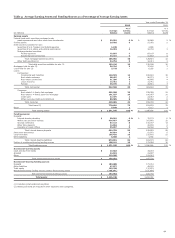

Wells Fargo 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

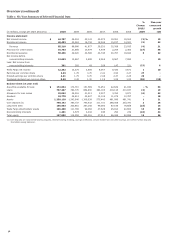

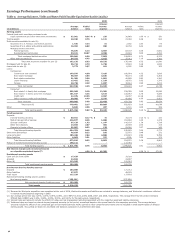

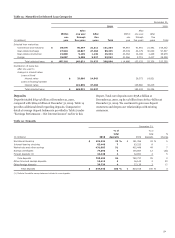

2008

2007

2006

Interest

Interest

Interest

Average

Yields/

income/

Average

Yields/

income/

Average

Yields/

income/

balance

rates

expense

balance

rates

expense

balance

rates

expense

$ 5,293

1.71

% $ 90

4,468

4.99

% $ 223

5,515

4.80

% $ 265

4,971

3.80

189

4,291

4.37

188

4,958

4.95

245

1,083

3.84

41

848

4.26

36

875

4.36

39

6,918

6.83

501

4,740

7.37

342

3,192

7.98

245

44,777

5.97

2,623

38,592

6.10

2,328

36,691

6.04

2,206

20,749

6.04

1,412

6,548

6.12

399

6,640

6.57

430

65,526

5.99

4,035

45,140

6.10

2,727

43,331

6.12

2,636

12,818

7.17

1,000

6,295

7.52

477

6,204

7.10

439

86,345

6.22

5,577

57,023

6.34

3,582

53,602

6.31

3,359

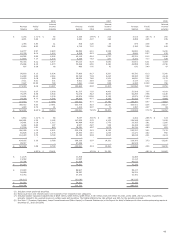

25,656

6.13

1,573

33,066

6.50

2,150

42,855

6.41

2,746

837

5.69

48

896

7.76

70

630

7.40

47

98,620

6.12

6,034

77,965

8.17

6,367

65,720

8.13

5,340

41,659

5.80

2,416

32,722

7.38

2,414

29,344

7.32

2,148

19,453

5.08

988

16,934

7.80

1,321

14,810

7.94

1,175

7,141

5.62

401

5,921

5.84

346

5,437

5.72

311

7,127

10.50

748

7,321

11.68

855

6,343

12.39

786

174,000

6.08

10,587

140,863

8.02

11,303

121,654

8.02

9,760

75,116

6.67

5,008

61,527

7.25

4,463

57,509

7.27

4,182

75,375

6.55

4,934

72,075

8.12

5,851

64,255

7.98

5,126

19,601

12.13

2,378

15,874

13.58

2,155

12,571

13.29

1,670

54,368

8.72

4,744

54,436

9.71

5,285

50,922

9.60

4,889

224,460

7.60

17,064

203,912

8.71

17,754

185,257

8.57

15,867

398,460

6.94

27,651

344,775

8.43

29,057

306,911

8.35

25,627

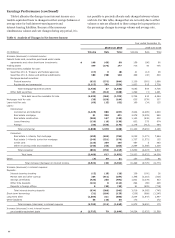

1,920

4.73

91

1,402

5.07

71

1,357

4.97

68

$ 523,482

6.69

% $ 35,219

445,921

7.93

% $ 35,341

415,828

7.79

% $ 32,357

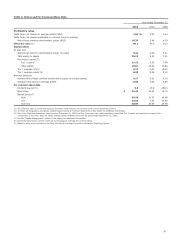

$ 5,650

1.12

% $ 64

5,057

3.16

% $ 160

4,302

2.86

% $ 123

166,691

1.32

2,195

147,939

2.78

4,105

134,248

2.40

3,225

39,481

3.08

1,215

40,484

4.38

1,773

32,355

3.91

1,266

6,656

2.83

187

8,937

4.87

435

32,168

4.99

1,607

47,578

1.81

860

36,761

4.57

1,679

20,724

4.60

953

266,056

1.70

4,521

239,178

3.41

8,152

223,797

3.21

7,174

65,826

2.25

1,478

25,854

4.81

1,245

21,471

4.62

992

102,283

3.70

3,789

93,193

5.18

4,824

84,035

4.91

4,124

-

-

-

-

-

-

-

-

-

434,165

2.25

9,788

358,225

3.97

14,221

329,303

3.73

12,290

89,317

-

-

87,696

-

-

86,525

-

-

$ 523,482

1.86

9,788

445,921

3.19

14,221

415,828

2.96

12,290

4.83

% $ 25,431

4.74

% $ 21,120

4.83

% $ 20,067

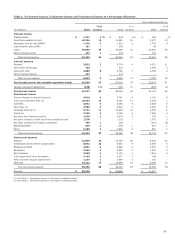

$ 11,175

11,806

12,466

13,353

11,957

11,114

56,386

51,068

46,615

$ 80,914

74,831

70,195

$ 87,820

88,907

89,117

28,658

26,287

24,221

53,753

47,333

43,382

(89,317)

(87,696)

(86,525)

$ 80,914

74,831

70,195

$ 604,396

520,752

486,023

(5) Includes certain preferred securities.

(6) Nonaccrual loans and related income are included in their respective loan categories.

(7) Includes taxable-equivalent adjustments of $629 million, $706 million, $288 million, $146 million and $116 million for 2010, 2009, 2008, 2007 and 2006, respectively,

primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate utilized was 35% for the periods presented.

(8) See Note 7 (Premises, Equipment, Lease Commitments and Other Assets) to Financial Statements in this Report for detail of balances of other noninterest-earning assets at

December 31, 2010 and 2009.

43