Safeway 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

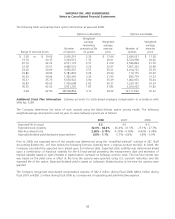

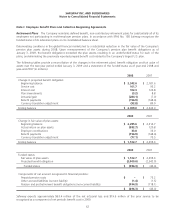

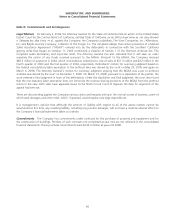

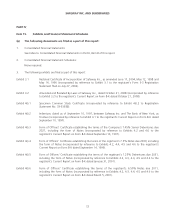

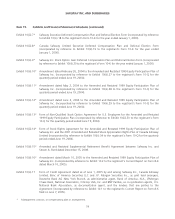

The following table presents sales revenue by type of similar product (dollars in millions):

2008 2007 2006

Amount % of total Amount % of total Amount % of total

Non-perishables (1) $ 19,826.5 45.0% $ 19,178.4 45.4% $ 18,513.0 46.0%

Perishables (2) 16,514.0 37.4% 15,833.9 37.4% 15,067.3 37.5%

Fuel 3,885.2 8.8% 3,487.8 8.2% 3,002.4 7.5%

Pharmacy 3,878.3 8.8% 3,785.9 9.0% 3,602.3 9.0%

Total sales and other revenue $ 44,104.0 100.0% $ 42,286.0 100.0% $ 40,185.0 100.0%

(1) Consists primarily of general merchandise, grocery, meal ingredients, soft drinks and other beverages, snacks and frozen foods.

(2) Consists primarily of produce, dairy, meat, bakery, deli, floral and seafood.

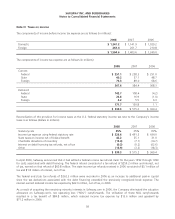

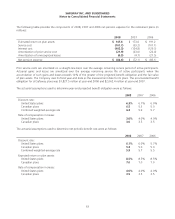

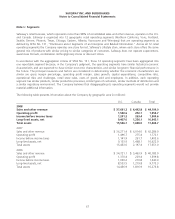

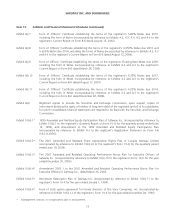

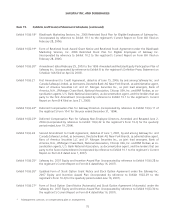

Note M: Computation of Earnings Per Share

(In millions, except per-share amounts) 2008 2007 2006

Diluted Basic Diluted Basic Diluted Basic

Net income $ 965.3 $ 965.3 $ 888.4 $ 888.4 $ 870.6 $ 870.6

Weighted-average common shares

outstanding 433.8 433.8 440.3 440.3 444.9 444.9

Common share equivalents 2.5 5.4 2.9

Weighted-average shares outstanding 436.3 445.7 447.8

Earnings per share $ 2.21 $ 2.23 $ 1.99 $ 2.02 $ 1.94 $ 1.96

Anti-dilutive shares totaling 21.9 million in 2008, 15.0 million in 2007 and 22.3 million in 2006 have been excluded from

diluted weighted-average shares outstanding.

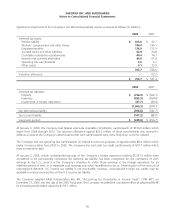

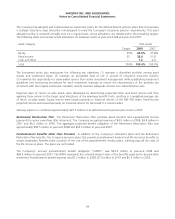

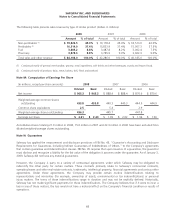

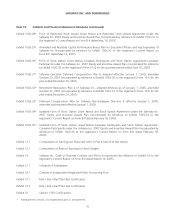

Note N: Guarantees

Safeway has applied the measurement and disclosure provisions of FIN No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others,” to the Company’s agreements

that contain guarantee and indemnification clauses. FIN No. 45 requires that upon issuance of a guarantee, the guarantor

must disclose and recognize a liability for the fair value of the obligation it assumes under the guarantee. As of January 3,

2009, Safeway did not have any material guarantees.

However, the Company is party to a variety of contractual agreements under which Safeway may be obligated to

indemnify the other party for certain matters. These contracts primarily relate to Safeway’s commercial contracts,

operating leases and other real estate contracts, trademarks, intellectual property, financial agreements and various other

agreements. Under these agreements, the Company may provide certain routine indemnifications relating to

representations and warranties (for example, ownership of assets, environmental or tax indemnifications) or personal

injury matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically,

Safeway has not made significant payments for these indemnifications. The Company believes that if it were to incur a

loss in any of these matters, the loss would not have a material effect on the Company’s financial condition or results of

operations.

68