Safeway 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

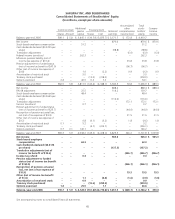

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

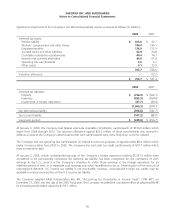

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS No. 141R”). SFAS No. 141R

established principles and requirements for how an entity which obtains control of one or more businesses (1) recognizes and

measures the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree, (2) recognizes

and measures the goodwill acquired in the business combination and (3) determines what information to disclose regarding

business combinations. SFAS No. 141R applies prospectively to business combinations for which the acquisition date is on or after

the beginning of the first annual report period beginning on or after December 15, 2008.

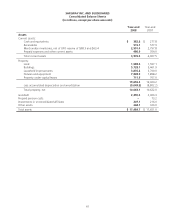

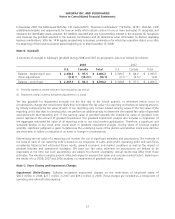

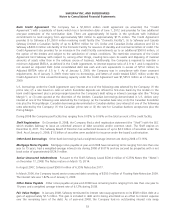

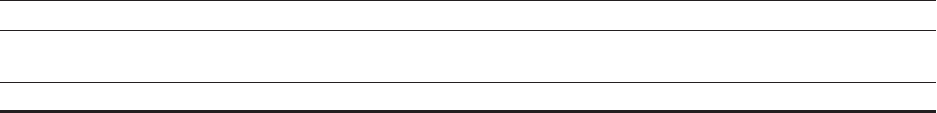

Note B: Goodwill

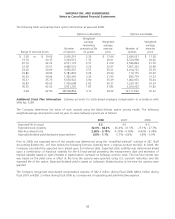

A summary of changes in Safeway’s goodwill during 2008 and 2007 by geographic area is as follows (in millions):

2008 2007

U.S. Canada Total U.S. Canada Total

Balance – beginning of year $ 2,308.8 $ 97.5 $ 2,406.3 $ 2,309.5 $ 84.0 $ 2,393.5

Other adjustments (0.9) (1) (15.2) (2) (16.1) (0.7) (1) 13.5 (2) 12.8

Balance – end of year $ 2,307.9 $ 82.3 $ 2,390.2 $ 2,308.8 $ 97.5 $ 2,406.3

(1) Primarily represents revised estimate of pre-acquisition tax accrual.

(2) Represents foreign currency translation adjustments in Canada.

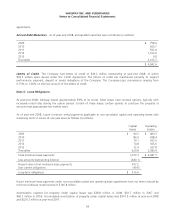

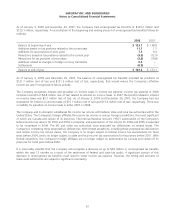

We test goodwill for impairment annually (on the first day of the fourth quarter), or whenever events occur or

circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount,

by initially comparing the fair value of each of our reporting units to their related carrying values. If the fair value of the

reporting unit is less than its carrying value, we perform an additional step to determine the implied fair value of goodwill

associated with that reporting unit. If the carrying value of goodwill exceeds the implied fair value of goodwill, such

excess represents the amount of goodwill impairment. Our goodwill impairment analysis also includes a comparison of

the aggregate estimated fair value of all reporting units to our total market capitalization. Therefore, a significant and

sustained decline in our stock price could result in goodwill impairment charges. During times of financial market

volatility, significant judgment is given to determine the underlying cause of the decline and whether stock price declines

are short-term in nature or indicative of an event or change in circumstances.

Determining the fair value of a reporting unit involves the use of significant estimates and assumptions. The estimate of

fair value of each of our reporting units is based on our projection of sales, gross profit, operating profit and cash flows

considering historical and estimated future results, general economic and market conditions as well as the impact of

planned business and operational strategies. We base our fair value estimates on assumptions we believe to be

reasonable at the time, but such assumptions are subject to inherent uncertainty. Actual results may differ from those

estimates. The valuations employ present value techniques to measure fair value and consider market factors. Based upon

the results of our 2008, 2007 and 2006 analyses, no impairment of goodwill was indicated.

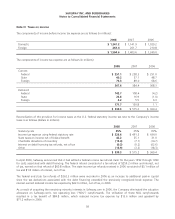

Note C: Store Closing and Impairment Charges

Impairment Write-Downs Safeway recognized impairment charges on the write-down of long-lived assets of

$40.3 million in 2008, $27.1 million in 2007 and $39.2 million in 2006. These charges are included as a component of

operating and administrative expense.

51