Wells Fargo 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

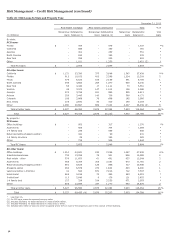

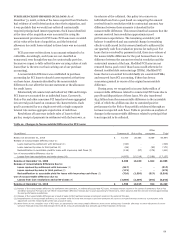

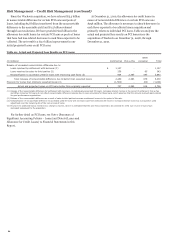

Risk Management – Credit Risk Management (continued)

During the recent credit cycle, we have experienced an

increase in requests for extensions of commercial and industrial

and CRE loans, which have repayment guarantees. All

extensions granted are based on a re-underwriting of the loan

and our assessment of the borrower’s ability to perform under

the agreed-upon terms. At the time of extension, borrowers are

generally performing in accordance with the contractual loan

terms. Extension terms generally range from six to thirty-six

months and may require that the borrower provide additional

economic support in the form of partial repayment, amortization

or additional collateral or guarantees. In cases where the value of

collateral or financial condition of the borrower is insufficient to

repay our loan, we may rely upon the support of an outside

repayment guarantee in providing the extension. In considering

the impairment status of the loan, we evaluate the collateral and

future cash flows as well as the anticipated support of any

repayment guarantor. When performance under a loan is not

reasonably assured, including the performance of the guarantor,

we place the loan on nonaccrual status and we charge-off all or a

portion of a loan based on the fair value of the collateral securing

the loan.

Our ability to seek performance under the guarantee is

directly related to the guarantor’s creditworthiness, capacity and

willingness to perform, which is evaluated on an annual basis, or

more frequently as warranted. Our evaluation is based on the

most current financial information available and is focused on

various key financial metrics, including net worth, leverage, and

current and future liquidity. We consider the guarantor’s

reputation, creditworthiness, and willingness to work with us

based on our analysis as well as other lenders’ experience with

the guarantor. Our assessment of the guarantor’s credit strength

is reflected in our loan risk ratings for such loans. The loan risk

rating is an important factor in our allowance methodology for

commercial and industrial and CRE loans.

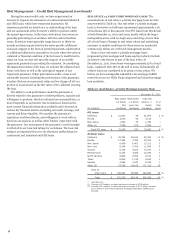

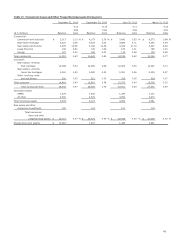

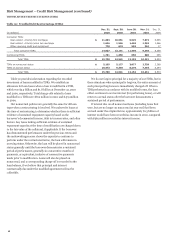

REAL ESTATE 1-4 FAMILY FIRST MORTGAGE LOANS The

concentrations of real estate 1-4 family mortgage loans by state

are presented in Table 20. Our real estate 1-4 family mortgage

loans to borrowers in California represented approximately 14%

of total loans (3% of this amount were PCI loans from Wachovia)

at both December 31, 2010 and 2009, mostly within the larger

metropolitan areas, with no single area consisting of more than

3% of total loans. Changes in real estate values and underlying

economic or market conditions for these areas are monitored

continuously within our credit risk management process.

Some of our real estate 1-4 family mortgage loans

(representing first mortgage and home equity products) include

an interest-only feature as part of the loan terms. At

December 31, 2010, these loans were approximately 25% of total

loans, compared with 26% at the end of 2009. Substantially all

of these loans are considered to be prime or near prime. We

believe we have manageable adjustable-rate mortgage (ARM)

reset risk across our Wells Fargo originated and owned mortgage

loan portfolios.

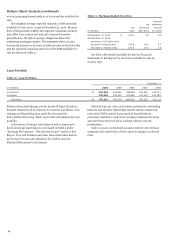

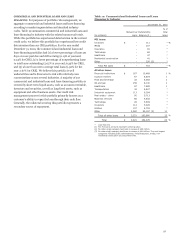

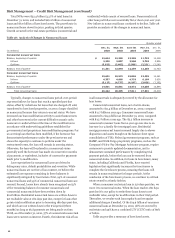

Table 20: Real Estate 1-4 Family Mortgage Loans by State

December 31, 2010

Real estate

Real estate

Total real

1-4 family

1-4 family

estate 1-4

% of

first

junior lien

family

total

(in millions)

mortgage

mortgage

mortgage

loans

PCI loans:

California $

21,630

49

21,679

3

%

Florida

3,076

56

3,132

*

New Jersey

1,293

36

1,329

*

Other (1)

7,246

109

7,355

*

Total PCI loans $

33,245

250

33,495

4

%

All other loans:

California $

55,794

26,612

82,406

11

%

Florida

17,296

7,782

25,078

3

New Jersey

8,908

6,403

15,311

2

New York

8,169

3,709

11,878

2

Virginia

6,145

4,622

10,767

1

Pennsylvania

6,233

4,066

10,299

1

North Carolina

5,860

3,552

9,412

1

Texas

6,645

1,519

8,164

1

Georgia

4,886

3,472

8,358

1

Other (2)

77,054

34,162

111,216

15

Total all

other loans $

196,990

95,899

292,889

39

%

Total $

230,235

96,149

326,384

43

%

* Less than 1%.

(1) Consists of 45 states; no state had loans in excess of $759 million.

(2) Consists of 41 states; no state had loans in excess of $7.2 billion. Includes

$15.5 billion in Government National Mortgage Association (GNMA) pool

buyouts.

58