Westjet 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

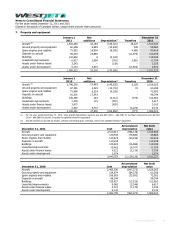

Notes to Consolidated Financial Statements

For the years ended December 31, 2011 and 2010

(Stated in thousands of Canadian dollars, except share and per share amounts)

│

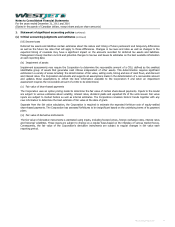

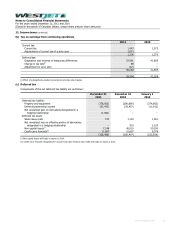

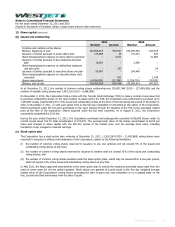

13. Share capital (continued)

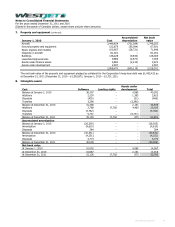

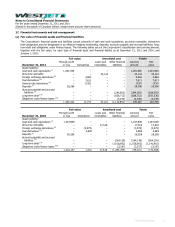

(b) Issued and outstanding

2011 2010

Number Amount Number Amount

Common and variable voting shares:

Balance, beginning of year 142,958,414 647,637 144,359,383 633,075

Issuance of shares pursuant to stock option plan 173,584 34 741,014 520

Share-based payment expense on stock options exercised – 4,011 – 21,860

Issuance of shares pursuant to key employee and pilot

plan 18,681 – 2,298 –

Share-based payment expense on settled key employee

and pilot units – 252 – 29

Issuance of shares pursuant to executive share unit plan 55,967 – 194,449 –

Share-based payment expense on executive share units

exercised – 832 – 2,748

Shares repurchased )4,926,090( )22,358( (2,338,730) (10,595)

Balance, end of year 138,280,556 630,408 142,958,414 647,637

As at December 31, 2011, the number of common voting shares outstanding was 130,827,446 (2010 – 137,489,456) and the

number of variable voting shares was 7,453,110 (2010 – 5,468,958).

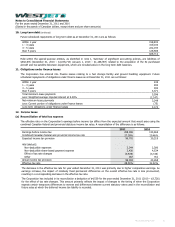

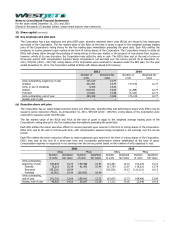

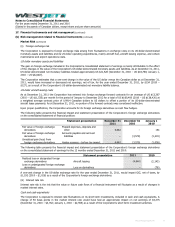

On November 2, 2010, the Corporation filed a notice with the Toronto Stock Exchange (TSX) to make a normal course issuer bid

to purchase outstanding shares on the open market. As approved by the TSX, the Corporation was authorized to purchase up to

7,264,820 shares (representing 5% of its issued and outstanding shares at the time of the bid) during the period of November 5,

2010, to November 4, 2011, or until such earlier time as the bid was completed or terminated at the option of the Corporation.

Shares purchased under the bid were purchased on the open market through the facilities of the TSX at the prevailing market

price at the time of the transaction. Shares acquired under the bid were cancelled. As of August 9, 2011, the Corporation

successfully completed the 2010 bid.

During the year ended December 31, 2011, the Corporation purchased and subsequently cancelled 4,926,090 shares under its

normal course issuer bid for total consideration of $74,570. The average book value of the shares repurchased of $4.54 per

share was charged to share capital with the $52,212 excess of the market price over the average book value, including

transaction costs, charged to retained earnings.

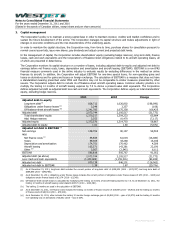

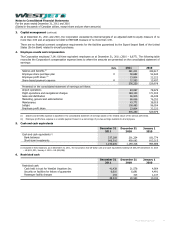

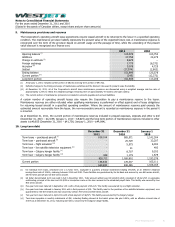

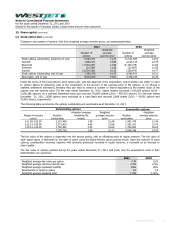

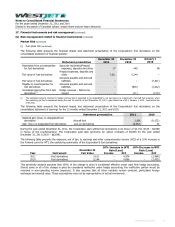

(c) Stock option plan

The Corporation has a stock option plan, whereby at December 31, 2011, 11,520,284 (2010 – 11,693,868) voting shares were

reserved for issuance to officers and employees of the Corporation, subject to the following limitations:

(i) the number of common voting shares reserved for issuance to any one optionee will not exceed 5% of the issued and

outstanding voting shares at any time;

(ii) the number of common voting shares reserved for issuance to insiders shall not exceed 10% of the issued and outstanding

voting shares; and

(iii) the number of common voting shares issuable under the stock option plans, which may be issued within a one-year period,

shall not exceed 10% of the issued and outstanding voting shares at any time.

In May 2011, the Board approved amendments to the stock option plan to extend the maximum permitted expiry date from five

years to seven years for all new options granted. Stock options are granted at a price equal to the five day weighted average

market value of the Corporation’s voting shares preceding the date of grant and vest completely or on a graded basis on the

first, second and third anniversary from the date of grant.

WestJet Annual Report 2011 86