Safeway 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

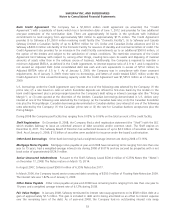

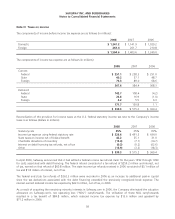

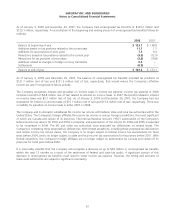

Bank Credit Agreement The Company has a $1,600.0 million credit agreement (as amended, the “Credit

Agreement”) with a syndicate of banks which has a termination date of June 1, 2012 and provides for two additional

one-year extensions of the termination date. There are approximately 30 banks in the syndicate with individual

commitments to lend ranging from approximately $20 million to approximately $115 million. The Credit Agreement

provides (i) to Safeway a $1,350.0 million revolving credit facility (the “Domestic Facility”), (ii) to Safeway and Canada

Safeway Limited a Canadian facility of up to $250.0 million for U.S. Dollar and Canadian Dollar advances and (iii) to

Safeway a $400.0 million sub-facility of the Domestic Facility for issuance of standby and commercial letters of credit. The

Credit Agreement also provides for an increase in the credit facility commitments up to an additional $500.0 million, at

the option of the lenders and subject to the satisfaction of certain conditions. The restrictive covenants of the Credit

Agreement limit Safeway with respect to, among other things, creating liens upon its assets and disposing of material

amounts of assets other than in the ordinary course of business. Additionally, the Company is required to maintain a

minimum Adjusted EBITDA, as defined in the Credit Agreement, to interest expense ratio of 2.0 to 1 and is required to

not exceed an Adjusted Debt (total consolidated debt less cash and cash equivalents in excess of $75.0 million) to

Adjusted EBITDA ratio of 3.5 to 1. As of January 3, 2009, the Company was in compliance with these covenant

requirements. As of January 3, 2009, there were no borrowings, and letters of credit totaled $34.5 million under the

Credit Agreement. Total unused borrowing capacity under the Credit Agreement was $1,565.5 million as of January 3,

2009.

U.S. borrowings under the Credit Agreement carry interest at one of the following rates selected by the Company: (1) the

prime rate; (2) a rate based on rates at which Eurodollar deposits are offered to first-class banks by the lenders in the

bank credit agreement plus a pricing margin based on the Company’s debt rating or interest coverage ratio (the “Pricing

Margin”); or (3) rates quoted at the discretion of the lenders. Canadian borrowings denominated in U.S. dollars carry

interest at one of the following rates selected by the Company: (a) the Canadian base rate; or (b) the Canadian Eurodollar

rate plus the Pricing Margin. Canadian borrowings denominated in Canadian dollars carry interest at one of the following

rates selected by the Company: (1) the Canadian prime rate or (2) the rate for Canadian bankers acceptances plus the

Pricing Margin.

During 2008 the Company paid facility fees ranging from 0.05% to 0.06% on the total amount of the credit facility.

Shelf Registration On December 8, 2008, the Company filed a shelf registration statement (the “Shelf”) with the SEC

which enables Safeway to issue an unlimited amount of debt securities and/or common stock. The Shelf expires on

December 8, 2011. The Safeway Board of Directors has authorized issuance of up to $2.0 billion of securities under the

Shelf. As of January 3, 2009, $1.5 billion of securities were available for issuance under the board’s authorization.

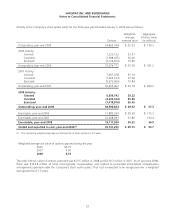

Other Bank Borrowings Other bank borrowings had a weighted average interest rate during 2008 of 3.16%.

Mortgage Notes Payable Mortgage notes payable at year-end 2008 have remaining terms ranging from less than one

year to 15 years, had a weighted-average interest rate during 2008 of 8.01% and are secured by properties with a net

book value of approximately $124.0 million.

Senior Unsecured Indebtedness Pursuant to the Shelf, Safeway issued $500.0 million of 6.25% Notes (the “Notes”)

on December 17, 2008. The Notes mature on March 15, 2014.

In August 2007, Safeway issued $500.0 million of 6.35% Notes due 2017.

In March 2006, the Company issued senior unsecured debt consisting of $250.0 million of Floating Rate Notes due 2009.

The interest rate was 1.82% as of January 3, 2009.

Other Notes Payable Other notes payable at year-end 2008 have remaining terms ranging from less than one year to

19 years and a weighted average interest rate of 6.12% during 2008.

Fair Value Hedges In January 2008, Safeway terminated its interest rate swap agreements on its $500 million debt at a

gain of approximately $7.5 million. This gain is included in debt and is being amortized as an offset to interest expense

over the remaining term of the debt. As of year-end 2008, the Company had no outstanding interest rate swap

53