Safeway 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

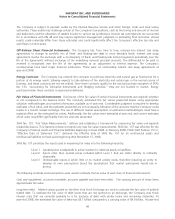

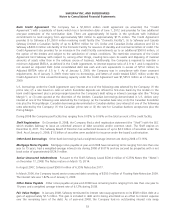

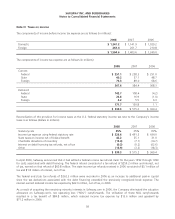

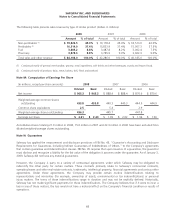

Note H: Taxes on Income

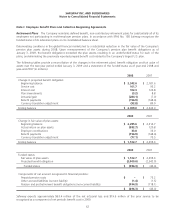

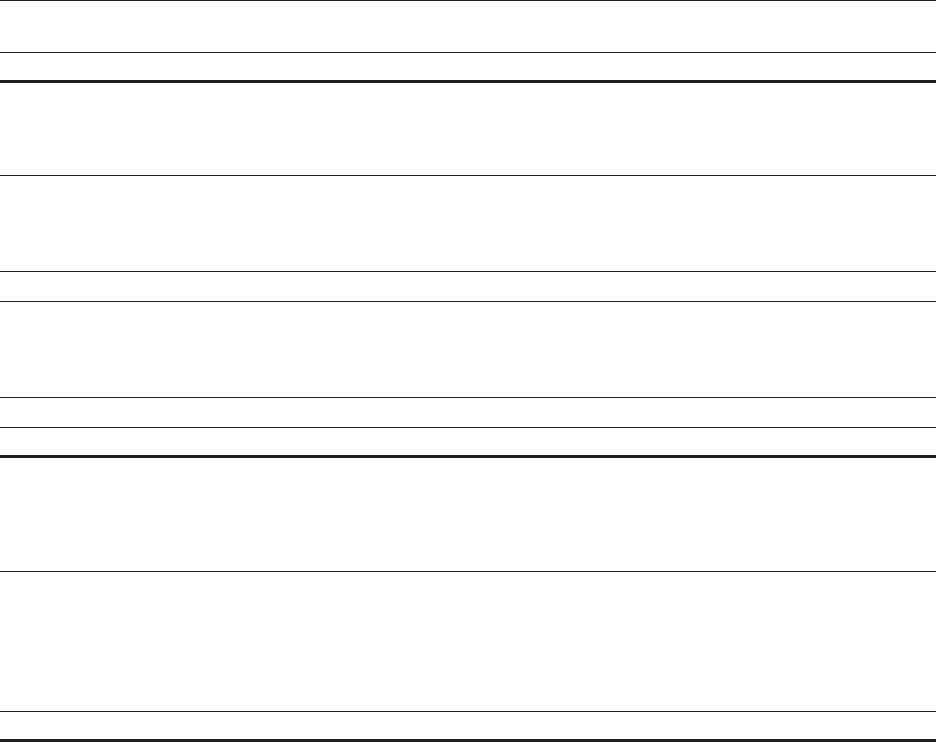

The components of income before income tax expense are as follows (in millions):

2008 2007 2006

Domestic $ 1,241.2 $ 1,141.9 $ 1,029.2

Foreign 263.4 261.7 210.8

$ 1,504.6 $ 1,403.6 $ 1,240.0

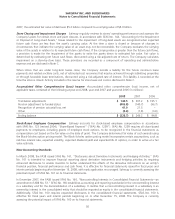

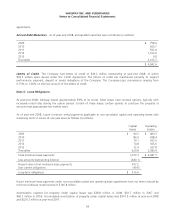

The components of income tax expense are as follows (in millions):

2008 2007 2006

Current:

Federal $ 251.1 $ 258.3 $ 251.0

State 40.2 37.1 48.7

Foreign 76.3 89.0 68.6

367.6 384.4 368.3

Deferred:

Federal 142.7 108.4 (4.2)

State 24.8 16.9 (1.0)

Foreign 4.2 5.5 6.3

171.7 130.8 1.1

$ 539.3 $ 515.2 $ 369.4

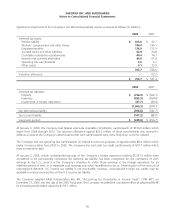

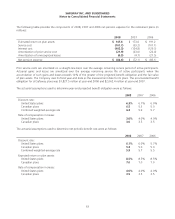

Reconciliation of the provision for income taxes at the U.S. federal statutory income tax rate to the Company’s income

taxes is as follows (dollars in millions):

2008 2007 2006

Statutory rate 35% 35% 35%

Income tax expense using federal statutory rate $ 526.6 $ 491.3 $ 434.0

State taxes on income net of federal benefit 42.2 35.1 31.0

Charitable donations of inventory (13.4) (7.7) (14.7)

Interest on debt financing tax refunds, net of tax (0.2) (0.2) (62.6)

Other (15.9) (3.3) (18.3)

$ 539.3 $ 515.2 $ 369.4

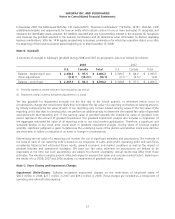

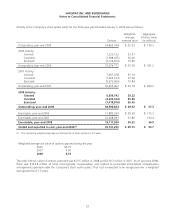

In April 2006, Safeway announced that it had settled a federal income tax refund claim for the years 1992 through 1999

for costs associated with debt financing. The federal refund consisted of a tax refund of $259.2 million and interest, net

of tax, earned on that refund of $60.8 million. The state income tax refunds received in 2006 consisted of $3.1 million of

tax and $1.8 million of interest, net of tax.

The federal and state tax refunds of $262.3 million were recorded in 2006 as an increase to additional paid-in capital

since the tax deductions associated with the debt financing exceeded the previously recognized book expense. The

interest earned reduced income tax expense by $62.6 million, net of tax, in 2006.

As a result of acquiring the remaining minority interests in Safeway.com in 2006, the Company eliminated the valuation

allowance on Safeway.com’s net operating loss (“NOL”) carryforwards. The utilization of these NOL carryforwards

resulted in a tax benefit of $84.8 million, which reduced income tax expense by $13.6 million and goodwill by

$71.2 million in 2006.

59