Safeway 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

results could materially differ from these estimates and could significantly affect the Company’s effective tax rate and

cash flows in future years. Note H to the consolidated financial statements set forth in Part II, Item 8 of this report

provides additional information on income taxes.

Liquidity and Financial Resources

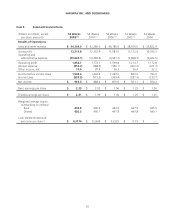

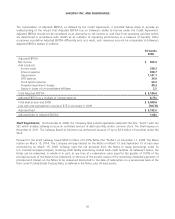

Net cash flow from operating activities was $2,250.9 million in 2008, $2,190.5 million in 2007 and $2,175.0 million in

2006 primarily due to the increasing amount of net income in such years.

Blackhawk receives a significant portion of the cash inflow from the sale of third-party gift cards late in the fourth quarter

of the year and remits the majority of the cash, less commissions, to the card partners early in the first quarter of the

following year. The growth of Blackhawk’s net payables related to third-party gift cards declined to $23.9 million in 2008

from $84.1 million in 2007 as a result of the timing of payments due to the holidays, the 53rd week of fiscal 2008 and a

change in the product mix.

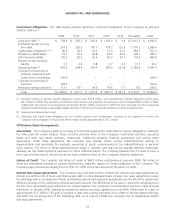

Historically, cash contributions to the Company’s retirement plans have been relatively small. For example, cash

contributions were $33.8 million and $33.0 million in 2008 and 2007, respectively, and were limited primarily to our

Canadian retirement plans. The decline in the financial markets during 2008 resulted in a substantial reduction in the fair

value of the retirement plan assets. As a result, at the end of fiscal 2008, pension benefit obligations exceeded the fair

value of plans assets for all of the Company’s pension plans. In 2009, we expect pension expense to increase significantly,

primarily as a result of the decline in the plan assets. The Company currently expects to contribute approximately

$25.9 million to its defined benefit pension plan trusts in 2009. If return on plan assets is less than expected or if

discounts rates decline, plan contributions could increase significantly in 2010 and beyond.

Net cash flow used by investing activities, which consists principally of cash paid for property additions, was

$1,546.0 million in 2008, $1,686.4 million in 2007 and $1,734.7 million in 2006. Net cash flow used by investing

activities declined in 2008 primarily due to lower cash paid for property additions. Cash paid for property additions was

greater in 2007 than in 2006. However, proceeds from the sale of property were also greater in 2007. In addition,

Safeway spent $83.8 million to acquire businesses in 2006.

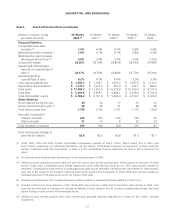

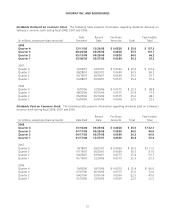

Capital expenditures decreased moderately in 2008 and increased in 2007 and 2006 compared to the prior years. During

2008, Safeway invested $1.6 billion in capital expenditures. The Company continued to focus on Lifestyle remodels. In

2008 the Company opened 20 new Lifestyle stores and completed 232 Lifestyle store remodels. The Company also

completed 21 other remodels. During 2007, Safeway invested $1.77 billion in capital expenditures. The Company opened

20 new Lifestyle stores, completed 253 Lifestyle remodels and closed 38 stores. In 2006 Safeway opened 17 new Lifestyle

stores and completed 276 Lifestyle store remodels. Safeway also completed eight other remodels. In 2009 the Company

expects to spend approximately $1.2 billion in cash capital expenditures and to open approximately 10 new Lifestyle

stores and to remodel approximately 135 stores into Lifestyle stores. The reduction in cash capital expenditures for fiscal

2009 is expected to increase cash flow available to pay down debt. The Company expects that approximately 82% and

88% of its store base will be Lifestyle stores by the end of 2009 and 2010, respectively.

Net cash flow used by financing activities was $594.3 million in 2008, $454.0 million in 2007 and $596.3 million in 2006.

In 2008 the Company paid down $130.0 million of debt, repurchased $359.5 million of common stock and paid

$132.1 million of dividends. In 2007 Safeway paid down $261.3 million of debt, repurchased $226.1 million of common

stock and paid $111.5 million of dividends. In 2006 Safeway paid down $493.1 million of debt, repurchased

$318.0 million of common stock and paid dividends of $96.0 million. Also in 2006 Safeway received a $262.3 million tax

refund related to prior years’ financing.

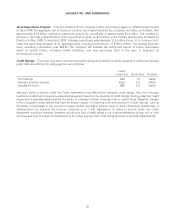

The recent economic turmoil in the credit markets may negatively impact the Company’s ability to access debt financing

in a timely manner and with acceptable terms. In the event the Company is unable to issue sufficient commercial paper or

public debt to repay current maturities, we may choose to borrow under the Credit Agreement, described under the

caption “Bank Credit Agreement” in this report. Although there can be no assurance because of these challenging

28