Westjet 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

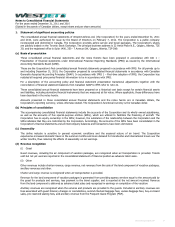

1. Statement of significant accounting policies (continued)

(s) Critical accounting judgments and estimates (continued)

(viii) Income taxes

Deferred tax assets and liabilities contain estimates about the nature and timing of future permanent and temporary differences

as well as the future tax rates that will apply to those differences. Changes in tax laws and rates as well as changes to the

expected timing of reversals may have a significant impact on the amounts recorded for deferred tax assets and liabilities.

Management closely monitors current and potential changes to tax law and bases its estimates on the best available information

at each reporting date.

(ix) Impairment of assets

Impairment assessments may require the Corporation to determine the recoverable amount of a CGU, defined as the smallest

identifiable group of assets that generates cash inflows independent of other assets. This determination requires significant

estimates in a variety of areas including: the determination of fair value, selling costs, timing and size of cash flows, and discount

and interest rates. The Corporation documents and supports all assumptions made in the determination of a recoverable amount

and updates these assumptions to reflect the best information available to the Corporation if and when an impairment

assessment requires the recoverable amount of a CGU to be determined.

(x) Fair value of share-based payments

The Corporation uses an option pricing model to determine the fair value of certain share-based payments. Inputs to the model

are subject to various estimates about volatility, interest rates, dividend yields and expected life of the units issued. Fair value

inputs are subject to market factors as well as internal estimates. The Corporation considers historic trends together with any

new information to determine the best estimate of fair value at the date of grant.

Separate from the fair value calculation, the Corporation is required to estimate the expected forfeiture rate of equity-settled

share-based payments. The Corporation has assessed forfeitures to be insignificant based on the underlying terms of its payment

plans.

(xi) Fair value of derivative instruments

The fair value of derivative instruments is estimated using inputs, including forward prices, foreign exchange rates, interest rates

and historical volatilities. These inputs are subject to change on a regular basis based on the interplay of various market forces.

Consequently, the fair value of the Corporation’s derivative instruments are subject to regular changes in fair value each

reporting period.

WestJet Annual Report 2011 76