Wells Fargo 2010 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

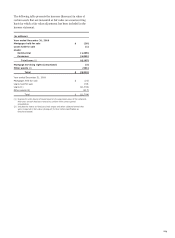

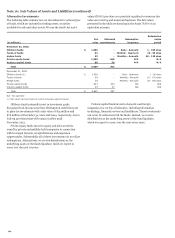

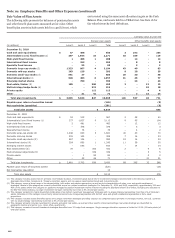

Common Stock

Note 18: Common Stock and Stock Plans

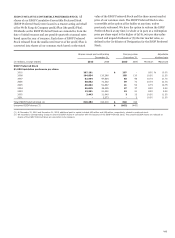

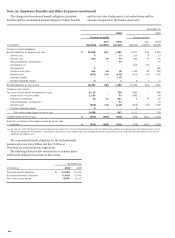

The following table presents our reserved, issued and authorized

shares of common stock at December 31, 2010.

Number of shares

Dividend reinvestment and

common stock purchase plans 8,791,078

Director plans 837,516

Stock plans (1) 667,226,530

Convertible securities and warrants 105,279,949

Total shares reserved 782,135,073

Shares issued 5,272,414,622

Shares not reserved 2,945,450,305

Total shares authorized 9,000,000,000

(1) Includes employee options, restricted shares and restricted share rights, 401(k),

profit sharing and compensation deferral plans.

At December 31, 2010, we have warrants outstanding and

exercisable to purchase 39,444,481 shares of our common stock

with an exercise price of $34.01 per share, expiring on October

28, 2018. These warrants were issued in connection with our

participation in the TARP CPP.

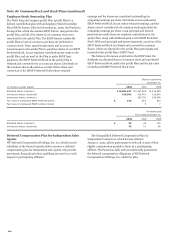

Dividend Reinvestment and Common Stock

Purchase Plans

Participants in our dividend reinvestment and common stock

direct purchase plans may purchase shares of our common stock

at fair market value by reinvesting dividends and/or making

optional cash payments, under the plan's terms.

Employee Stock Plans

We offer the stock based employee compensation plans

described below. We measure the cost of employee services

received in exchange for an award of equity instruments, such as

stock options, restricted share rights (RSRs) or performance

shares, based on the fair value of the award on the grant date.

The cost is normally recognized in our income statement over

the vesting period of the award; awards with graded vesting are

expensed on a straight line method. Awards that continue to vest

after retirement are expensed over the shorter of the period of

time between the grant date and the final vesting period or

between the grant date and when a team member becomes

retirement eligible; awards to team members who are retirement

eligible at the grant date are subject to immediate expensing

upon grant.

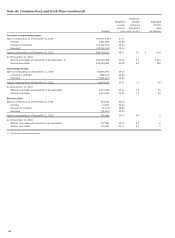

LONG-TERM INCENTIVE COMPENSATION PLANS Our Long

Term Incentive Compensation Plan (LTICP) provides for awards

of incentive and nonqualified stock options, stock appreciation

rights, restricted shares, RSRs, performance share awards and

stock awards without restrictions.

During 2010 we granted RSRs and performance shares as our

primary long-term incentive awards instead of stock options.

Holders of RSRs are entitled to the related shares of common

stock at no cost generally over three to five years after the RSRs

were granted. Holders of RSRs may be entitled to receive

additional RSRs (dividend equivalents) or cash payments equal

to the cash dividends that would have been paid had the RSRs

been issued and outstanding shares of common stock. RSRs

granted as dividend equivalents are subject to the same vesting

schedule and conditions as the underlying RSRs. RSRs generally

continue to vest after retirement according to the original vesting

schedule. Except in limited circumstances, RSRs are cancelled

when employment ends.

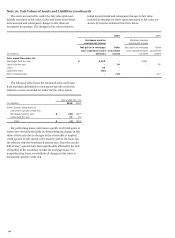

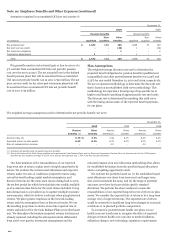

A target number of 1,602,336 and 949,000 performance

shares were granted in 2010 and 2009, respectively, with a fair

value of $27.46 per share and $27.09 per share, respectively.

The final number of performance shares that will vest is subject

to the achievement of specified performance criteria over a

three-year period ending June 30, 2013 and December 31, 2012,

for the 2010 and 2009 awards, respectively, and has a cap of

150% of the target number of performance shares. Holders of

each vested performance share are entitled to the related shares

of common stock at no cost. Performance shares continue to vest

after retirement according to the original vesting schedule

subject to satisfying the performance criteria and other vesting

conditions. As of December 31, 2010, no performance shares

were forfeited or vested and unrecognized compensation cost for

unvested performance shares was $18 million and is expected to

be recognized over a weighted-average period of 2.2 years.

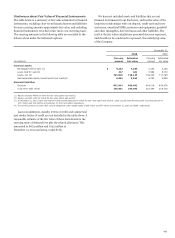

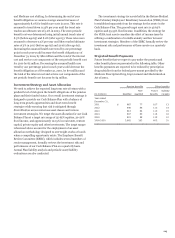

Stock options must have an exercise price at or above fair

market value (as defined in the plan) of the stock at the date of

grant (except for substitute or replacement options granted in

connection with mergers or other acquisitions) and a term of no

more than 10 years. Except for options granted in 2004 and

2005, which generally vested in full upon grant, options

generally become exercisable over three years beginning on the

first anniversary of the date of grant. Except as otherwise

permitted under the plan, if employment is ended for reasons

other than retirement, permanent disability or death, the option

exercise period is reduced or the options are cancelled.

Options granted prior to 2004 may include the right to

acquire a “reload” stock option. If an option contains the reload

feature and if a participant pays all or part of the exercise price

of the option with shares of stock purchased in the market or

held by the participant for at least six months and, in either case,

not used in a similar transaction in the last six months, upon

exercise of the option, the participant is granted a new option to

purchase at the fair market value of the stock as of the date of the

reload, the number of shares of stock equal to the sum of the

number of shares used in payment of the exercise price and a

number of shares with respect to related statutory minimum

withholding taxes. Reload grants are fully vested upon grant and

are expensed immediately.

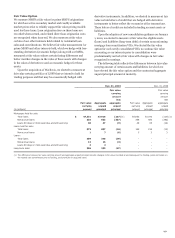

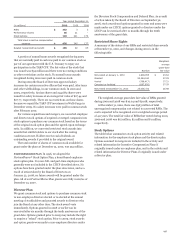

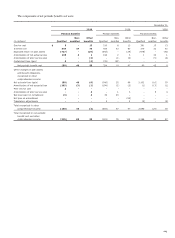

Compensation expense for RSRs and performance shares is

based on the quoted market price of the related stock at the

grant date. Stock option expense is based on the fair value of the

awards at the date of grant. The following table summarizes the

major components of stock incentive compensation expense and

the related recognized tax benefit.

196