Safeway 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Stock Repurchase Program From the initiation of the Company’s stock repurchase program in 1999 through the end

of fiscal 2008, the aggregate cost of shares of common stock repurchased by the Company, including commissions, was

approximately $3.8 billion, leaving an authorized amount for repurchases of approximately $1.2 billion. This includes an

increase in the total authorized level of the repurchase program by $1.0 billion to $5.0 billion approved by the Board of

Directors in May 2008. During fiscal 2008, Safeway repurchased approximately 12.6 million shares of its common stock

under the repurchase program at an aggregate price, including commissions, of $359.5 million. The average price per

share, excluding commissions, was $28.45. The Company will evaluate the timing and volume of future repurchases

based on several factors, including market conditions, and may repurchase stock in the near- or long-term as

circumstances warrant.

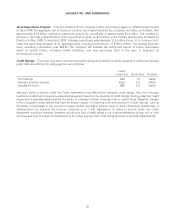

Credit Ratings The senior long-term and short-term debt ratings and outlooks currently assigned to unsecured Safeway

public debt securities by the rating agencies are as follows:

Senior

Long-Term Short-Term Outlook

Fitch Ratings BBB F2 Stable

Moody’s Investors Services Baa2 P-2 Stable

Standard & Poor’s BBB A-2 Stable

Safeway’s ability to borrow under the Credit Agreement is not affected by Safeway’s credit ratings. Also, the Company

maintains no debt which requires accelerated repayment based on the lowering of credit ratings. Pricing under the Credit

Agreement is generally determined by the better of Safeway’s interest coverage ratio or credit ratings. Negative changes

in the Company’s credit ratings may have an adverse impact on financing costs and structure in future periods, such as

the ability to participate in the commercial paper market and higher interest costs on future financings. Additionally, if

Safeway does not maintain the financial covenants in its Credit Agreement, its ability to borrow under the Credit

Agreement would be impaired. Investors should note that a credit rating is not a recommendation to buy, sell or hold

securities and may be subject to withdrawal by the rating agency. Each credit rating should be evaluated independently.

32