Wells Fargo 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

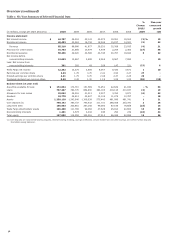

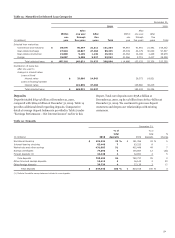

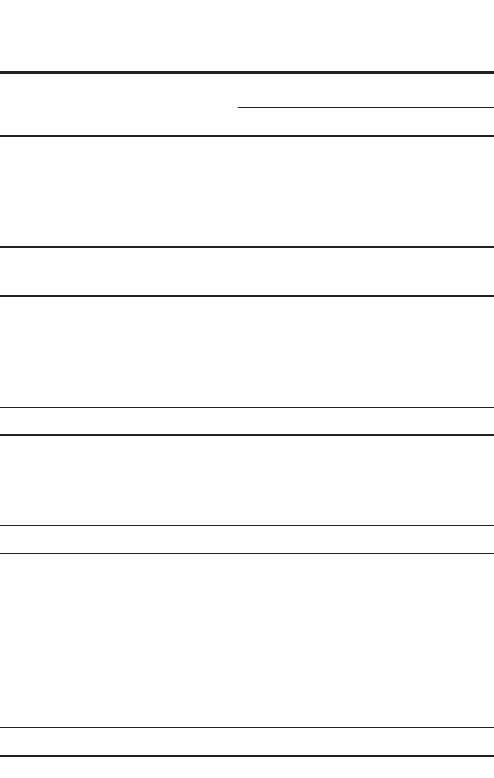

Noninterest Income

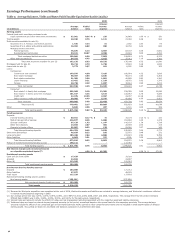

Table 7: Noninterest Income

Year ended December 31,

(in millions)

2010

2009

2008

Service charges on

deposit accounts $ 4,916

5,741

3,190

Trust and investment fees:

Tr us t , investment and IRA fees 4,038

3,588

2,161

Commissions and all other fees 6,896

6,147

763

Total trust and

investment fees 10,934

9,735

2,924

Card fees 3,652

3,683

2,336

Other fees:

Cash network fees 260

231

188

Charges and fees on loans 1,690

1,801

1,037

All other fees 2,040

1,772

872

Total other fees 3,990

3,804

2,097

Mortgage banking:

Servicing income, net 3,340

5,791

1,233

Net gains on mortgage loan

origination/sales activities 6,397

6,237

1,292

Total mortgage banking 9,737

12,028

2,525

Insurance 2,126

2,126

1,830

Net gains from trading activities 1,648

2,674

275

Net gains (losses) on debt

securities available for sale (324)

(127)

1,037

Net gains (losses) from

equity investments 779

185

(757)

Operating leases 815

685

427

All other 2,180

1,828

850

Total $ 40,453

42,362

16,734

Noninterest income of $40.5 billion represented 47% of revenue

for 2010 compared with $42.4 billion or, 48%, for 2009. The

decrease from 2009 was primarily the net result of an increase in

trust and investment fees to 13% of 2010 revenues from 11% for

2009, offset by the decrease in mortgage banking to 11% of 2010

revenues from 14% for 2009.

Our service charges on deposit accounts decreased in 2010 by

$825 million from 2009, although the deposit account portfolio

increased for the year. This decrease was related to regulatory

changes to debit card and ATM overdraft practices announced

by the Federal Reserve Board (FRB) in fourth quarter 2009. In

third quarter 2009, we also announced policy changes to help

customers limit overdraft and returned item fees. The

combination of these changes reduced our 2010 fee revenue by

approximately $810 million.

We earn trust, investment and IRA (Individual Retirement

Account) fees from managing and administering assets,

including mutual funds, corporate trust, personal trust,

employee benefit trust and agency assets. At December 31, 2010,

these assets totaled $2.1 trillion, up 11% from $1.9 trillion at

December 31, 2009. Trust, investment and IRA fees are largely

based on a tiered scale relative to the market value of the assets

under management or administration. The fees increased to

$4.0 billion in 2010 from $3.6 billion a year ago.

We receive commissions and other fees for providing services

to full-service and discount brokerage customers. These fees

increased to $6.9 billion in 2010 from $6.1 billion a year ago.

These fees include transactional commissions, which are based

on the number of transactions executed at the customer’s

direction, and asset-based fees, which are based on the market

value of the customer’s assets. Brokerage client assets totaled

$1.2 trillion at December 31, 2010, up 6% from a year ago.

Commissions and other fees also include fees from investment

banking activities including equity and bond underwriting.

Card fees were $3.7 billion in 2010, essentially flat from

2009. Legislative and regulatory changes enacted in 2010 caused

a reduction in card fee income, which was offset by growth in

purchase volume driven by improvements in the economy. The

effect of the Credit Card Accountability Responsibility and

Disclosure Act of 2009 (the Card Act) on card fees is fully

reflected in our 2010 results.

Mortgage banking noninterest income is generated by

servicing activities and loan origination/sales activities. This

income was $9.7 billion in 2010, compared with $12.0 billion for

2009. The reduction in mortgage banking noninterest income

was primarily driven by a $2.5 billion decline in net servicing

income, partially offset by a $160 million increase in net gains on

mortgage origination/sales.

Net servicing income includes both changes in the fair value

of mortgage servicing rights (MSRs) during the period as well as

changes in the value of derivatives (economic hedges) used to

hedge the MSRs. Net servicing income for 2010 included a

$1.5 billion net MSR valuation gain that was recorded to

earnings ($3.0 billion decrease in the fair value of the MSRs

offset by a $4.5 billion hedge gain) and for 2009 included a

$5.3 billion net MSR valuation gain ($1.5 billion decrease in the

fair value of MSRs offset by a $6.8 billion hedge gain). The

$3.8 billion decline in the net MSR valuation gain results for

2010 compared with 2009 was primarily due to a decline in

hedge carry income. See the “Risk Management – Mortgage

Banking Interest Rate and Market Risk” section of this Report

for a detailed discussion of our MSRs risks and hedging

approach. Our portfolio of loans serviced for others was

$1.84 trillion at December 31, 2010, and $1.88 trillion at

December 31, 2009. At December 31, 2010, the ratio of MSRs to

related loans serviced for others was 0.86%, compared with

0.91% at December 31, 2009.

Income from loan origination/sale activities was $6.4 billion

in 2010 compared with $6.2 billion for 2009. The slight increase

in 2010 was driven by higher margins on loan originations, offset

by lower loan origination volume and higher provision for loan

repurchase losses. Residential real estate originations were

$386 billion in 2010 compared with $420 billion a year ago and

mortgage applications were $620 billion in 2010 compared with

$651 billion in 2009. The 1-4 family first mortgage unclosed

pipeline was $73 billion at December 31, 2010, and $57 billion at

December 31, 2009. For additional detail, see the “Risk

Management – Mortgage Banking Interest Rate and Market

Risk” section and Note 1 (Summary of Significant Accounting

Policies), Note 9 (Mortgage Banking Activities) and Note 16 (Fair

Values of Assets and Liabilities) to Financial Statements in this

Report.

45