Wells Fargo 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

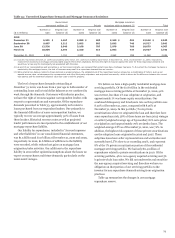

Risk Management – Credit Risk Management (continued)

Total NPAs were $32.4 billion (4.27% of total loans) at

December 31, 2010, and included $26.2 billion of nonaccrual

loans and $6.0 billion of foreclosed assets. The growth rate in

nonaccrual loans slowed in 2010, peaking in third quarter.

Growth occurred in the real estate portfolios (commercial and

residential) which consist of secured loans. Nonaccruals in all

other loan portfolios were essentially flat or down year over year.

New inflows to nonaccrual loans continued to decline. Table 28

provides an analysis of the changes in nonaccrual loans.

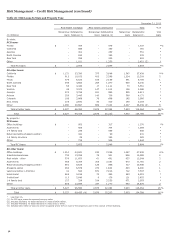

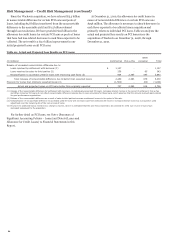

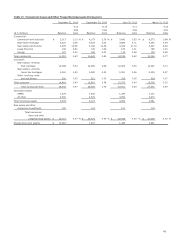

Table 28: Analysis of Changes in Nonaccrual Loans

Quarter ended

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

(in millions) 2010

2010

2010

2010

2009

Commercial nonaccrual loans

Balance, beginning of quarter $ 12,644

12,239

12,265

11,723

10,408

Inflows 2,329

2,807

2,560

2,763

3,856

Outflows (3,622)

(2,402)

(2,586)

(2,221)

(2,541)

Balance, end of quarter 11,351

12,644

12,239

12,265

11,723

Consumer nonaccrual loans

Balance, beginning of quarter 15,661

15,572

15,036

12,695

10,461

Inflows 4,357

4,866

4,733

6,169

5,626

Outflows (5,127)

(4,777)

(4,197)

(3,828)

(3,392)

Balance, end of quarter 14,891

15,661

15,572

15,036

12,695

Total nonaccrual loans 26,242

28,305

27,811

27,301

24,418

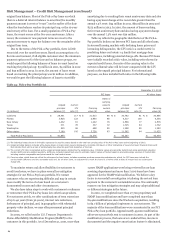

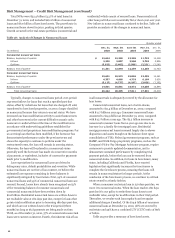

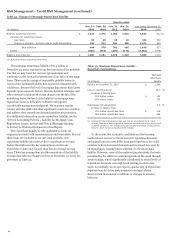

Typically, changes to nonaccrual loans period-over-period

represent inflows for loans that reach a specified past due

status, offset by reductions for loans that are charged off, sold,

transferred to foreclosed properties, or are no longer classified

as nonaccrual because they return to accrual status. We have

increased our loan modification activity to assist homeowners

and other borrowers in the current difficult economic cycle.

Loans are re-underwritten at the time of the modification in

accordance with underwriting guidelines established for

governmental and proprietary loan modification programs. For

an accruing loan that has been modified, if the borrower has

demonstrated performance under the previous terms and

shows the capacity to continue to perform under the

restructured terms, the loan will remain in accruing status.

Otherwise, the loan will be placed in a nonaccrual status

generally until the borrower has made six consecutive months

of payments, or equivalent, inclusive of consecutive payments

made prior to modification.

Loss expectations for nonaccrual loans are driven by

delinquency rates, default probabilities and severities. While

nonaccrual loans are not free of loss content, we believe the

estimated loss exposure remaining in these balances is

significantly mitigated by four factors. First, 99% of consumer

nonaccrual loans and 95% of commercial nonaccrual loans are

secured. Second, losses have already been recognized on 52%

of the remaining balance of consumer nonaccruals and

commercial nonaccruals have been written down by

$2.6 billion. Residential nonaccrual loans are written down to

net realizable value at 180 days past due, except for loans that

go into trial modification prior to becoming 180 days past due,

and which are not written down in the trial period (three

months) as long as trial payments are being made on time.

Third, as of December 31, 2010, 57% of commercial nonaccrual

loans were current on interest. Fourth, the inherent risk of loss

in all nonaccruals is adequately covered by the allowance for

loan losses.

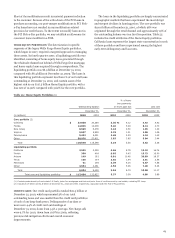

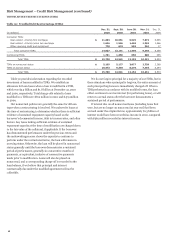

Commercial nonaccrual loans, net of write-downs,

amounted to $11.4 billion at December 31, 2010, compared

with $11.7 billion a year ago. Consumer nonaccrual loans

amounted to $14.9 billion at December 31, 2010, compared

with $12.7 billion a year ago. The $2.2 billion increase in

nonaccrual consumer loans from a year ago was due to an

increase in 1-4 family first mortgage loans. Residential

mortgage nonaccrual loans increased largely due to slower

disposition and assets brought on the balance sheet upon

consolidation of VIEs. Federal government programs, such as

HAMP, and Wells Fargo proprietary programs, such as the

Company’s Pick-a-Pay Mortgage Assistance program, require

customers to provide updated documentation, and to

demonstrate sustained performance by completing trial

payment periods, before the loan can be removed from

nonaccrual status. In addition, for loans in foreclosure, many

states, including California and Florida, have enacted

legislation that significantly increases the time frames to

complete the foreclosure process, meaning that loans will

remain in nonaccrual status for longer periods. At the

conclusion of the foreclosure process, we continue to sell real

estate owned in a timely fashion.

When a consumer real estate loan is 120 days past due, we

move it to nonaccrual status. When the loan reaches 180 days

past due it is our policy to write these loans down to net

realizable value, except for modifications in their trial period.

Thereafter, we revalue each loan regularly and recognize

additional charges if needed. Of the $14.9 billion of consumer

nonaccrual loans at December 31, 2010, 98% are secured by

real estate and 33% have a combined LTV (CLTV) ratio of 80%

or below.

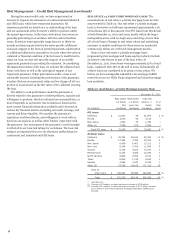

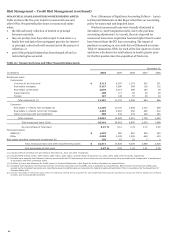

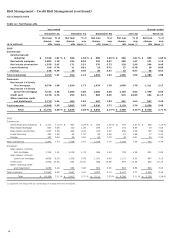

Table 29 provides a summary of foreclosed assets.

66