Wells Fargo 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

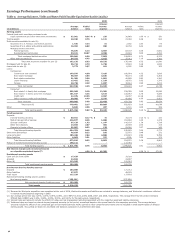

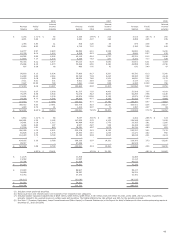

Earnings Performance (continued)

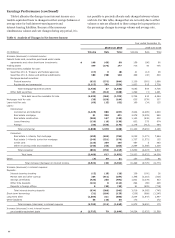

Net gains on mortgage loan origination/sales activities

include the cost of any additions to the mortgage repurchase

liability. Mortgage loans are repurchased from third parties

based on standard representations and warranties and early

payment default clauses in mortgage sale contracts. Additions to

the mortgage repurchase liability that were charged against net

gains on mortgage loan origination/sales activities during 2010

totaled $1.6 billion ($927 million for 2009), of which $144

million ($302 million for 2009) was related to our estimate of

loss content associated with loan sales during the year and $1.5

billion ($625 million for 2009) was for subsequent increases in

estimated losses on prior year’s loan sales because of the current

economic environment. For additional information about

mortgage loan repurchases, see the “Risk Management – Credit

Risk Management – Liability for Mortgage Loan Repurchase

Losses” section in this Report.

Income from trading activities was $1.6 billion in 2010, down

from $2.7 billion a year ago. This decrease reflects a return to a

more normal trading environment from a year ago as well as a

continued reduction in risk levels while we continue to prioritize

support for our customer-related activities.

Net gains on debt and equity securities totaled $455 million

for 2010 and $58 million for 2009, after other-than-temporary

impairment (OTTI) write-downs of $940 million for 2010 and

$1.7 billion for 2009.

Noninterest income of $42.4 billion in 2009 represented

48% of revenue, up from $16.7 billion (40%) in 2008. The

increase in noninterest income as a percentage of revenue was

due to a higher percentage of trust and investment fees (11% in

2009, up from 7% in 2008) with the addition of Wells Fargo

Advisors (formerly Wachovia Securities) retail brokerage

business, Wachovia wealth management and retirement, and

reinsurance businesses, and also due to strong mortgage banking

results, primarily from legacy Wells Fargo (14% in 2009, up

from 6% in 2008).

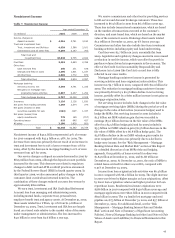

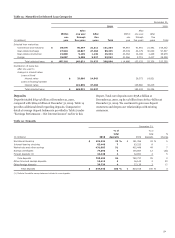

Noninterest Expense

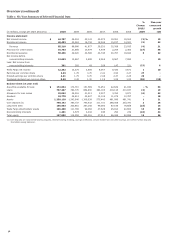

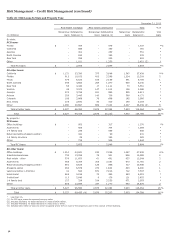

Table 8: Noninterest Expense

Year ended December 31,

(in millions) 2010

2009

2008

Salaries $ 13,869

13,757

8,260

Commission and incentive

compensation 8,692

8,021

2,676

Employee benefits 4,651

4,689

2,004

Equipment 2,636

2,506

1,357

Net occupancy 3,030

3,127

1,619

Core deposit and other intangibles 2,199

2,577

186

FDIC and other deposit

assessments 1,197

1,849

120

Outside professional services 2,370

1,982

847

Contract services 1,642

1,088

407

Foreclosed assets 1,537

1,071

414

Operating losses 1,258

875

142

Outside data processing 1,046

1,027

480

Postage, stationery and supplies 944

933

556

Travel and entertainment 783

575

447

Advertising and promotion 630

572

378

Telecommunications 596

610

321

Insurance 464

845

725

Operating leases 109

227

389

All other 2,803

2,689

1,270

Total $ 50,456

49,020

22,598

Noninterest expense increased $1.4 billion (3%) in 2010 over

2009, primarily due to merger integration costs, Wells Fargo

Financial restructuring costs and a charitable donation to the

Wells Fargo Foundation. The increase in 2009 over 2008 was

predominantly due to the acquisition of Wachovia, increased

staffing and other costs related to problem loan modifications

and workouts, special deposit assessments and operating losses.

Merger integration costs totaled $1.9 billion in 2010 and

$1.1 billion in 2009, and primarily contributed to the increases

in outside professional and contract services for both years. The

acquisition of Wachovia resulted in an expanded geographic

platform in our banking businesses and added capabilities in

businesses such as retail brokerage, asset management and

investment banking. As part of our integration investment to

enhance both the short- and long-term benefits to our

customers, we added platform team members in the Eastern

market to align Wachovia’s banking stores with Wells Fargo’s

sales and service model. We completed the second year of our

merger integration, converting 749 Wachovia stores in Alabama,

Arizona, California, Georgia, Illinois, Kansas, Mississippi,

Nevada, Tennessee and Texas. We migrated major processing

systems for credit card, mortgage, trust, and mutual funds. We

expect to substantially complete our integration of Wachovia by

the end of 2011.

In July 2010, we announced the restructuring of our Wells

Fargo Financial consumer finance division, including the closing

of 638 Wells Fargo Financial stores, realigning this business into

other Wells Fargo business units and transitioning employees

into other parts of our organization. The restructuring costs

totaled $161 million, predominantly for severance and store

closures.

46