Wells Fargo 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Credit Risk Management (continued)

original loan balance. Most of the Pick-a-Pay loans on which

there is a deferred interest balance re-amortize (the monthly

payment amount is reset or “recast”) on the earlier of the date

when the loan balance reaches its principal cap, or the 10-year

anniversary of the loan. For a small population of Pick-a-Pay

loans, the recast occurs at the five-year anniversary. After a

recast, the customers’ new payment terms are reset to the

amount necessary to repay the balance over the remainder of the

original loan term.

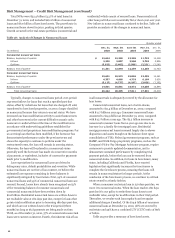

Due to the terms of the Pick-a-Pay portfolio, there is little

recast risk over the next three years. Based on assumptions of a

flat rate environment, if all eligible customers elect the minimum

payment option 100% of the time and no balances prepay, we

would expect the following balances of loans to recast based on

reaching the principal cap: $3 million in 2011, $4 million in 2012

and $32 million in 2013. In 2010, the amount of loans recast

based on reaching the principal cap was $1 million. In addition,

we would expect the following balances of loans to start fully

amortizing due to reaching their recast anniversary date and also

having a payment change at the recast date greater than the

annual 7.5% reset: $34 million in 2011, $69 million in 2012 and

$275 million in 2013. In 2010, the amount of loans reaching

their recast anniversary date and also having a payment change

over the annual 7.5% reset was $39 million.

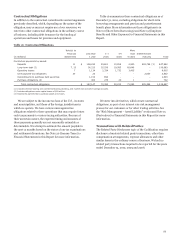

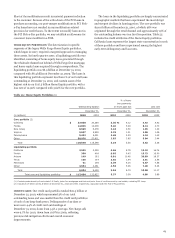

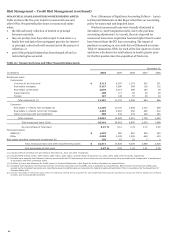

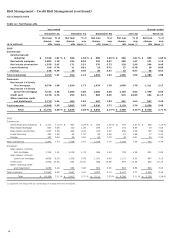

Table 24 reflects the geographic distribution of the Pick-a-

Pay portfolio broken out between PCI loans and all other loans.

In stressed housing markets with declining home prices and

increasing delinquencies, the LTV ratio is a useful metric in

predicting future real estate 1-4 family first mortgage loan

performance, including potential charge-offs. Because PCI loans

were initially recorded at fair value, including write-downs for

expected credit losses, the ratio of the carrying value to the

current collateral value will be lower compared with the LTV

based on the unpaid principal balance. For informational

purposes, we have included both ratios in the following table.

Table 24: Pick-a-Pay Portfolio (1)

December 31, 2010

PCI loans

All other loans

Ratio of

carrying

Unpaid

Current

value to

Unpaid

Current

principal

LTV

Carrying

current

principal

LTV

Carrying

(in millions) balance (2)

ratio (3)

value (4)

value

balance (2)

ratio (3)

value (4)

California $ 28,451

117

%

$ 21,623

88

% $ 20,782

81

% $ 20,866

Florida

3,925

122

2,960

88

4,317

100

4,335

New Jersey

1,432

91

1,242

78

2,568

77

2,578

Texas

371

78

337

72

1,725

64

1,732

Washington

525

96

488

89

1,288

80

1,293

Other states

7,189

106

5,726

83

11,587

84

11,635

Total Pick-a-Pay loans $ 41,893

$ 32,376

$ 42,267

$ 42,439

(1)

The individual states shown in this table represent the top five states based on the total net carrying value of the Pick-a-Pay loans at the beginning of 2010.

(2) Unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial stress exist

that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(3) The current LTV ratio is calculated as the unpaid principal balance divided by the collateral value. Collateral values are generally determined using automated valuation

models (AVM) and are updated quarterly. AVMs are computer-based tools used to estimate market values of homes based on processing large volumes of market data

including market comparables and price trends for local market areas.

(4) Carrying value, which does not reflect the allowance for loan losses, includes remaining purchase accounting adjustments, which, for PCI loans may include the

nonaccretable difference and the accretable yield and, for all other loans, an adjustment to mark the loans to a market yield at date of merger less any subsequent

charge-offs.

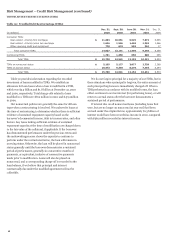

To maximize return and allow flexibility for customers to

avoid foreclosure, we have in place several loss mitigation

strategies for our Pick-a-Pay loan portfolio. We contact

customers who are experiencing difficulty and may in certain

cases modify the terms of a loan based on a customer’s

documented income and other circumstances.

We also have taken steps to work with customers to refinance

or restructure their Pick-a-Pay loans into other loan products.

For customers at risk, we offer combinations of term extensions

of up to 40 years (from 30 years), interest rate reductions,

forbearance of principal, and, in geographies with substantial

property value declines, we may offer permanent principal

reductions.

In 2009, we rolled out the U.S. Treasury Department’s

Home Affordability Modification Program (HAMP) to the

customers in this portfolio. As of December 31, 2010, more than

11,000 HAMP applications were being reviewed by our loan

servicing department and more than 7,000 loans have been

approved for the HAMP trial modification. We believe a key

factor to successful loss mitigation is tailoring the revised loan

payment to the customer’s sustainable income. We continually

reassess our loss mitigation strategies and may adopt additional

or different strategies in the future.

In 2010, we completed more than 27,700 proprietary and

HAMP loan modifications and have completed more than

80,400 modifications since the Wachovia acquisition, resulting

in $3.7 billion of principal forgiveness to our customers. The

majority of the loan modifications were concentrated in our PCI

Pick-a-Pay loan portfolio. Approximately 49,000 modification

offers were proactively sent to customers in 2010. As part of the

modification process, the loans are re-underwritten, income is

documented and the negative amortization feature is eliminated.

62