Wells Fargo 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 15: Derivatives (continued)

Fair Value Hedges

We use interest rate swaps to convert certain of our fixed-rate

long-term debt and CDs to floating rates to hedge our exposure

to interest rate risk. We also enter into cross-currency swaps,

cross-currency interest rate swaps and forward contracts to

hedge our exposure to foreign currency risk and interest rate risk

associated with the issuance of non-U.S. dollar denominated

long-term debt and repurchase agreements. In addition, we use

interest rate swaps and forward contracts to hedge against

changes in fair value of certain investments in available-for-sale

debt securities, due to changes in interest rates, foreign currency

rates, or both. The entire derivative gain or loss is included in the

assessment of hedge effectiveness, for all fair value hedge

relationships, except for those involving foreign-currency

denominated securities available for sale, short-term borrowings

and long-term debt hedged with foreign currency forward

derivatives for which the component of the derivative gain or

loss related to the changes in the difference between the spot and

forward price is excluded from the assessment of hedge

effectiveness.

We use statistical regression analysis to assess hedge

effectiveness, both at inception of the hedging relationship and

on an ongoing basis. The regression analysis involves regressing

the periodic change in fair value of the hedging instrument

against the periodic changes in fair value of the asset or liability

being hedged due to changes in the hedged risk(s). The

assessment includes an evaluation of the quantitative measures

of the regression results used to validate the conclusion of high

effectiveness.

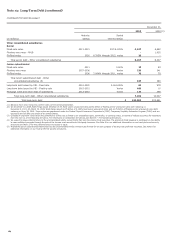

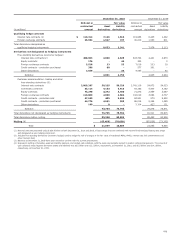

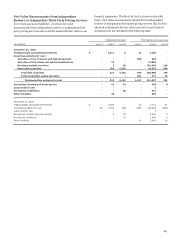

The following table shows the net gains (losses) recognized in

the income statement related to derivatives in fair value hedging

relationships.

Interest rate

Foreign exchange

Total net

contracts hedging:

contracts hedging:

gains

(losses)

Securities

Securities

on fair

available

Long-term

available

Short-term

Long-term

value

(in millions) for sale

debt

for sale

borrowings

debt

hedges

Year ended December 31, 2010

Gains (losses) recorded in net interest income $ (390)

1,755

(4)

-

374

1,735

Gains (losses) recorded in noninterest income

Recognized on derivatives (432)

1,565

269

-

(1,030)

372

Recognized on hedged item 469

(1,469)

(270)

-

1,007

(263)

Recognized on fair value hedges (ineffective portion) (1) $ 37

96

(1)

-

(23)

109

Year ended December 31, 2009

Gains (losses) recorded in net interest income $ (289)

1,677

(56)

27

349

1,708

Gains (losses) recorded in noninterest income

Recognized on derivatives 954

(3,270)

(713)

217

2,612

(200)

Recognized on hedged item (936)

3,132

713

(217)

(2,626)

66

Recognized on fair value hedges (ineffective portion) (1) $ 18

(138)

-

-

(14)

(134)

(1) Included $3 million and $(10) million, respectively, for year ended December 31, 2010 and 2009, of gains (losses) on forward derivatives hedging foreign currency securities

available for sale, short-term borrowings and long-term debt, representing the portion of derivatives gains (losses) excluded from the assessment of hedge effectiveness

(time value).

174