Safeway 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

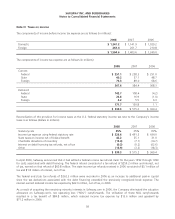

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

2007, the estimated fair value of debt was $5.2 billion compared to a carrying value of $5.0 billion.

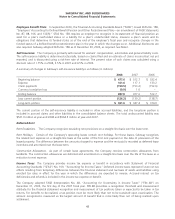

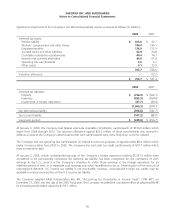

Store Closing and Impairment Charges Safeway regularly reviews its stores’ operating performance and assesses the

Company’s plans for certain store and plant closures. In accordance with SFAS No. 144, “Accounting for the Impairment

or Disposal of Long-Lived Assets,” losses related to the impairment of long-lived assets are recognized when expected

future cash flows are less than the asset’s carrying value. At the time a store is closed or because of changes in

circumstances that indicate the carrying value of an asset may not be recoverable, the Company evaluates the carrying

value of the assets in relation to its expected future cash flows. If the carrying value is greater than the future cash flows,

a provision is made for the impairment of the assets to write the assets down to estimated fair value. Fair value is

determined by estimating net future cash flows, discounted using a risk-adjusted rate of return. The Company calculates

impairment on a store-by-store basis. These provisions are recorded as a component of operating and administrative

expense and are disclosed in Note C.

When stores that are under long-term leases close, the Company records a liability for the future minimum lease

payments and related ancillary costs, net of estimated cost recoveries that may be achieved through subletting properties

or through favorable lease terminations, discounted using a risk-adjusted rate of interest. This liability is recorded at the

time the store is closed. Activity included in the reserve for store lease exit costs is disclosed in Note C.

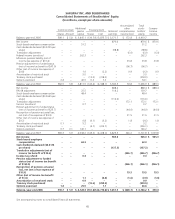

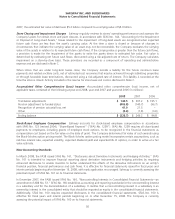

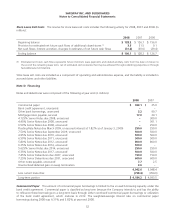

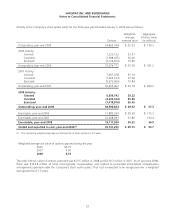

Accumulated Other Comprehensive (Loss) Income Accumulated other comprehensive (loss) income, net of

applicable taxes, consisted of the following at year-end 2008, year-end 2007 and year-end 2006 (in millions):

2008 2007 2006

Translation adjustments $ 140.5 $ 367.2 $ 195.1

Pension adjustment to funded status (406.8) (140.7) (96.7)

Recognition of pension actuarial loss, net 41.0 21.5 –

Other (3.4) (1.8) (3.6)

Ending balance $ (228.7) $ 246.2 $ 94.8

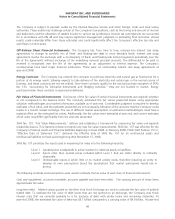

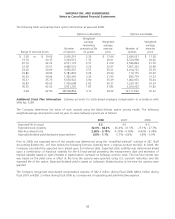

Stock-Based Employee Compensation Safeway accounts for stock-based employee compensation in accordance

with SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”). SFAS No. 123R requires all share-based

payments to employees, including grants of employee stock options, to be recognized in the financial statements as

compensation cost based on the fair value on the date of grant. The Company determines fair value of such awards using

the Black-Scholes option pricing model. The Black-Scholes option pricing model incorporates certain assumptions, such as

risk-free interest rate, expected volatility, expected dividend yield and expected life of options, in order to arrive at a fair

value estimate.

New Accounting Standards

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities.” SFAS

No. 161 is intended to improve financial reporting about derivative instruments and hedging activities by requiring

enhanced disclosures to enable investors to better understand the effects of the derivative instruments on an entity’s

financial position, financial performance and cash flows. It is effective for financial statements issued for fiscal years and

interim periods beginning after November 15, 2008, with early application encouraged. Safeway is currently assessing the

potential impact of SFAS No. 161 on its financial statements.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements—an

amendment of ARB No. 51.” SFAS No. 160 establishes accounting and reporting standards for the noncontrolling interest

in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an

ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements.

Additionally, SFAS No. 160 requires expanded disclosures in the consolidated financial statements. SFAS No. 160 is

effective for fiscal years and interim periods beginning on or after December 15, 2008. The Company is currently

assessing the potential impact of SFAS No. 160 on its financial statements.

50