Wells Fargo 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Credit Risk Management (continued)

TROUBLED DEBT RESTRUCTURINGS (TDRs)

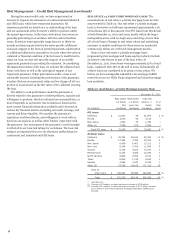

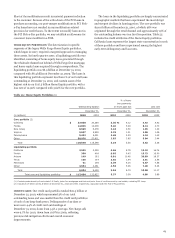

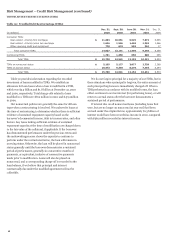

Table 30: Troubled Debt Restructurings (TDRs)

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

(in millions) 2010

2010

2010

2010

2009

Consumer TDRs:

Real estate 1-4 family first mortgage $ 11,603

10,951

9,525

7,972

6,685

Real estate 1-4 family junior lien mortgage 1,626

1,566

1,469

1,563

1,566

Other revolving credit and installment 778

674

502

310

17

Total consumer TDRs 14,007

13,191

11,496

9,845

8,268

Commercial TDRs 1,751

1,350

656

386

265

Total TDRs $ 15,758

14,541

12,152

10,231

8,533

TDRs on nonaccrual status $ 5,185

5,177

3,877

2,738

2,289

TDRs on accrual status 10,573

9,364

8,275

7,493

6,244

Total TDRs $ 15,758

14,541

12,152

10,231

8,533

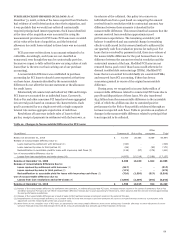

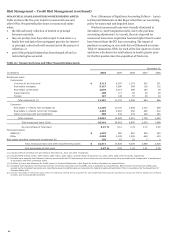

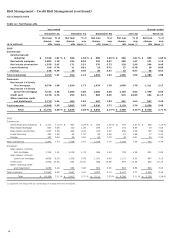

Table 30 provides information regarding the recorded

investment of loans modified in TDRs. We establish an

allowance for loan losses when a loan is modified in a TDR,

which was $3.9 billion and $1.8 billion at December 31, 2010

and 2009, respectively. Total charge-offs related to loans

modified in a TDR were $812 million in 2010 and $479 million

in 2009.

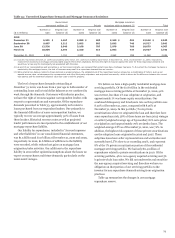

Our nonaccrual policies are generally the same for all loan

types when a restructuring is involved. We underwrite loans at

the time of restructuring to determine whether there is sufficient

evidence of sustained repayment capacity based on the

borrower’s documented income, debt to income ratios, and other

factors. Any loans lacking sufficient evidence of sustained

repayment capacity at the time of modification are charged down

to the fair value of the collateral, if applicable. If the borrower

has demonstrated performance under the previous terms and

the underwriting process shows the capacity to continue to

perform under the restructured terms, the loan will remain in

accruing status. Otherwise, the loan will be placed in nonaccrual

status generally until the borrower demonstrates a sustained

period of performance, generally six consecutive months of

payments, or equivalent, inclusive of consecutive payments

made prior to modification. Loans will also be placed on

nonaccrual, and a corresponding charge-off is recorded to the

loan balance, if we believe that principal and interest

contractually due under the modified agreement will not be

collectible.

We do not forgive principal for a majority of our TDRs, but in

those situations where principal is forgiven, the entire amount of

such principal forgiveness is immediately charged off. When a

TDR performs in accordance with its modified terms, the loan

either continues to accrue interest (for performing loans), or will

return to accrual status after the borrower demonstrates a

sustained period of performance.

If interest due on all nonaccrual loans (including loans that

were, but are no longer on nonaccrual at year end) had been

accrued under the original terms, approximately $1.3 billion of

interest would have been recorded as income in 2010, compared

with $362 million recorded as interest income.

68