Wells Fargo 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

collateralized by auto leases or loans and cash reserves, private

collateralized mortgage obligations (CMOs), collateralized debt

obligations (CDOs), collateralized loan obligations (CLOs),

auction-rate securities, certain derivative contracts such as credit

default swaps related to CMO, CDO and CLO exposures and

certain MHFS and MSRs.

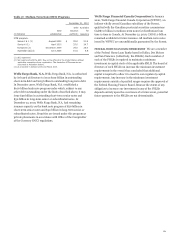

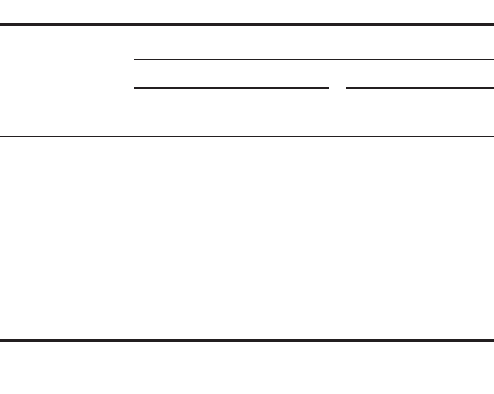

Table 39 presents the summary of the fair value of financial

instruments recorded at fair value on a recurring basis, and the

amounts measured using significant Level 3 inputs (before

derivative netting adjustments). The fair value of the remaining

assets and liabilities were measured using valuation

methodologies involving market-based or market-derived

information, collectively Level 1 and 2 measurements.

Table 39: Fair Value Level 3 Summary

December 31,

2010

2009

Total

Total

($ in billions) balance

Level 3 (1)

balance

Level 3 (1)

Assets carried

at fair value $ 293.1

47.9

277.4

52.0

As a percentage

of total assets 23

%

4

22

4

Liabilities carried

at fair value $ 21.2

6.4

21.7

6.9

As a percentage of

total liabilities 2

%

1

2

1

(1)

Before derivative netting adjustments.

See Note 16 (Fair Values of Assets and Liabilities) to Financial

Statements in this Report for a complete discussion on our use of

fair valuation of financial instruments, our related measurement

techniques and its impact to our financial statements.

Income Taxes

We are subject to the income tax laws of the U.S., its states and

municipalities and those of the foreign jurisdictions in which we

operate. Our income tax expense consists of two components:

current and deferred. Current income tax expense approximates

taxes to be paid or refunded for the current period and includes

income tax expense related to our uncertain tax positions. We

determine deferred income taxes using the balance sheet

method. Under this method, the net deferred tax asset or liability

is based on the tax effects of the differences between the book

and tax bases of assets and liabilities, and recognized enacted

changes in tax rates and laws in the period in which they

occur. Deferred income tax expense results from changes in

deferred tax assets and liabilities between periods. Deferred tax

assets are recognized subject to management’s judgment that

realization is “more likely than not.” Uncertain tax positions that

meet the more likely than not recognition threshold are

measured to determine the amount of benefit to recognize. An

uncertain tax position is measured at the largest amount of

benefit that management believes has a greater than 50%

likelihood of realization upon settlement. Foreign taxes paid are

generally applied as credits to reduce federal income taxes

payable. We account for interest and penalties as a component of

income tax expense.

The income tax laws of the jurisdictions in which

we operate are complex and subject to different interpretations

by the taxpayer and the relevant government taxing authorities.

In establishing a provision for income tax expense, we must

make judgments and interpretations about the application of

these inherently complex tax laws. We must also make estimates

about when in the future certain items will affect taxable income

in the various tax jurisdictions by the government taxing

authorities, both domestic and foreign. Our interpretations may

be subjected to review during examination by taxing authorities

and disputes may arise over the respective tax positions. We

attempt to resolve these disputes during the tax examination and

audit process and ultimately through the court systems when

applicable.

We monitor relevant tax authorities and revise our estimate of

accrued income taxes due to changes in income tax laws and

their interpretation by the courts and regulatory authorities on a

quarterly basis. Revisions of our estimate of accrued income

taxes also may result from our own income tax planning and

from the resolution of income tax controversies. Such revisions

in our estimates may be material to our operating results for any

given quarter.

See Note 20 (Income Taxes) to Financial Statements in this

Report for a further description of our provision for income taxes

and related income tax assets and liabilities.

89