Wells Fargo 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

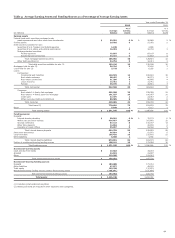

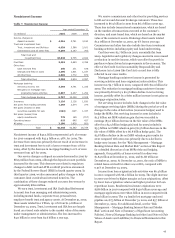

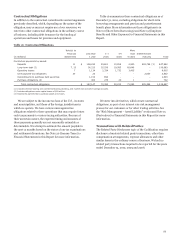

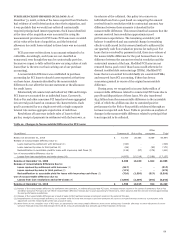

Table 13: Maturities for Selected Loan Categories

December 31,

2010

2009

After

After

Within

one year

After

Within

one year

After

one

through

five

one

through

five

(in millions) year

five years

years

Total

year

five years

years

Total

Selected loan maturities:

Commercial and industrial $ 39,576

90,497

21,211

151,284

44,919

91,951

21,482

158,352

Real estate mortgage 27,544

44,627

27,264

99,435

25,339

42,179

30,009

97,527

Real estate construction 15,009

9,189

1,135

25,333

23,362

12,188

1,428

36,978

Foreign 25,087

5,508

2,317

32,912

21,266

5,715

2,417

29,398

Total selected loans $ 107,216

149,821

51,927

308,964

114,886

152,033

55,336

322,255

Distribution of loans due

after one year to

changes in interest rates:

Loans at fixed

interest rates $ 29,886

14,543

26,373

18,921

Loans at floating/variable

interest rates 119,935

37,384

125,660

36,415

Total selected loans $ 149,821

51,927

152,033

55,336

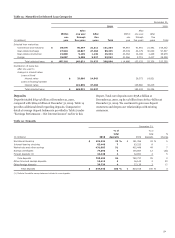

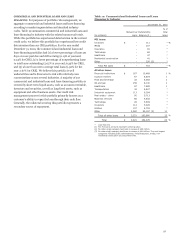

Deposits

Deposits totaled $847.9 billion at December 31, 2010,

compared with $824.0 billion at December 31, 2009. Table 14

provides additional detail regarding deposits. Comparative

detail of average deposit balances is provided in Table 5 under

“Earnings Performance – Net Interest Income” earlier in this

Report. Total core deposits were $798.2 billion at

December 31, 2010, up $17.5 billion from $780.7 billion at

December 31, 2009. We continued to gain new deposit

customers and deepen our relationships with existing

customers.

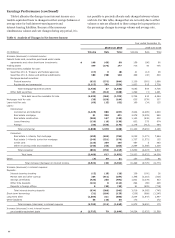

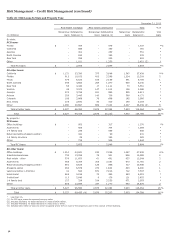

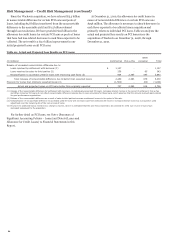

Table 14: Deposits

December 31,

% of

% of

total

total

%

(in millions)

2010

deposits

2009

deposits

Change

Noninterest-bearing $ 191,231

23

%

$ 181,356

22

%

5

Interest-bearing checking 63,440

7

63,225

8

-

Market rate and other savings 431,883

51

402,448

49

7

Savings certificates 77,292

9

100,857

12

(23)

Foreign deposits (1) 34,346

4

32,851

4

5

Core deposits 798,192

94

780,737

95

2

Other time and savings deposits 19,412

2

16,142

2

20

Other foreign deposits 30,338

4

27,139

3

12

Total deposits $ 847,942

100

%

$ 824,018

100

%

3

(1)

Reflects Eurodollar sweep balances included in core deposits.

51