Westjet 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

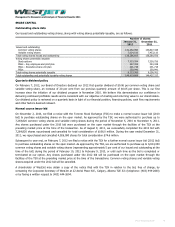

Sales and distribution

Included in sales and distribution expenses are commissions and incentives paid to travel agents, credit card settlement fees,

Global Distribution Systems (GDS) fees, transaction fees related to our reservation system, costs of our call centre, as well as

sales and distribution costs associated with WestJet Vacations.

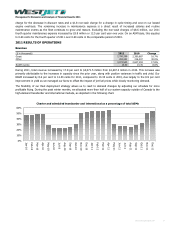

Sales and distribution expenses increased to $273.4 million in 2011, representing an increase of 6.9 per cent from $255.7

million in 2010. On an ASM basis, sales and distribution improved by 0.8 per cent to 1.29 cents in 2011, as compared to 1.30

cents in the prior year. We are pleased with this trend because as we continue to grow as an airline and vacation package

provider, managing our sales and distribution expenses becomes increasingly important. During 2011, we reduced

compensation paid to our travel agents and with low-cost options in mind, we enhanced our direct channel and self-serve

options through website improvements and the implementation of an interactive voice response system for use in our call

centre.

Maintenance

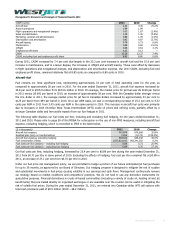

Maintenance expense for the year ended December 31, 2011 was $146.3 million, a 24.9 per cent increase from $117.1 million

in the comparable period of 2010. Our maintenance cost per ASM was 0.69 cents in 2011, representing an increase of 15.0

per cent from 0.60 cents in 2010. This year-over-year increase was mainly attributable to an increase in overall maintenance

events as our fleet continues to grow and mature as well as changes in estimates included within our maintenance provision

for leased aircraft. In accordance with IFRS, we provide for the future costs of certain overhaul maintenance activities on our

leased aircraft over the term of the lease rather than expense as incurred. Our provision is calculated based on the best

information available to us and includes estimates on maintenance cycle timing, total cost and discount rates. Any difference

from the provided amount and the actual amount incurred is recognized in the period the activity is performed. Furthermore,

IFRS requires us to adjust the provision as changes in the discount rate used to determine the present value occur. During

2011, the $29.2 million year-over-year increase in maintenance expense included a $6.8 million non-cash charge for the

decrease in discount rates used to present value the liability, a $1.8 million non-cash charge for a change in cycle timing and

cost on our leased engine overhauls and a $4.9 million charge as a result of the actual cost and timing of engine overhauls

differing from our estimate. The remaining increase in maintenance expense is a direct result of increased salaries and routine

maintenance events as our fleet continues to grow and mature.

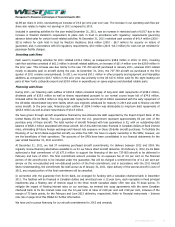

Compensation

Our compensation philosophy is designed to align corporate and personal success. We have created a compensation plan

whereby a portion of our expenses are variable and are tied to our financial results. Our compensation strategy encourages

employees to become owners in WestJet, which creates a personal vested interest in our financial results and

accomplishments.

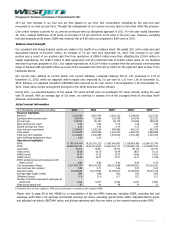

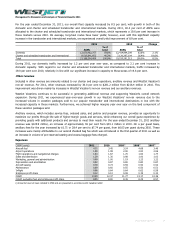

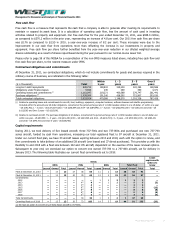

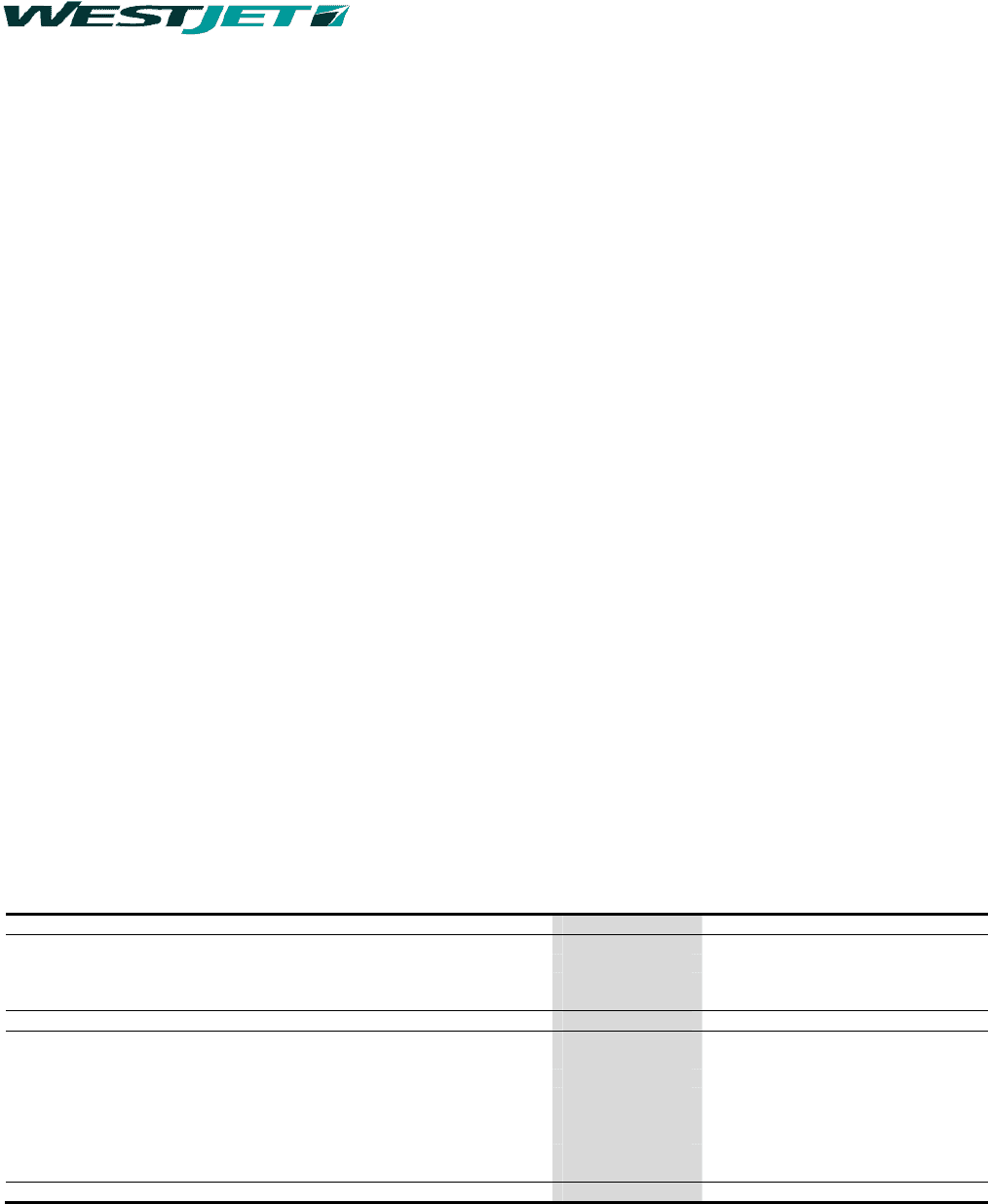

($ in thousands) 2011 2010 Change

Salaries and benefits 481,211 439,617 9.5%

Employee share purchase plan 58,682 52,643 11.5%

Employee profit share 23,804 22,222 7.1%

Share-based payment plans 12,553 15,497 (19.0%)

576,250 529,979 8.7%

Presentation on the statement of earnings:

Airport operations 83,067 78,679 5.6%

Flight operations and navigational charges 184,143 171,403 7.4%

Sales and distribution 46,915 46,349 1.2%

Marketing, general and administration 86,066 76,353 12.7%

Maintenance 43,772 38,919 12.5%

Inflight 108,483 96,054 12.9%

Employee profit share 23,804 22,222 7.1%

576,250 529,979 8.7%

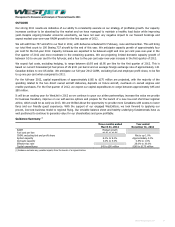

Salaries and benefits

Salaries and benefits are determined via a framework of job levels based on internal experience and external market data.

During 2011, salaries and benefits increased by 9.5 per cent to $481.2 million from $439.6 million in 2010. This increase was

primarily due to an increase in our total number of full-time equivalent employees of 3.8 per cent to 7,141 employees at

December 31, 2011 (2010 – 6,877 employees) as well as our annual market and merit increases. This was offset by salary

WestJet Annual Report 2011 31