Wells Fargo 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wealth, Brokerage and Retirement provides a full range of

financial advisory services to clients using a planning approach

to meet each client’s needs. Wealth Management provides

affluent and high net worth clients with a complete range of

wealth management solutions including financial planning,

private banking, credit, investment management and trust.

Family Wealth meets the unique needs of the ultra high net

worth customers. Brokerage serves customers’ advisory,

brokerage and financial needs as part of one of the largest full-

service brokerage firms in the United States. Retirement is a

national leader in providing institutional retirement and trust

services (including 401(k) and pension plan record keeping) for

businesses, retail retirement solutions for individuals, and

reinsurance services for the life insurance industry.

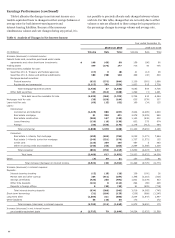

Wealth, Brokerage and Retirement earned net income of

$1.0 billion in 2010. Revenue of $11.7 billion included a mix of

brokerage commissions, asset-based fees and net interest

income. Net interest income growth was dampened by the

continued low short-term interest rate environment. Equity

market gains helped drive growth in fee income. During 2010

client assets grew 6% from a year ago, including managed

account asset growth of 20%. Deposit balances grew 10% during

2010. Expenses increased slightly from the prior year due to

growth in broker commissions partially offset by the realization

of merger synergies during the year and the loss reserve for the

auction rate securities (ARS) legal settlement in 2009. The

wealth, brokerage and retirement businesses have strengthened

partnerships across the Company, working with Community

Banking and Wholesale Banking to provide financial solutions

for clients.

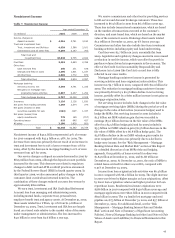

During 2010, our total assets grew 1%, funded by core deposit

growth of 2% and internal capital generation, partially offset by a

reduction in our long-term borrowings. As a result of continued

soft loan demand, our loans decreased 3% and most of our asset

growth was therefore in more liquid earning assets. However,

the strength of our business model continued to produce high

rates of internal capital generation as reflected in our improved

capital ratios. Tier 1 capital increased to 11.16% as a percentage

of total risk-weighted assets, total capital to 15.01%, Tier 1

leverage to 9.19% and Tier 1 common equity to 8.30% at

December 31, 2010, up from 9.25%, 13.26%, 7.87% and 6.46%,

respectively, at December 31, 2009. At December 31, 2010, core

deposits funded 105% of the loan portfolio, and we have

significant capacity to add loans and higher yielding long-term

MBS to generate future revenue and earnings growth.

Balance Sheet Analysis

The following discussion provides additional information

about the major components of our balance sheet. Information

about changes in our asset mix and about our capital is included

in the “Earnings Performance – Net Interest Income” and

“Capital Management” sections of this Report.

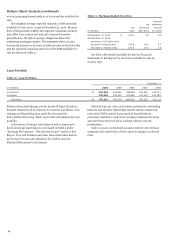

Securities Available for Sale

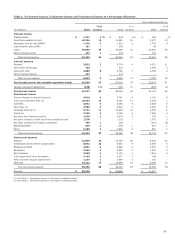

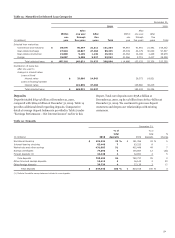

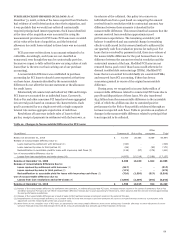

Table 10: Securities Available for Sale – Summary

December 31,

2010

2009

Net

Net

unrealized

Fair

unrealized

Fair

(in millions) Cost

gain

value

Cost

gain

value

Debt securities available for sale $ 160,071

7,394

167,465

162,314

4,804

167,118

Marketable equity securities 4,258

931

5,189

4,749

843

5,592

Total securities available for sale $ 164,329

8,325

172,654

167,063

5,647

172,710

Table 10 presents a summary of our securities available-for-

sale portfolio. Securities available for sale consist of both debt

and marketable equity securities. We hold debt securities

available for sale primarily for liquidity, interest rate risk

management and long-term yield enhancement. Accordingly,

this portfolio consists primarily of very liquid, high-quality

federal agency debt and privately issued MBS. The total net

unrealized gains on securities available for sale were $8.3 billion

at December 31, 2010, up from net unrealized gains of

$5.6 billion at December 31, 2009, due to a general decline in

long-term yields and narrowing of credit spreads.

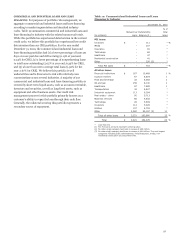

We analyze securities for OTTI quarterly, or more often if a

potential loss-triggering event occurs. Of the $692 million OTTI

write-downs in 2010, $672 million related to debt securities and

$20 million to equity securities. For a discussion of our OTTI

accounting policies and underlying considerations and analysis

see Note 1 (Summary of Significant Accounting Policies –

Securities) and Note 5 (Securities Available for Sale) to Financial

Statements in this Report.

At December 31, 2010, debt securities available for sale

included $19 billion of municipal bonds, of which 84% were

rated “A-” or better, based on external, and in some cases

internal, ratings. Additionally, some of these bonds are

guaranteed against loss by bond insurers. These bonds are

predominantly investment grade and were generally

underwritten in accordance with our own investment standards

prior to the determination to purchase, without relying on the

bond insurer’s guarantee in making the investment decision.

These municipal bonds will continue to be monitored as part of

49