Wells Fargo 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

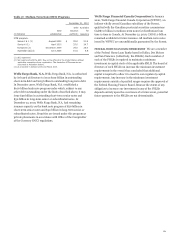

The following accounting pronouncement has been issued by the

Financial Accounting Standards Board (FASB):

Current Accounting Developments

• Accounting Standards Update (ASU) 2011-01, Deferral of

the Effective Date of Disclosures about Troubled Debt

Restructurings in Update No. 2010-20.

ASU 2011-01 defers the effective date for disclosures on TDRs.

The deferral is intended to provide the FASB with additional

time to complete a separate TDRs project, with new disclosures

expected to be effective for second quarter 2011. For more

information on the disclosure requirements for TDRs, see the

discussion on ASU 2010-20, Disclosures about the Credit

Quality of Financing Receivables and the Allowance for Credit

Losses, in Note 1 (Summary of Significant Accounting Policies) to

Financial Statements in this Report.

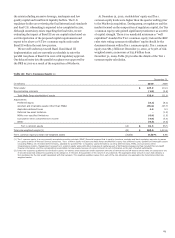

This Report contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as

“anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,”

“expects,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,”

“should,” “can” and similar references to future periods.

Examples of forward-looking statements in this Report include,

but are not limited to, statements we make about: (i) future

results of the Company; (ii) future credit quality and

expectations regarding future loan losses in our loan portfolios

and life-of-loan estimates, including our belief that quarterly

total credit losses have peaked and that our credit cycle is

turning; the level and loss content of NPAs and nonaccrual loans

as well as the level of inflows and outflows into NPAs; the

adequacy of the allowance for credit losses, including our current

expectation of future reductions in the allowance for credit

losses; and the reduction or mitigation of risk in our loan

portfolios and the effects of loan modification programs; (iii) the

merger integration of the Company and Wachovia, including

expense savings, merger costs and revenue synergies; (iv) our

mortgage repurchase exposure and exposure relating to our

foreclosure practices; (v) future capital levels and our

expectations that we will be above a 7% Tier 1 common equity

ratio under proposed Basel III capital standards within the next

few quarters; (vi) the expected outcome and impact of legal,

regulatory and legislative developments; and (vii) the Company’s

plans, objectives and strategies.

Forward-Looking Statements

Forward-looking statements are based on our current

expectations and assumptions regarding our business, the

economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Our actual results may differ materially from

those contemplated by the forward-looking statements. We

caution you, therefore, against relying on any of these forward-

looking statements. They are neither statements of historical fact

nor guarantees or assurances of future performance. While there

is no assurance that any list of risks and uncertainties or risk

factors is complete, important factors that could cause actual

results to differ materially from those in the forward-looking

statements include the following, without limitation:

• current and future economic and market conditions,

including the effects of further declines in housing prices

and high unemployment rates;

• our capital and liquidity requirements (including under

regulatory capital standards, such as the proposed Basel III

capital standards, as determined and interpreted by

applicable regulatory authorities) and our ability to generate

capital internally or raise capital on favorable terms;

• financial services reform and other current, pending or

future legislation or regulation that could have a negative

effect on our revenue and businesses, including the Dodd-

Frank Act and legislation and regulation relating to

overdraft fees (and changes to our overdraft practices as a

result thereof), debit card interchange fees, credit cards, and

other bank services;

• legislative proposals to allow mortgage cram-downs in

bankruptcy or require other loan modifications;

• the extent of our success in our loan modification efforts, as

well as the effects of regulatory requirements or guidance

regarding loan modifications or changes in such

requirements or guidance;

• the amount of mortgage loan repurchase demands that we

receive and our ability to satisfy any such demands without

having to repurchase loans related thereto or otherwise

indemnify or reimburse third parties, and the credit quality

of or losses on such repurchased mortgage loans;

• negative effects relating to mortgage foreclosures, including

changes in our procedures or practices and/or industry

standards or practices, regulatory or judicial requirements,

penalties or fines, increased costs, or delays or moratoriums

on foreclosures;

• our ability to successfully integrate the Wachovia merger

and realize the expected cost savings and other benefits and

the effects of any delays or disruptions in systems

conversions relating to the Wachovia integration;

• our ability to realize the efficiency initiatives to lower

expenses when and in the amount expected;

• recognition of OTTI on securities held in our available-for-

sale portfolio;

• the effect of changes in interest rates on our net interest

margin and our mortgage originations, MSRs and MHFS;

• hedging gains or losses;

90