Safeway 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

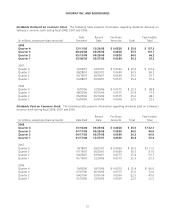

SAFEWAY INC. AND SUBSIDIARIES

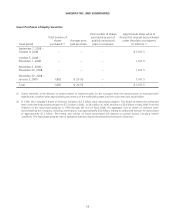

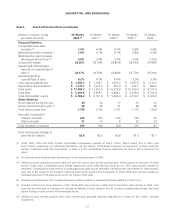

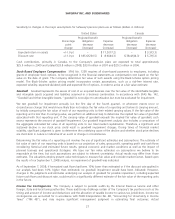

Item 6. Selected Financial Data (continued)

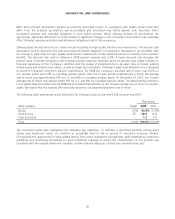

(Dollars in millions, except

per-share amounts)

53 Weeks

2008 (1)

52 Weeks

2007 (1)

52 Weeks

2006 (1)

52 Weeks

2005 (1)

52 Weeks

2004

Financial Statistics

Comparable-store sales

increases (3) 1.5% 4.4% 4.4% 5.9% 0.9%

Identical-store sales increases (3) 1.4% 4.1% 4.1% 5.8% 0.3%

Identical-store sales increases

(decreases) without fuel (3) 0.8% 3.4% 3.3% 4.3% (1.3%)

Gross profit margin 28.38% 28.74% 28.82% 28.93% 29.58%

Operating & administrative

expense as a percentage of

sales (4) 24.17% 24.55% 24.84% 25.77% 26.30%

Operating profit as

a percentage of sales 4.2% 4.2% 4.0% 3.2% 3.3%

Cash capital expenditures $ 1,595.7 $ 1,768.7 $ 1,674.2 $ 1,383.5 $ 1,212.5

Depreciation & amortization $ 1,141.1 $ 1,071.2 $ 991.4 $ 932.7 $ 894.6

Total assets $ 17,484.7 $ 17,651.0 $ 16,273.8 $ 15,756.9 $ 15,377.4

Total debt $ 5,499.8 $ 5,655.1 $ 5,868.1 $ 6,358.6 $ 6,763.4

Total stockholders’ equity $ 6,786.2 $ 6,701.8 $ 5,666.9 $ 4,919.7 $ 4,306.9

Other Statistics

Stores opened during the year 20 20 17 21 33

Stores closed during the year (5) 24 38 31 48 48

Total stores at year end 1,739 1,743 1,761 1,775 1,802

Remodels completed (6)

Lifestyle remodels 232 253 276 293 92

Other remodels 21 15 8 22 23

Total remodels completed 253 268 284 315 115

Total retail square footage at

year end (in millions) 80.4 80.3 80.8 81.0 82.1

(1) 2008, 2007, 2006 and 2005 include stock-based compensation expense of $62.3 million, $48.4 million, $51.2 million and

$59.7 million, respectively. For additional information, see the caption “Stock-Based Employee Compensation” in Note A and the

caption “Additional Stock Plan Information” in Note G to the consolidated financial statements set forth in Part II, Item 8 of this

report.

(2) No common stock dividends were declared prior to the second quarter of 2005.

(3) Defined as stores operating the same period in both the current year and the previous year. 2008 is based on the same 53-week

period in both years. Comparable stores include replacement stores while identical stores do not. 2005 sales increase includes an

estimated 130-basis-point improvement in comparable-store sales and an estimated 140-basis-point improvement in identical-store

sales due to the impact of the Southern California strike which ended in the first quarter of 2004. 2004 sales increase includes an

estimated reduction of 60 basis points due to the impact of this strike.

(4) Management believes this ratio is relevant because it assists investors in evaluating Safeway’s ability to control costs.

(5) Included 14 Dominick’s store closures in 2007, 26 Randall’s store closures in 2005 and 12 Dominick’s store closures in 2004. Such

store closures were part of a program to improve profitability in those divisions. We do not plan to significantly change total retail

square footage or store count in the foreseeable future.

(6) Defined as store remodel projects (other than maintenance) generally requiring expenditures in excess of $0.2 million. Excludes

acquisitions.

21