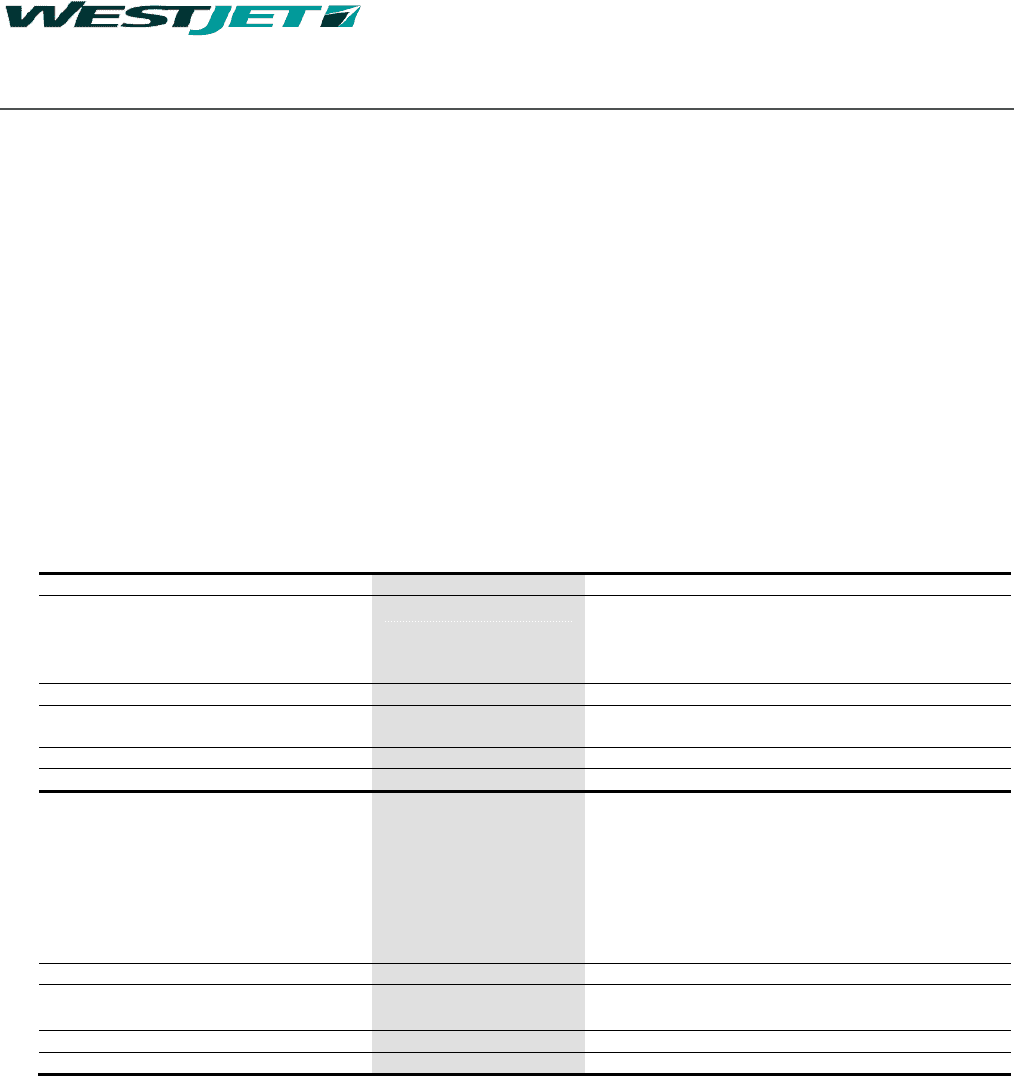

2011 2010 Chan

g

e

Adjusted debt-to-equity

Long-term debt (i) 828,712 1,026,802 )198,090(

Obligations under finance leases (ii) 3,249 3,357 )108(

Off-balance-sheet aircraft leases (iii) 1,241,783 1,075,358 166,425

Adjusted debt 2,073,744 2,105,517 )31,773(

Total shareholders’ equity 1,370,217 1,304,233 65,984

Add: Hedge reserves 3,353 10,470 )7,117(

Adjusted equity 1,373,570 1,314,703 58,867

Adjusted debt-to-equity 1.51 1.60 %)5.6(

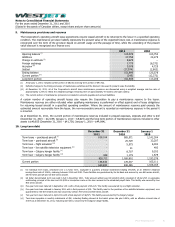

A

d

j

usted net debt to EBITDAR (iv)

Net earnings 148,702 90,197 58,505

Add:

Net finance costs (v) 44,924 61,004 )16,080(

Taxes 59,304 43,268 16,036

Depreciation and amortization 174,751 170,462 4,289

Aircraft leasing 165,571 143,381 22,190

Other (vi) 3,567 (2,545) 6,112

EBITDAR 596,819 505,767 91,052

Adjusted debt (as above) 2,073,744 2,105,517 )31,773(

Less: Cash and cash equivalents )1,243,605( (1,159,316) )84,289(

Adjusted net debt 830,139 946,201 )116,062(

Adjusted net debt to EBITDAR 1.39 1.87 %)25.7(

(i) As at December 31, 2011, long-term debt includes the current portion of long-term debt of $158,832 (2010 – $178,337) and long-term debt of

$669,880 (2010 – $848,465).

(ii) As at December 31, 2011, obligations under finance leases includes the current portion of obligations under finance leases of $75 (2010 – $108) and

obligations under finance leases of $3,174 (2010 – $3,249).

(iii) Off-balance-sheet aircraft leases is calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. As at December 31, 2011, the

trailing 12 months of aircraft leasing costs totaled $165,571 (2010 – $143,381).

(iv) The trailing 12 months are used in the calculation of EBITDAR.

(v) As at December 31, 2011, net finance costs includes the trailing 12 months of finance income of $15,987 (2010 – $9,910) and the trailing 12 months

of finance costs of $60,911 (2010 – $70,914).

(vi) As at December 31, 2011, other includes the trailing 12 months foreign exchange gain of $2,485 (2010 – gain of $2,579) and the trailing 12 months

non-operating loss on derivatives of $6,052 (2010 – loss of $34).

WestJet Annual Report 2011 78