Wells Fargo 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

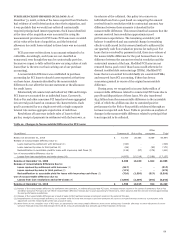

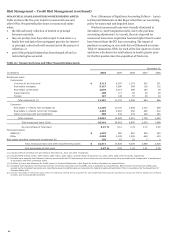

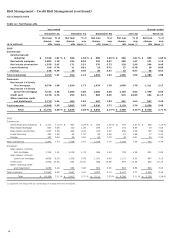

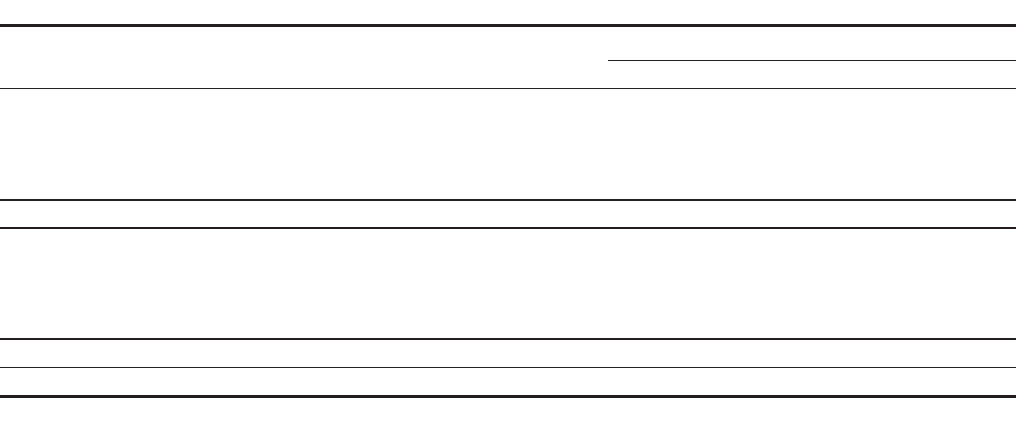

LOANS 90 DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans included in this category are 90 days or more past due as

to interest or principal and still accruing, because they are (1)

well-secured and in the process of collection or (2) real estate

1-4 family mortgage loans or consumer loans exempt under

regulatory rules from being classified as nonaccrual until later

delinquency, usually 120 days past due. PCI loans of $11.6 billion

at December 31, 2010, and $16.1 billion at December 31, 2009,

are excluded from this disclosure even though they are 90 days

or more contractually past due. These PCI loans are considered

to be accruing due to the existence of the accretable yield and not

based on consideration given to contractual interest payments.

Non-PCI loans 90 days or more past due and still accruing

were $18.5 billion at December 31, 2010, and $22.2 billion at

December 31, 2009. Those balances include $14.7 billion and

$15.3 billion, respectively, in loans whose repayments are

insured by the FHA or guaranteed by the VA.

Excluding these insured/guaranteed loans, loans 90 days or

more past due and still accruing at December 31, 2010, were

down $3.1 billion, or 45%, from December 31, 2009. The decline

was due to loss mitigation activities including modifications and

increased collection capacity/process improvements, charge-

offs, lower early stage delinquency levels and credit stabilization.

Table 31 reflects loans 90 days or more past due and still

accruing excluding the insured/guaranteed loans.

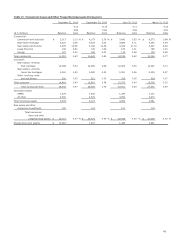

Table 31: Loans 90 Days or More Past Due and Still Accruing (Excluding Insured/Guaranteed Loans)

December 31,

(in millions) 2010

2009

2008

2007

2006

Commercial:

Commercial and industrial $ 308

590

218

32

15

Real estate mortgage 104

1,014

70

10

3

Real estate construction 193

909

250

24

3

Foreign 22

73

34

52

44

Total commercial 627

2,586

572

118

65

Consumer:

Real estate 1-4 family first mortgage (1) 941

1,623

883

286

154

Real estate 1-4 family junior lien mortgage (1) 366

515

457

201

63

Credit card 516

795

687

402

262

Other revolving credit and installment 1,305

1,333

1,047

552

616

Total consumer 3,128

4,266

3,074

1,441

1,095

Total $ 3,755

6,852

3,646

1,559

1,160

(1)

Includes MHFS 90 days or more past due and still accruing.

69