Westjet 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Results 2011

│

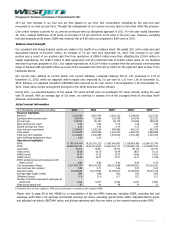

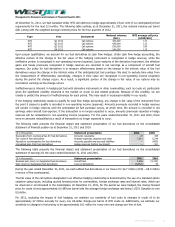

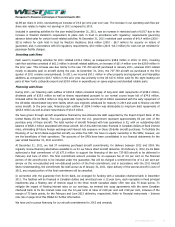

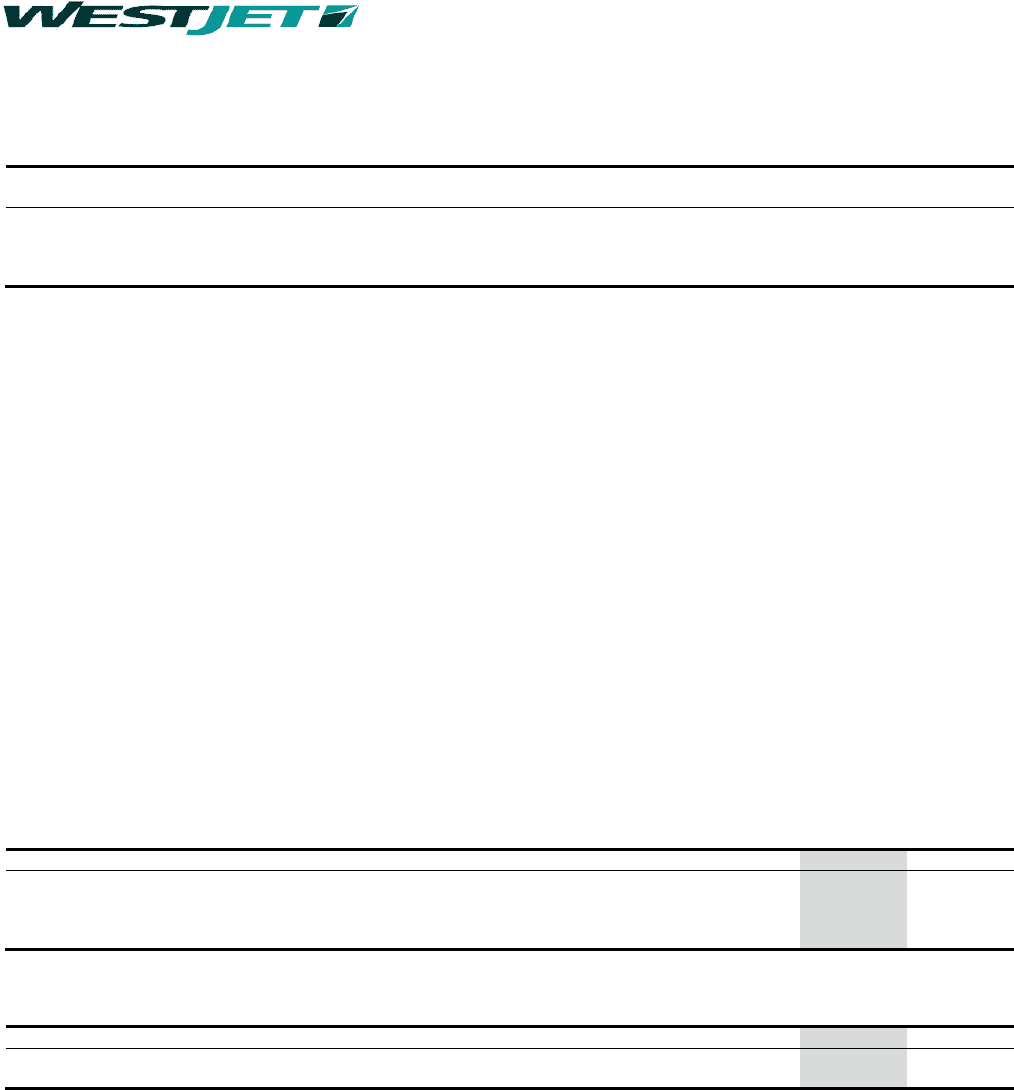

At December 31, 2011, we had Canadian-dollar WTI call options to hedge approximately 23 per cent of our anticipated jet fuel

requirements for the next 12 months. The following table outlines, as at December 31, 2011, the notional volumes per barrel

(bbl.) along with the weighted average contract prices for the four quarters of 2012.

Type Year Instrument

Notional volumes

(bbl.) WTI average call price

($CAD/bbl.)

WTI Q1 2012 Call options 420,000 117

WTI Q2 2012 Call options 430,000 112

WTI Q3 2012 Call options 520,000 109

WTI Q4 2012 Call options 240,000 115

Upon proper qualification, we account for our fuel derivatives as cash flow hedges. Under cash flow hedge accounting, the

effective portion of the change in the fair value of the hedging instrument is recognized in hedge reserves, while the

ineffective portion is recognized in non-operating income (expense). Upon maturity of the derivative instrument, the effective

gains and losses previously recognized in hedge reserves are recorded in net earnings as a component of aircraft fuel

expense. Our policy for fuel derivatives is to measure effectiveness based on the change in the intrinsic value of the fuel

derivatives versus the change in the intrinsic value of the anticipated jet fuel purchase. We elect to exclude time value from

the measurement of effectiveness; accordingly, changes in time value are recognized in non-operating income (expense)

during the period the change occurs. As a result, a significant portion of the change in fair value of our options may be

recorded in earnings as the change occurs.

Ineffectiveness is inherent in hedging jet fuel with derivative instruments in other commodities, such as crude oil, particularly

given the significant volatility observed in the market on crude oil and related products. Because of this volatility, we are

unable to predict the amount of ineffectiveness for each period. This may result in increased volatility in our results.

If the hedging relationship ceases to qualify for cash flow hedge accounting, any change in fair value of the instrument from

the point it ceases to qualify is recorded in non-operating income (expense). Amounts previously recorded in hedge reserves

will remain in hedge reserves until the anticipated jet fuel purchase occurs, at which time, the amount is recorded in net

earnings under aircraft fuel expense. If the transaction is no longer expected to occur, amounts previously recorded in hedge

reserves will be reclassified to non-operating income (expense). For the years ended December 31, 2011 and 2010, there

were no amounts reclassified as a result of transactions no longer expected to occur.

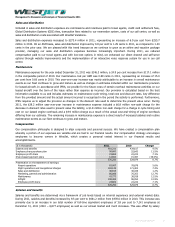

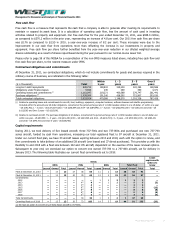

The following table presents the financial impact and statement presentation of our fuel derivatives on the consolidated

statement of financial position as at December 31, 2011 and 2010.

($ in thousands) Statement presentation 2011 2010

Receivable from counterparties for fuel derivatives Accounts receivable 27 445

Fair value of fuel derivatives Prepaid expenses, deposits and other 7,611 5,244

Payable to counterparties for fuel derivatives Accounts payable and accrued liabilities ― (800)

Unrealized gain from fuel derivatives Hedge reserves (before tax impact) ― (11)

The following table presents the financial impact and statement presentation of our fuel derivatives on the consolidated

statement of earnings for the years ended December 31, 2011 and 2010.

($ in thousands) Statement presentation 2011 2010

Realized gain (loss) on designated fuel derivatives Aircraft fuel 2,656 (9,172)

Gain (loss) on designated fuel derivatives Loss on derivatives (6,052) 44

During the year ended December 31, 2011, we cash settled fuel derivatives in our favour for $2.7 million (2010 – $9.0 million

in favour of the counterparty).

The fair value of the call options designated in an effective hedging relationship is determined by the use of a standard option

valuation using inputs, including quoted forward prices for commodities, foreign exchange rates and interest rates, which can

be observed or corroborated in the marketplace. At December 31, 2011, for the period we were hedged, the closing forward

price for crude oil was approximately US $99 per barrel with the average foreign exchange rate being 1.0251 Canadian to one

US dollar.

For 2012, excluding the impact of fuel hedging, we estimate our sensitivity of fuel costs to changes in crude oil to be

approximately $7 million annually for every one US-dollar change per barrel of WTI crude oil. Additionally, we estimate our

sensitivity to changes in fuel pricing to be approximately $11 million for every one-cent change per litre of fuel.

WestJet Annual Report 2011 30