Safeway 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

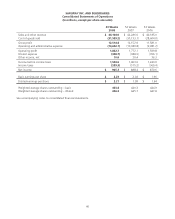

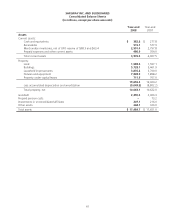

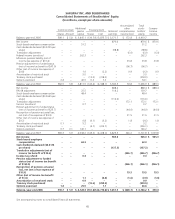

SAFEWAY INC. AND SUBSIDIARIES

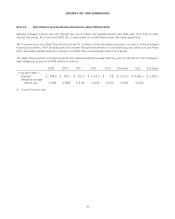

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Safeway manages interest rate risk through the use of fixed- and variable-interest rate debt and, from time to time,

interest rate swaps. As of year-end 2008, the Company had no outstanding interest rate swap agreements.

The Company does not utilize financial instruments for trading or other speculative purposes, nor does it utilize leveraged

financial instruments. The Company does not consider the potential declines in future earnings, fair values and cash flows

from reasonably possible near-term changes in interest rates and exchange rates to be material.

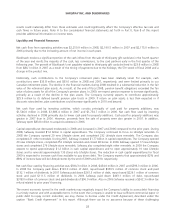

The table below presents principal amounts and related weighted-average rates by year of maturity for the Company’s

debt obligations at year-end 2008 (dollars in millions):

2009 2010 2011 2012 2013 Thereafter Total Fair value

Long-term debt: (1)

Principal $ 758.4 $ 505.7 $ 502.4 $ 1,163.0 $ 0.8 $ 2,012.3 $ 4,942.6 $ 5,090.3

Weighted average

interest rate 5.24% 4.98% 6.51% 5.62% 7.42% 6.59% 6.03%

(1) Primarily fixed-rate debt

35