Safeway 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

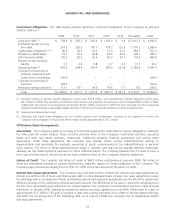

Safeway to keep product on the shelf for a minimum period of time or when volume thresholds are achieved.

Operating and Administrative Expense Operating and administrative expense consists primarily of store occupancy

costs and backstage expenses, which, in turn, consist primarily of wages, employee benefits, rent, depreciation and

utilities.

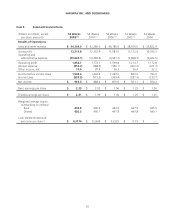

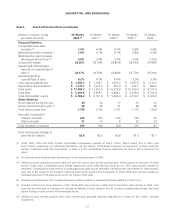

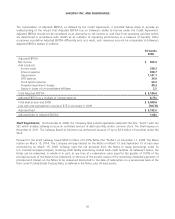

Operating and administrative expense was 24.17% of sales in 2008 compared to 24.55% in 2007 and 24.84% in 2006.

Operating and administrative expense improved 38 basis points to 24.17% of sales in 2008 from 24.55% of sales in

2007. Higher fuel sales in 2008 improved operating and administrative expense by 11 basis points. The remaining 27

basis point improvement is primarily due to reduced employee costs as a percentage of sales partly offset by higher

energy costs, currency exchange losses and workers’ compensation costs.

Operating and administrative expense decreased 29 basis points to 24.55% of sales in 2007 from 24.84% of sales in

2006. Higher fuel sales in 2007 reduced operating and administrative expense by 16 basis points. The remaining 13 basis

point decline is primarily the result of reduced employee costs as a percentage of sales and higher gains on disposal of

property, partly offset by higher depreciation expense.

Dominick’s In February 2007, the Company announced a strategic plan to revitalize its operations at Dominick’s. This

plan included remodeling 20 stores to Lifestyle stores, new store development and closing 14 under-performing stores in

2007. In the second quarter of 2007, Safeway incurred a store-lease exit charge of $30.3 million ($0.04 per diluted share)

as a result of these closures.

Operating and administrative expense decreased 93 basis points to 24.84% of sales in 2006 from 25.77% of sales in

2005. The store exit activities and employee buyouts in 2005 reduced operating and administrative expense by 44 basis

points. Higher fuel sales in 2006 reduced operating and administrative expense by 13 basis points. The remaining decline

is primarily the result of increased sales and reduced costs as a percentage of sales from store labor, workers’

compensation and pension expense.

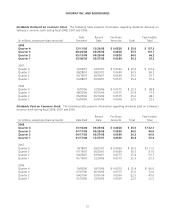

Gains on Property Retirements Operating and administrative expense included net gains on property retirements of

$19.0 million in 2008, $42.3 million in 2007 and $17.8 million in 2006. In 2007 the Company sold a Bellevue,

Washington distribution center at a gain of $46.6 million and a warehouse in Chicago, Illinois at a gain of $11.2 million.

These gains were partly offset by net losses on other property retirements.

Interest Expense Interest expense was $358.7 million in 2008, compared to $388.9 million in 2007 and $396.1 million

in 2006. Interest expense decreased in 2008 primarily due to a combination of lower average borrowings and a lower

average interest rate. Interest expense decreased in 2007 and 2006 primarily due to lower average borrowings, partially

offset by a higher average interest rate.

Other Income Other income consists of interest income, minority interest in a consolidated affiliate and equity in

earnings from Safeway’s unconsolidated affiliates. Interest income was $12.5 million in 2008, $11.8 million in 2007 and

$11.1 million in 2006. Equity in (losses) earnings of unconsolidated affiliates was a loss of $2.5 million in 2008, income of

$8.7 million in 2007 and income of $21.1 million in 2006.

Income Taxes The Company’s effective tax rates for 2008, 2007 and 2006 were 35.8%, 36.7% and 29.8%,

respectively. The effective tax rate for 2006 included a benefit of $62.6 million related to interest, net of income tax, on

federal and state income tax refunds, and various other favorable items.

Critical Accounting Policies and Estimates

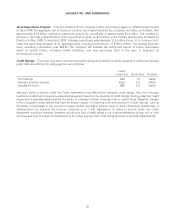

Critical accounting policies are those accounting policies that management believes are important to the portrayal of

Safeway’s financial condition and results of operations and require management’s most difficult, subjective or complex

judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

24