Safeway 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

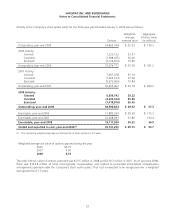

vendor allowances are classified as an element of cost of goods sold.

Promotional allowances make up approximately three-quarters of all allowances. With promotional allowances, vendors

pay Safeway to promote their product. The promotion may be any combination of a temporary price reduction, a feature

in print ads, a feature in a Safeway circular or a preferred location in the store. The promotions are typically one to two

weeks long.

Slotting allowances are a small portion of total allowances (typically less than 5% of all allowances). With slotting

allowances, the vendor reimburses Safeway for the cost of placing new product on the shelf. Safeway has no obligation

or commitment to keep the product on the shelf for a minimum period.

Contract allowances make up the remainder of all allowances. Under a typical contract allowance, a vendor pays Safeway

to keep product on the shelf for a minimum period of time or when volume thresholds are achieved.

Promotional and slotting allowances are accounted for as a reduction in the cost of purchased inventory and recognized

when the related inventory is sold. Contract allowances are recognized as a reduction in the cost of goods sold as volume

thresholds are achieved or through the passage of time.

Use of Estimates The preparation of financial statements, in conformity with accounting principles generally accepted

in the United States of America, requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements,

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

Translation of Foreign Currencies Assets and liabilities of the Company’s Canadian subsidiaries and Casa Ley are

translated into U.S. dollars at year-end rates of exchange, and income and expenses are translated at average rates during

the year. Adjustments resulting from translating financial statements into U.S. dollars are reported, net of applicable

income taxes, as a separate component of comprehensive income in the consolidated statements of stockholders’ equity.

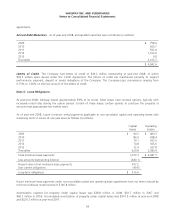

Cash and Cash Equivalents Short-term investments with original maturities of less than three months are considered

to be cash equivalents. Book overdrafts at year-end 2008 and 2007 of $185.1 million and $313.2 million, respectively, are

included in accounts payable.

Merchandise Inventories Merchandise inventory of $1,740 million at year-end 2008 and $1,886 million at year-end

2007 is valued at the lower of cost on a last-in, first-out (“LIFO”) basis or market value. Such LIFO inventory had a

replacement or current cost of $1,838 million at year-end 2008 and $1,949 million at year-end 2007. Liquidations of LIFO

layers during the three years reported did not have a material effect on the results of operations. All remaining inventory

is valued at the lower of cost on a first-in, first-out (“FIFO”) basis or market value. The FIFO cost of inventory

approximates replacement or current cost. The Company takes a physical count of perishable inventory in stores every

four weeks and nonperishable inventory in stores and all distribution centers twice a year. The Company records an

inventory shrink adjustment upon physical counts and also provides for estimated inventory shrink adjustments for the

period between the last physical inventory and each balance sheet date.

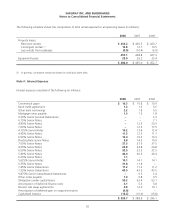

Property and Depreciation Property is stated at cost. Depreciation expense on buildings and equipment is computed

on the straight-line method using the following lives:

Stores and other buildings 7 to 40 years

Fixtures and equipment 3 to 15 years

Property under capital leases and leasehold improvements are amortized on a straight-line basis over the shorter of the

remaining terms of the leases or the estimated useful lives of the assets.

47