Safeway 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

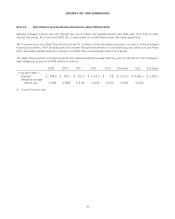

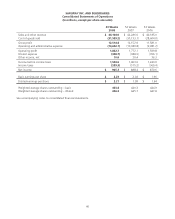

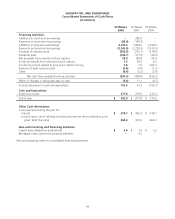

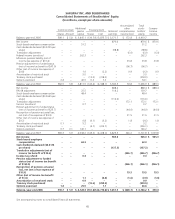

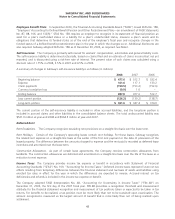

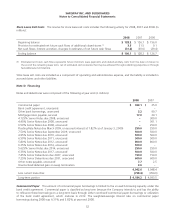

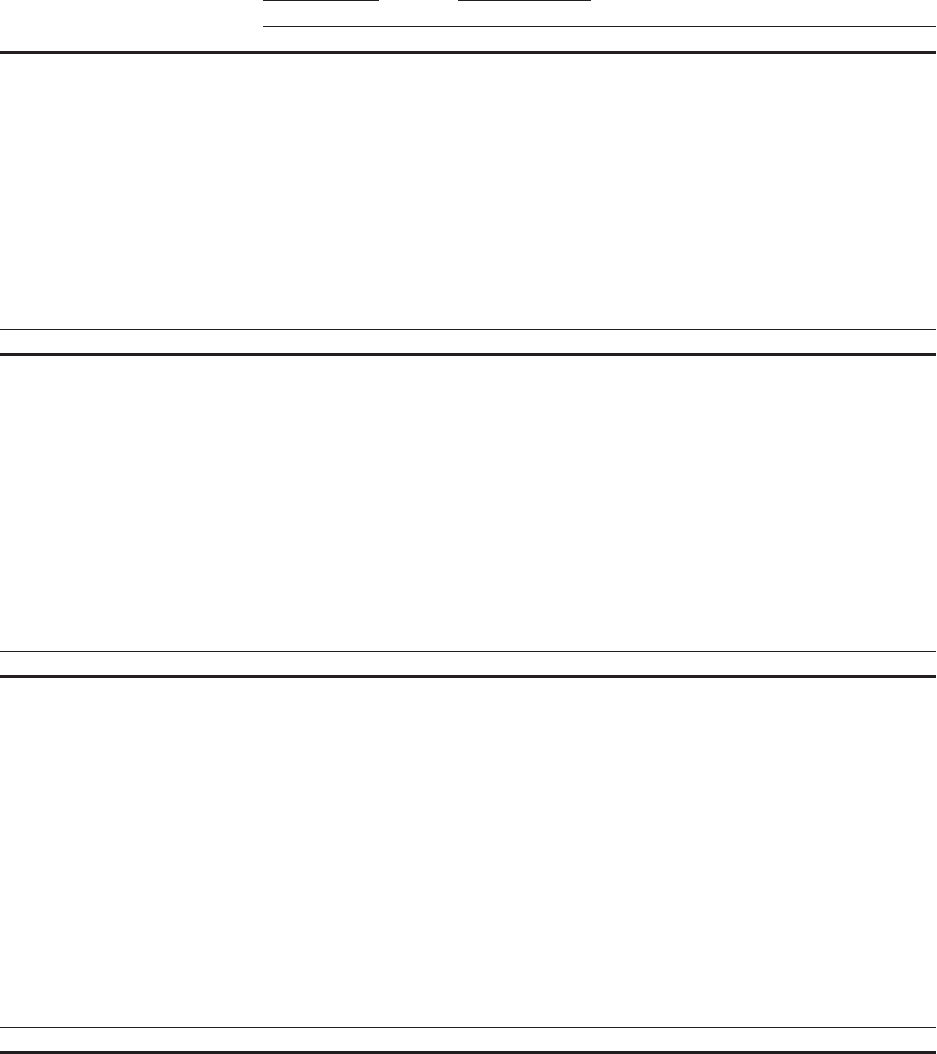

SAFEWAY INC. AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity

(In millions, except per-share amounts)

Common stock Additional

paid-in

capital

Treasury stock Retained

earnings

Accumulated

other

comprehensive

income (loss)

Total

stock-

holders’

equity

Compre-

hensive

incomeShares Amount Shares Cost

Balance, year-end 2005 580.1 $ 5.8 $ 3,445.1 (130.7) $ (3,875.7) $ 5,171.7 $ 172.8 $ 4,919.7

Net income – – – – – 870.6 – 870.6 $ 870.6

Stock-based employee compensation – – 51.2 – – – – 51.2 –

Cash dividends declared ($0.2225 per

share) – – – – – (98.8) – (98.8) –

Translation adjustments – – – – – – (6.0) (6.0) (6.0)

Federal income tax refund – – 262.3 – – – – 262.3 –

Minimum pension liability (net of

income tax expense of $10.4) – – – – – – 23.8 23.8 23.8

Pension adjustment to funded status

(net of income tax benefit of $47.9) – – – – – – (96.7) (96.7) –

Other (net of income tax expense of

$0.8) – – 1.0 – (2.2) – 0.9 (0.3) 0.9

Amortization of restricted stock – – 5.0 – – – – 5.0 –

Treasury stock purchased – – – (12.0) (318.0) – – (318.0) –

Options exercised 2.4 – 46.9 0.3 7.2 – – 54.1 –

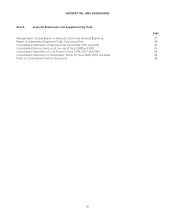

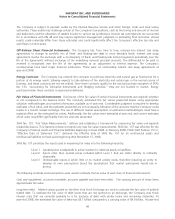

Balance, year-end 2006 582.5 5.8 3,811.5 (142.4) (4,188.7) 5,943.5 94.8 5,666.9 $ 889.3

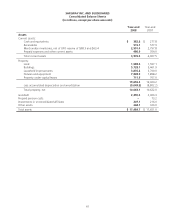

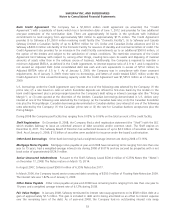

Net income – – – – – 888.4 – 888.4 $ 888.4

FIN 48 adjustment – – 25.5 – – 114.2 – 139.7 –

Stock-based employee compensation – – 48.4 – – – – 48.4 –

Cash dividends declared ($0.2645 per

share) – – – – – (116.6) – (116.6) –

Translation adjustments – – – – – – 172.1 172.1 172.1

Income tax refund – – 0.7 – – – – 0.7 –

Pension adjustment to funded status

(net of income tax benefit of $25.7) – – – – – – (44.0) (44.0) (44.0)

Recognition of pension actuarial loss,

net (net of tax expense of $9.9) – – – – – – 21.5 21.5 21.5

Other (net of income tax expense of

$0.2) – – 0.8 (0.1) (3.2) – 1.8 (0.6) 1.8

Amortization of restricted stock 0.1 – 5.2 – – – – 5.2 –

Treasury stock purchased – – – (6.7) (226.1) – – (226.1) –

Options exercised 6.7 0.1 146.1 – – – – 146.2 –

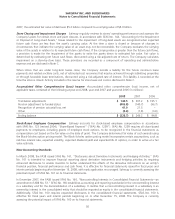

Balance, year-end 2007 589.3 5.9 4,038.2 (149.2) (4,418.0) 6,829.5 246.2 6,701.8 $ 1,039.8

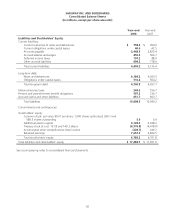

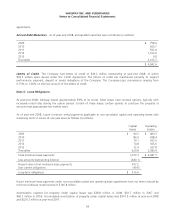

Net income – – – – – 965.3 – 965.3 $ 965.3

Stock-based employee

compensation – – 62.3 – – – – 62.3 –

Cash dividends declared ($0.3174

per share) – – – – – (137.3) – (137.3) –

Translation adjustments (net of

income tax benefit of $10.6) – – – – – – (226.7) (226.7) (226.7)

Income tax refund – – 0.3 – – – – 0.3 –

Pension adjustment to funded

status (net of income tax benefit

of $165.5) – – – – – – (266.1) (266.1) (266.1)

Recognition of pension actuarial

loss, net (net of tax expense of

$10.9) – – – – – – 19.5 19.5 19.5

Other (net of income tax benefit

of $1.4) – – 1.1 – (0.4) – (1.6) (0.9) (1.6)

Amortization of restricted stock – – 0.9 – – – – 0.9 –

Treasury stock purchased – – – (12.6) (359.5) – – (359.5) –

Options exercised 1.4 – 25.5 – 1.1 – – 26.6 –

Balance, year-end 2008 590.7 $ 5.9 $ 4,128.3 (161.8) $ (4,776.8) $ 7,657.5 $ (228.7) $ 6,786.2 $ 490.4

See accompanying notes to consolidated financial statements.

45