Safeway 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

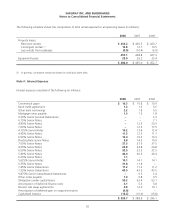

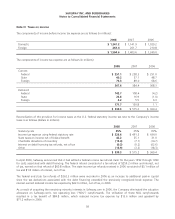

The Company is subject to periodic audits by the Internal Revenue Service and other foreign, state and local taxing

authorities. These audits may challenge certain of the Company’s tax positions, such as the timing and amount of income

and deductions and the allocation of taxable income to various tax jurisdictions. Income tax contingencies are accounted

for in accordance with FIN 48 and may require significant management judgment in estimating final outcomes. Actual

results could materially differ from these estimates and could significantly affect the Company’s effective tax rate and

cash flows in future years.

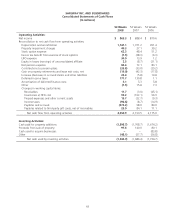

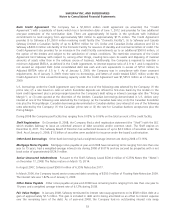

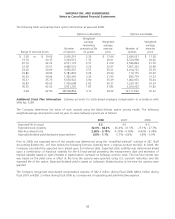

Off-Balance Sheet Financial Instruments The Company has, from time to time, entered into interest rate swap

agreements to change its portfolio mix of fixed- and floating-rate debt to more desirable levels. Interest rate swap

agreements involve the exchange with a counterparty of fixed- and floating-rate interest payments periodically over the

life of the agreements without exchange of the underlying notional principal amounts. The differential to be paid or

received is recognized over the life of the agreements as an adjustment to interest expense. The Company’s

counterparties have been major financial institutions. There were no outstanding interest rate swap agreements at

year-end 2008.

Energy Contracts The Company has entered into contracts to purchase electricity and natural gas at fixed prices for a

portion of its energy needs. Safeway expects to take delivery of the electricity and natural gas in the normal course of

business, and these contracts are not net settled. Since these contracts qualify for the normal purchase exception of SFAS

No. 133, “Accounting for Derivative Instruments and Hedging Activities,” they are not marked to market. Energy

purchased under these contracts is expensed as delivered.

Fair Value of Financial Instruments Disclosures of the fair value of certain financial instruments are required, whether

or not recognized in the balance sheet. The Company estimated the fair values presented below using appropriate

valuation methodologies and market information available as of year end. Considerable judgment is required to develop

estimates of fair value, and the estimates presented are not necessarily indicative of the amounts that the Company could

realize in a current market exchange. The use of different market assumptions or estimation methodologies could have a

material effect on the estimated fair values. Additionally, the fair values were estimated at year end, and current estimates

of fair value may differ significantly from the amounts presented.

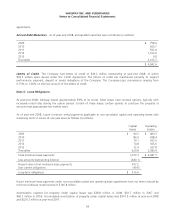

SFAS No. 157, “Fair Value Measurements,” defines and establishes a framework for measuring fair value and expands

related disclosures. This Statement does not require any new fair value measurements. SFAS No. 157 was effective for the

Company’s financial assets and financial liabilities beginning in fiscal 2008. In February 2008, FASB Staff Position 157-2,

“Effective Date of Statement 157,” deferred the effective date of SFAS No. 157 for all nonfinancial assets and

nonfinancial liabilities to fiscal years beginning after November 15, 2008.

SFAS No. 157 prioritizes the inputs used in measuring fair value into the following hierarchy:

Level 1 Quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 Inputs other than quoted prices included within Level 1 that are either directly or indirectly

observable;

Level 3 Unobservable inputs in which little or no market activity exists, therefore requiring an entity to

develop its own assumptions about the assumptions that market participants would use in

pricing.

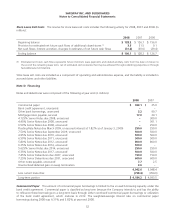

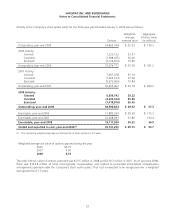

The following methods and assumptions were used to estimate the fair value of each class of financial instruments:

Cash and equivalents, accounts receivable, accounts payable and short-term debt. The carrying amount of these items

approximates fair value.

Long-term debt. Market values quoted on the New York Stock Exchange are used to estimate the fair value of publicly

traded debt. To estimate the fair value of debt issues that are not quoted on an exchange, the Company uses those

interest rates that are currently available to it for issuance of debt with similar terms and remaining maturities. At

year-end 2008, the estimated fair value of debt was $5.1 billion compared to a carrying value of $4.9 billion. At year-end

49