Wells Fargo 2010 Annual Report Download - page 37

Download and view the complete annual report

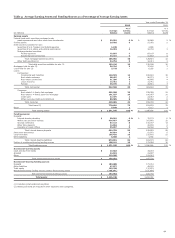

Please find page 37 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our progress to date remains on track and on schedule, with

business and revenue synergies exceeding our expectations at

the time the merger was announced. The Wachovia merger has

already proven to be a financial success, with substantially all of

the expected savings already realized and growing revenue

synergies reflecting market share gains in many businesses,

including mortgage, auto dealer services and investment

banking.

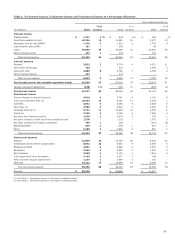

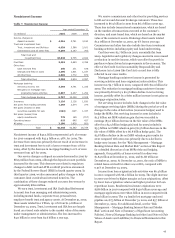

We continued to invest in core businesses while maintaining

a strong balance sheet. In 2010, we opened 47 retail banking

stores for a retail network total of 6,314 stores. We converted a

total of 749 Wachovia banking stores in Alabama, Arizona,

California, Georgia, Illinois, Kansas, Mississippi, Nevada,

Tennessee and Texas, as well as the Wachovia credit card

business and ATM network. The conversion of the remaining

Wachovia eastern markets is expected to be substantially

completed by the end of 2011.

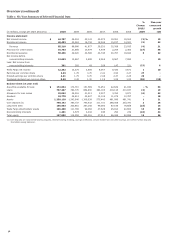

We continued taking actions to further strengthen our

balance sheet, including reducing our non-strategic and

liquidating loan portfolios, which have declined $54.6 billion

since the Wachovia acquisition, including $26.3 billion in 2010,

to $115.7 billion at December 31, 2010. We significantly built

capital in 2010, up $12.9 billion, or 12%, from a year ago. Our

capital growth since our merger with Wachovia has been driven

by record retained earnings and other sources of internal capital

generation, as well as three common stock offerings between

October 2008 and December 2009 totaling over $33 billion.

This included the $12.2 billion offering in fourth quarter 2009,

which allowed us to repay in full the U.S. Treasury’s Troubled

Asset Relief Program (TARP) preferred stock investment. We

substantially increased the size of the Company with the

Wachovia merger, and experienced cyclically elevated credit

costs. However, our capital ratios at December 31, 2010, were

higher than they were prior to the Wachovia acquisition. Tier 1

common equity increased to $81.3 billion at December 31, 2010,

or 8.30% of risk-weighted assets. The Tier 1 capital ratio

increased to 11.16% and Tier 1 leverage ratio increased to 9.19%.

See the “Capital Management” section in this Report for more

information regarding Tier 1 common equity.

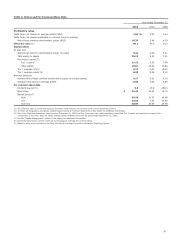

We experienced continued and significant improvement in

our credit portfolio, with most metrics showing positive

movement by the end of 2010. Net charge-offs declined in 2010

from the peak in fourth quarter 2009, with almost every major

loan category recording lower charge-offs by the end of 2010.

Delinquencies continued to decline from the peak at the end of

2009 and, in the fourth quarter 2010, nonaccrual loans declined

for the first time since the Wachovia merger. The improvement

in credit quality was also evident in the portfolio of purchased

credit-impaired (PCI) loans acquired through the Wachovia

merger, which overall has performed better than originally

expected. Reflecting improved performance in our loan

portfolios, the provision for credit losses was $2.0 billion less

than net charge-offs for 2010. Absent significant deterioration in

the economy, we expect future reductions in the allowance for

credit losses. The improvement in losses, a more favorable

economic outlook and improved credit statistics in several

portfolios further increase our confidence that our credit cycle is

turning, provided economic conditions do not deteriorate.

We believe it is important to maintain a well controlled

operating environment as we complete the integration of the

Wachovia businesses and grow the combined company. We

manage our credit risk by establishing what we believe are sound

credit policies for underwriting new business, while monitoring

and reviewing the performance of our loan portfolio. We manage

the interest rate and market risks inherent in our asset and

liability balances within established ranges, while ensuring

adequate liquidity and funding. We maintain strong capital

levels to facilitate future growth.

As a result of PCI accounting for loans acquired in the merger

with Wachovia, ratios of the Company, including the growth rate

in nonperforming assets (NPAs) since December 31, 2008, may

not be directly comparable with periods prior to the merger or

with credit-related ratios of other financial institutions. In

particular:

• Wachovia’s high risk loans were written down pursuant to

PCI accounting at the time of merger. Therefore, the

allowance for credit losses is lower than otherwise would

have been required without PCI loan accounting; and

• Because we virtually eliminated Wachovia’s nonaccrual

loans at December 31, 2008, quarterly growth in our

nonaccrual loans during 2010 and 2009 was higher than it

would have been without PCI loan accounting. Similarly,

our net charge-offs rate was lower than it otherwise would

have been.

35