Wells Fargo 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

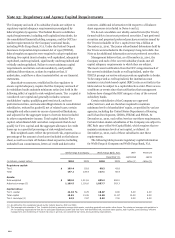

The Company and each of its subsidiary banks are subject to

regulatory capital adequacy requirements promulgated by

federal regulatory agencies. The Federal Reserve establishes

capital requirements, including well capitalized standards, for

the consolidated financial holding company, and the OCC has

similar requirements for the Company’s national banks,

including Wells Fargo Bank, N.A. Under the Federal Deposit

Insurance Corporation Improvement Act of 1991 (FDICIA),

federal regulatory agencies were required to adopt regulations

defining five capital tiers for banks: well capitalized, adequately

capitalized, undercapitalized, significantly undercapitalized and

critically undercapitalized. Failure to meet minimum capital

requirements can initiate certain mandatory, and possibly

additional discretionary, actions by regulators that, if

undertaken, could have a direct material effect on our financial

statements.

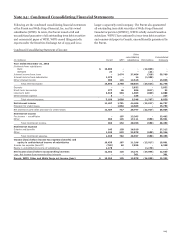

Note 25: Regulatory and Agency Capital Requirements

Quantitative measures, established by the regulators to

ensure capital adequacy, require that the Company and each of

its subsidiary banks maintain minimum ratios (set forth in the

following table) of capital to risk-weighted assets. Tier 1 capital is

considered core capital and generally includes common

stockholders’ equity, qualifying preferred stock, and trust

preferred securities, and noncontrolling interests in consolidated

subsidiaries, reduced by goodwill, net of related taxes, certain

intangible and other assets in excess of prescribed limitations,

and adjusted for the aggregate impact of certain items included

in other comprehensive income. Total capital includes Tier 1

capital, subordinated debt and other components that do not

qualify for Tier 1 capital, and the aggregate allowance for credit

losses up to a specified percentage of risk-weighted assets.

Risk-weighted assets reflect the perceived risk, expressed as a

percentage of the amount of each asset included on the balance

sheet, as well as certain off-balance sheet exposures, including

unfunded loan commitments, letters of credit and derivative

contracts. Additional information with respect to off-balance

sheet exposures is included in Notes 6 and 15.

We do not consolidate our wholly-owned trusts (the Trusts)

formed solely to issue trust preferred securities. Trust preferred

securities and perpetual preferred purchase securities issued by

the Trusts includable in Tier 1 capital were $19.2 billion at

December 31, 2010. The junior subordinated debentures held by

the Trusts were included in the Company's long-term debt. See

Note 13 for additional information on trust preferred securities.

Management believes that, as of December 31, 2010, the

Company and each of the covered subsidiary banks met all

capital adequacy requirements to which they are subject.

The most recent notification from the OCC categorized each of

the covered subsidiary banks as well capitalized, under the

FDICIA prompt corrective action provisions applicable to banks.

To be categorized as well capitalized, the institution must

maintain a total risk-based capital (RBC) ratio as set forth in the

table and not be subject to a capital directive order. There are no

conditions or events since that notification that management

believes have changed the RBC category of any of the covered

subsidiary banks.

Certain subsidiaries of the Company are approved

seller/servicers, and are therefore required to maintain

minimum levels of shareholders’ equity, as specified by various

agencies, including the United States Department of Housing

and Urban Development, GNMA, FHLMC and FNMA. At

December 31, 2010, each seller/servicer met these requirements.

Certain broker-dealer subsidiaries of the Company are subject to

SEC Rule 15c3-1 (the Net Capital Rule), which requires that we

maintain minimum levels of net capital, as defined. At

December 31, 2010, each of these subsidiaries met these

requirements.

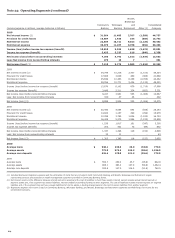

The following table presents regulatory capital information

for Wells Fargo & Company and Wells Fargo Bank, N.A.

Wells Fargo & Company

Wells Fargo Bank, N.A.

Well-

Minimum

December 31,

capitalized

capital

(in billions, except ratios) 2010

2009

2010

2009

ratios (1)

ratios (1)

Regulatory capital:

Tier 1 $ 109.4

93.8

90.2

43.8

Total 147.1

134.4

117.1

58.4

Assets:

Risk-weighted $ 980.0

1,013.6

895.2

492.0

Adjusted average (2) 1,189.5

1,191.6

1,057.7

583.3

Capital ratios:

Tier 1 capital 11.16

%

9.25

10.07

8.90

6.00

4.00

Total capital 15.01

13.26

13.09

11.87

10.00

8.00

Tier 1 leverage (2) 9.19

7.87

8.52

7.50

5.00

4.00

(1) As defined by the regulations issued by the Federal Reserve, OCC and FDIC.

(2) The leverage ratio consists of Tier 1 capital divided by quarterly average total assets, excluding goodwill and certain other items. The minimum leverage ratio guideline is

3% for banking organizations that do not anticipate significant growth and that have well-diversified risk, excellent asset quality, high liquidity, good earnings, effective

management and monitoring of market risk and, in general, are considered top-rated, strong banking organizations.

220