Safeway 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note I: Employee Benefit Plans and Collective Bargaining Agreements

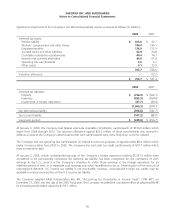

Retirement Plans The Company maintains defined benefit, non-contributory retirement plans for substantially all of its

employees not participating in multi-employer pension plans. In accordance with SFAS No. 158 Safeway recognizes the

funded status of its retirement plans on its consolidated balance sheet.

Deteriorating conditions in the global financial markets led to a substantial reduction in the fair value of the Company’s

pension plan assets during 2008. Upon remeasurement of the Company’s pension plan benefit obligations as of

January 3, 2009, the benefit obligations exceeded the plan assets, resulting in an underfunded status for each of the

plans, and eliminating the previously reported prepaid benefit cost related to the Company’s largest U.S. plan.

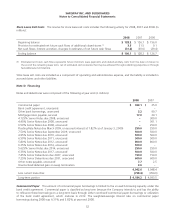

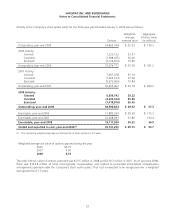

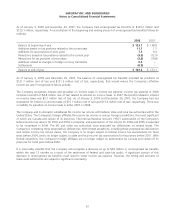

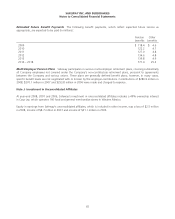

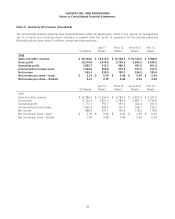

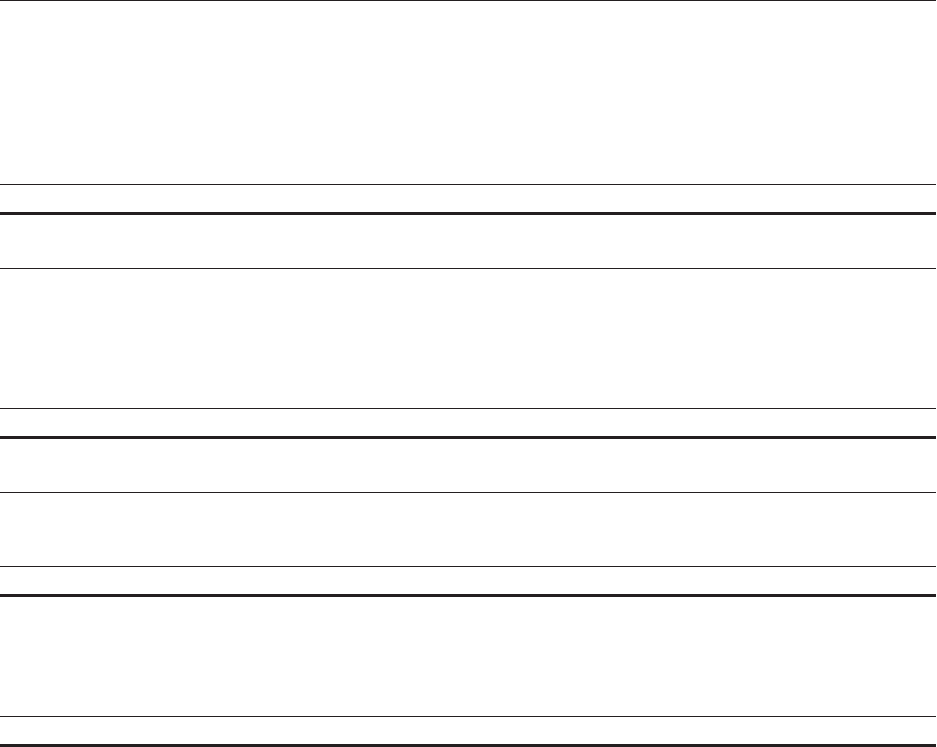

The following tables provide a reconciliation of the changes in the retirement plans’ benefit obligation and fair value of

assets over the two-year period ended January 3, 2009 and a statement of the funded status as of year-end 2008 and

year-end 2007 (in millions):

2008 2007

Change in projected benefit obligation:

Beginning balance $ 2,342.0 $ 2,181.6

Service cost 101.7 93.2

Interest cost 102.3 124.8

Plan amendments (3.2) 8.8

Actuarial gain (284.1) (7.0)

Benefit payments (156.9) (148.4)

Currency translation adjustment (92.8) 89.0

Ending balance $ 2,009.0 $ 2,342.0

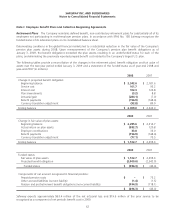

2008 2007

Change in fair value of plan assets:

Beginning balance $ 2,295.6 $ 2,214.7

Actual return on plan assets (582.7) 120.8

Employer contributions 33.8 33.0

Benefit payments (156.9) (148.4)

Currency translation adjustment (77.1) 75.5

Ending balance $ 1,512.7 $ 2,295.6

2008 2007

Funded status:

Fair value of plan assets $ 1,512.7 $ 2,295.6

Projected benefit obligation (2,009.0) (2,342.0)

Funded status $ (496.3) $ (46.4)

Components of net amount recognized in financial position:

Prepaid pension costs $–$ 73.2

Other accrued liabilities (current liability) (1.4) (1.5)

Pension and postretirement benefit obligations (non-current liability) (494.9) (118.1)

$ (496.3) $ (46.4)

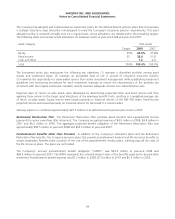

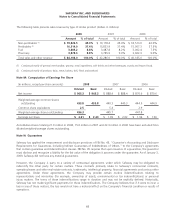

Safeway expects approximately $63.4 million of the net actuarial loss and $19.6 million of the prior service to be

recognized as a component of net periodic benefit cost in 2009.

62