Safeway 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

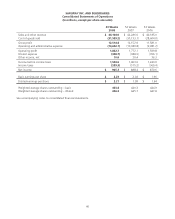

SAFEWAY INC. AND SUBSIDIARIES

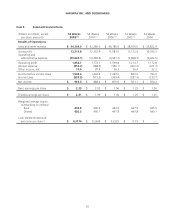

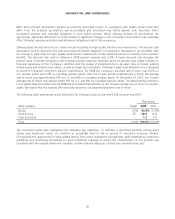

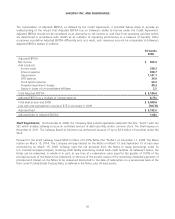

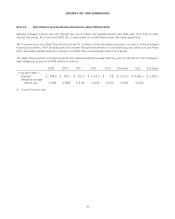

The computation of Adjusted EBITDA, as defined by the Credit Agreement, is provided below solely to provide an

understanding of the impact that Adjusted EBITDA has on Safeway’s ability to borrow under the Credit Agreement.

Adjusted EBITDA should not be considered as an alternative to net income or cash flow from operating activities (which

are determined in accordance with GAAP) as an indicator of operating performance or a measure of liquidity. Other

companies may define Adjusted EBITDA differently and, as a result, such measures may not be comparable to Safeway’s

Adjusted EBITDA (dollars in millions).

53 weeks

2008

Adjusted EBITDA:

Net income $ 965.3

Add (subtract):

Income taxes 539.3

Interest expense 358.7

Depreciation 1,141.1

LIFO expense 34.9

Stock option expense 62.3

Property impairment charges 40.3

Equity in losses of unconsolidated affiliates 2.5

Total Adjusted EBITDA $ 3,144.4

Adjusted EBITDA as a multiple of interest expense 8.77x

Total debt at year-end 2008 $ 5,499.8

Less cash and equivalents in excess of $75.0 at January 3, 2009 (307.8)

Adjusted Debt $ 5,192.0

Adjusted Debt to Adjusted EBITDA 1.65x

Shelf Registration On December 8, 2008, the Company filed a shelf registration statement the (the “Shelf”) with the

SEC which enables Safeway to issue an unlimited amount of debt securities and/or common stock. The Shelf expires on

December 8, 2011. The Safeway Board of Directors has authorized issuance of up to $2.0 billion of securities under the

Shelf.

Pursuant to the Shelf, Safeway issued $500.0 million of 6.25% Notes (the “Notes”) on December 17, 2008. The Notes

mature on March 15, 2014. The Company will pay interest on the Notes on March 15 and September 15 of each year

commencing on March 15, 2009. Safeway used the net proceeds from the Notes to repay borrowings under its

U.S. commercial paper program, revolving credit facility and money market bank credit facilities. At Safeway’s option, the

Notes can be redeemed, in whole or in part, at any time at a redemption price equal to the greater of 100% of the

principal amount of the Notes to be redeemed, or the sum of the present values of the remaining scheduled payments of

principal and interest on the Notes to be redeemed discounted to the date of redemption on a semiannual basis at the

then current United States Treasury Rate, as defined in the Notes, plus 50 basis points.

30