Wells Fargo 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

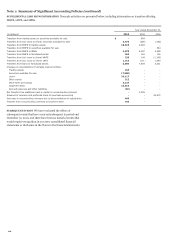

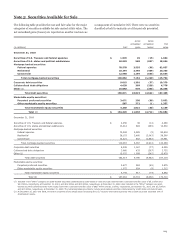

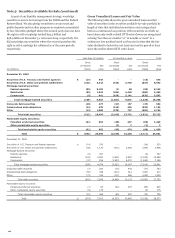

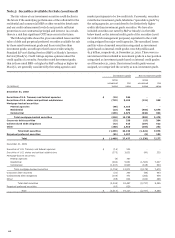

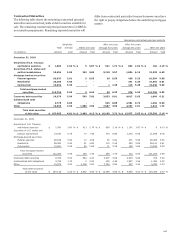

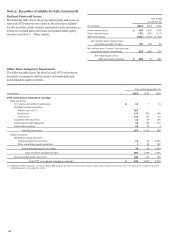

Note 5: Securities Available for Sale (continued)

The fair values of our investment securities could decline in

the future if the underlying performance of the collateral for the

residential and commercial MBS or other securities deteriorate

and our credit enhancement levels do not provide sufficient

protection to our contractual principal and interest. As a result,

there is a risk that significant OTTI may occur in the future.

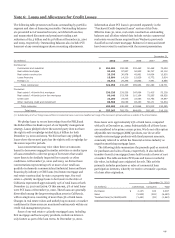

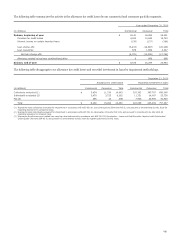

The following table shows the gross unrealized losses and fair

value of debt and perpetual preferred securities available for sale

by those rated investment grade and those rated less than

investment grade, according to their lowest credit rating by

Standard & Poor’s Rating Services (S&P) or Moody’s Investors

Service (Moody’s). Credit ratings express opinions about the

credit quality of a security. Securities rated investment grade,

that is those rated BBB- or higher by S&P or Baa3 or higher by

Moody’s, are generally considered by the rating agencies and

market participants to be low credit risk. Conversely, securities

rated below investment grade, labeled as “speculative grade” by

the rating agencies, are considered to be distinctively higher

credit risk than investment grade securities. We have also

included securities not rated by S&P or Moody’s in the table

below based on the internal credit grade of the securities (used

for credit risk management purposes) equivalent to the credit

rating assigned by major credit agencies. The unrealized losses

and fair value of unrated securities categorized as investment

grade based on internal credit grades were $83 million and

$1.3 billion, respectively, at December 31, 2010. There were no

unrated securities included in investment grade in a loss position

categorized as investment grade based on internal credit grades

as of December 31, 2009. If an internal credit grade was not

assigned, we categorized the security as non-investment grade.

Investment grade

Non-investment grade

Gross

Gross

unrealized

Fair

unrealized

Fair

(in millions) losses

value

losses

value

December 31, 2010

Securities of U.S. Treasury and federal agencies $ (15)

544

-

-

Securities of U.S. states and political subdivisions (722)

8,423

(115)

539

Mortgage-backed securities:

Federal agencies (96)

8,163

-

-

Residential (23)

888

(466)

4,575

Commercial (299)

4,679

(336)

903

Total mortgage-backed securities (418)

13,730

(802)

5,478

Corporate debt securities (22)

330

(15)

304

Collateralized debt obligations (42)

613

(187)

522

Other (180)

2,510

(103)

232

Total debt securities (1,399)

26,150

(1,222)

7,075

Perpetual preferred securities (81)

1,327

(8)

102

Total $ (1,480)

27,477

(1,230)

7,177

December 31, 2009

Securities of U.S. Treasury and federal agencies $ (14)

530

-

-

Securities of U.S. states and political subdivisions (275)

3,621

(90)

325

Mortgage-backed securities:

Federal agencies (9)

767

-

-

Residential (480)

5,661

(1,563)

7,027

Commercial (1,247)

6,543

(615)

643

Total mortgage-backed securities (1,736)

12,971

(2,178)

7,670

Corporate debt securities (31)

260

(46)

463

Collateralized debt obligations (104)

471

(263)

439

Other (85)

644

(160)

388

Total debt securities (2,245)

18,497

(2,737)

9,285

Perpetual preferred securities (65)

620

-

-

Total $ (2,310)

19,117

(2,737)

9,285

126