Safeway 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

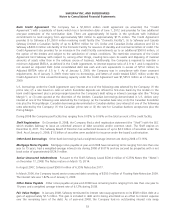

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

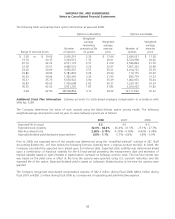

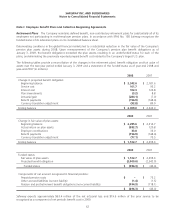

The following table provides the components of 2008, 2007 and 2006 net pension expense for the retirement plans (in

millions):

2008 2007 2006

Estimated return on plan assets $ 147.8 $ 173.6 $ 191.2

Service cost (101.7) (93.2) (101.1)

Interest cost (102.3) (124.8) (129.3)

Amortization of prior service cost (21.9) (23.0) (22.4)

Amortization of unrecognized losses (6.5) (4.7) (21.5)

Net pension expense $ (84.6) $ (72.1) $ (83.1)

Prior service costs are amortized on a straight-line basis over the average remaining service period of active participants.

Actuarial gains and losses are amortized over the average remaining service life of active participants when the

accumulation of such gains and losses exceeds 10% of the greater of the projected benefit obligation and the fair value

of plan assets. The Company uses its fiscal year-end date as the measurement date for its plans. The accumulated benefit

obligation for all Safeway plans was $1,827.5 million at year-end 2008 and $2,062.4 million at year-end 2007.

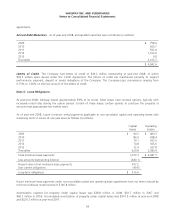

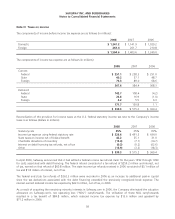

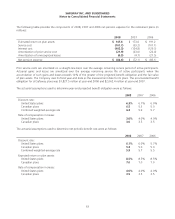

The actuarial assumptions used to determine year-end projected benefit obligation were as follows:

2008 2007 2006

Discount rate:

United States plans 6.3% 6.1% 6.0%

Canadian plans 6.5 5.3 5.0

Combined weighted-average rate 6.3 5.9 5.7

Rate of compensation increase:

United States plans 3.0% 4.0% 4.0%

Canadian plans 3.0 3.5 3.5

The actuarial assumptions used to determine net periodic benefit cost were as follows:

2008 2007 2006

Discount rate:

United States plans 6.1% 6.0% 5.7%

Canadian plans 5.3 5.0 5.0

Combined weighted-average rate 5.9 5.7 5.5

Expected return on plan assets:

United States plans 8.5% 8.5% 8.5%

Canadian plans 7.0 7.0 7.0

Rate of compensation increase:

United States plans 4.0% 4.0% 4.0%

Canadian plans 3.5 3.5 3.5

63