Wells Fargo 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Critical Accounting Policies (continued)

The amount of cash flows expected to be collected and,

accordingly, the adequacy of the allowance for loan loss due to

certain decreases in cash flows expected to be collected, is

particularly sensitive to changes in loan credit quality. The

sensitivity of the overall allowance for credit losses, including

PCI loans, is presented in the preceding section, “Critical

Accounting Policies – Allowance for Credit Losses.”

PCI loans that were classified as nonperforming loans by

Wachovia are no longer classified as nonperforming because, at

acquisition, we believe we will fully collect the new carrying value

of these loans and due to the existence of the accretable yield. It

is important to note that judgment is required to classify PCI

loans as performing and is dependent on having a reasonable

expectation about the timing and amount of cash flows expected

to be collected, even if the loan is contractually past due.

See the “Risk Management – Credit Risk Management”

section and Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report for further discussion of PCI

loans.

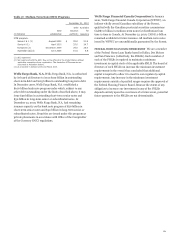

Valuation of Residential Mortgage Servicing Rights

Mortgage servicing rights (MSRs) are assets that represent the

rights to service mortgage loans for others. We recognize MSRs

when we purchase servicing rights from third parties, or retain

servicing rights in connection with the sale or securitization of

loans we originate (asset transfers). We also have MSRs acquired

in the past under co-issuer agreements that provide for us to

service loans that were originated and securitized by third-party

correspondents. We initially measure and carry substantially all

of our MSRs related to residential mortgage loans at fair value.

At the end of each quarter, we determine the fair value of

MSRs using a valuation model that calculates the present value

of estimated future net servicing income. The model incorporates

assumptions that market participants use in estimating future

net servicing income, including estimates of prepayment speeds

(including housing price volatility), discount rate, default rates,

cost to service (including delinquency and foreclosure costs),

escrow account earnings, contractual servicing fee income,

ancillary income and late fees.

To reduce the sensitivity of earnings to interest rate and

market value fluctuations, we may use securities available for

sale and free-standing derivatives (economic hedges) to hedge

the risk of changes in the fair value of MSRs, with the resulting

gains or losses reflected in income. Changes in the fair value of

the MSRs from changing mortgage interest rates are generally

offset by gains or losses in the fair value of the derivatives and

the particular instruments used to hedge the MSRs. In addition,

we also consider origination volume in our risk management

strategy as it tends to act as a “natural hedge.” For example, as

interest rates decline, servicing values generally decrease and

fees from origination volume tend to increase. Conversely, as

interest rates increase, the fair value of the MSRs generally

increases, while fees from origination volume tend to decline. See

the “Risk Management – Mortgage Banking Interest Rate and

Market Risk” section in this Report for discussion of the timing

of the effect of changes in mortgage interest rates.

Net servicing income, a component of mortgage banking

noninterest income, includes the changes from period to period

in fair value of both our residential MSRs and the free-standing

derivatives (economic hedges) used to hedge our residential

MSRs. Changes in the fair value of residential MSRs from period

to period result from (1) changes in the valuation model inputs or

assumptions (principally reflecting changes in discount rates and

prepayment speed assumptions, mostly due to changes in

interest rates and costs to service, including delinquency and

foreclosure costs), and (2) other changes, representing changes

due to collection/realization of expected cash flows.

We use a dynamic and sophisticated model to estimate the

value of our MSRs. The model is validated by an independent

internal model validation group operating in accordance with

Company policies. Senior management reviews all significant

assumptions quarterly. Mortgage loan prepayment speed – a key

assumption in the model – is the annual rate at which borrowers

are forecasted to repay their mortgage loan principal. The

discount rate used to determine the present value of estimated

future net servicing income – another key assumption in the

model – is the required rate of return investors in the market

would expect for an asset with similar risk. To determine the

discount rate, we consider the risk premium for uncertainties

from servicing operations (e.g., possible changes in future

servicing costs, ancillary income and earnings on escrow

accounts). Both assumptions can, and generally will, change

quarterly as market conditions and interest rates change. For

example, an increase in either the prepayment speed or discount

rate assumption results in a decrease in the fair value of the

MSRs, while a decrease in either assumption would result in an

increase in the fair value of the MSRs. In recent years, there have

been significant market-driven fluctuations in loan prepayment

speeds and the discount rate. These fluctuations can be rapid and

may be significant in the future. Therefore, estimating

prepayment speeds within a range that market participants

would use in determining the fair value of MSRs requires

significant management judgment.

The valuation and sensitivity of MSRs is discussed further in

Note 1 (Summary of Significant Accounting Policies), Note 8

(Securitizations and Variable Interest Entities), Note 9

(Mortgage Banking Activities) and Note 16 (Fair Values of Assets

and Liabilities) to Financial Statements in this Report.

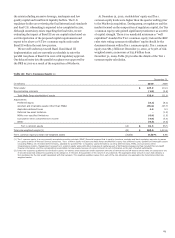

Liability for Mortgage Loan Repurchase Losses

We sell residential mortgage loans to various parties, including

(1) Freddie Mac and Fannie Mae (GSEs), which include the

mortgage loans in GSE-guaranteed mortgage securitizations, (2)

special purpose entities that issue private label MBS, and (3)

other financial institutions that purchase mortgage loans for

investment or private label securitization. In addition, we pool

FHA-insured and VA-guaranteed mortgage loans, which back

securities guaranteed by GNMA. The agreements under which

we sell mortgage loans and the insurance or guaranty

agreements with FHA and VA contain provisions that include

various representations and warranties regarding the origination

and characteristics of the mortgage loans. Although the specific

representations and warranties vary among different sales,

insurance or guarantee agreements, they typically cover

ownership of the loan, compliance with loan criteria set forth in

the applicable agreement, validity of the lien securing the loan,

86