Safeway 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

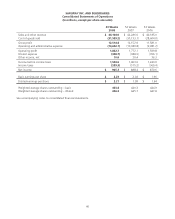

SAFEWAY INC. AND SUBSIDIARIES

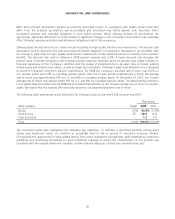

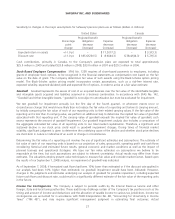

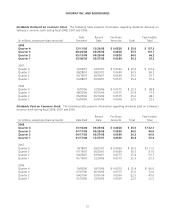

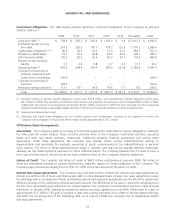

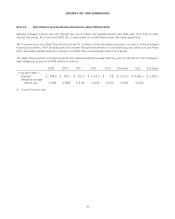

Contractual Obligations The table below presents significant contractual obligations of the Company at year-end

2008 (in millions) (1):

2009 2010 2011 2012 2013 Thereafter Total

Long-term debt (2) $ 758.4 $ 505.7 $ 502.4 $ 1,163.0 $ 0.8 $ 2,012.3 $ 4,942.6

Estimated interest on long-

term debt 267.5 236.5 195.1 178.7 132.3 1,076.3 2,086.4

Capital lease obligations (2),(3) 40.6 36.7 32.3 31.3 32.2 384.1 557.2

Interest on capital leases 53.7 50.2 46.8 43.5 40.2 245.7 480.1

Self-insurance liability 126.2 92.0 62.9 43.6 30.7 132.4 487.8

Interest on self-insurance

liability 1.1 2.4 2.8 2.7 2.5 31.7 43.2

Operating leases (3) 469.3 438.4 397.0 365.6 327.8 2,383.4 4,381.5

Contracts for purchase of

property, equipment and

construction of buildings 245.4 – – – – – 245.4

Contracts for purchase of

inventory 394.0 – – – – – 394.0

Fixed-price energy contracts 113.1 55.1 34.6 34.6 0.7 8.2 246.3

Total $ 2,469.3 $ 1,417.0 $ 1,273.9 $ 1,863.0 $ 567.2 $ 6,274.1 $ 13,864.5

(1) Excludes funding of pension benefit obligations which were $33.8 million and postretirement benefit obligations which were

$8.7 million in 2008. Also excludes contributions under various multi-employer pension plans, which totaled $286.9 million in 2008.

Additionally, the amount of unrecognized tax benefits ($129.2 million at January 3, 2009) has been excluded from the contractual

obligations table because a reasonably reliable estimate of the timing of future tax settlements cannot be determined.

(2) Required principal payments only.

(3) Operating and capital lease obligations do not include common area maintenance, insurance or tax payments for which the

Company is also obligated. In fiscal 2008, these charges totaled approximately $215.2 million.

Off-Balance Sheet Arrangements

Guarantees The Company is party to a variety of contractual agreements under which it may be obligated to indemnify

the other party for certain matters. These contracts primarily relate to the Company’s commercial contracts, operating

leases and other real estate contracts, trademarks, intellectual property, financial agreements and various other

agreements. Under these agreements, the Company may provide certain routine indemnifications relating to

representations and warranties (for example, ownership of assets, environmental or tax indemnifications) or personal

injury matters. The terms of these indemnifications range in duration and may not be explicitly defined. Historically,

Safeway has not made significant payments for these indemnifications. The Company believes that if it were to incur a

loss in any of these matters, the loss would not have a material effect on the Company’s financial statements.

Letters of Credit The Company had letters of credit of $49.2 million outstanding at year-end 2008. The letters of

credit are maintained primarily to support performance, payment, deposit or surety obligations of the Company. The

Company pays commissions ranging from 0.15% to 1.00% on the face amount of the letters of credit.

Interest Rate Swap Agreements The Company has, from time to time, entered into interest rate swap agreements to

change its portfolio mix of fixed- and floating-rate debt to more desirable levels. Interest rate swap agreements involve

the exchange with a counterparty of fixed- and floating-rate interest payments periodically over the life of the agreements

without exchange of the underlying notional principal amounts. The differential to be paid or received is recognized over

the life of the agreements as an adjustment to interest expense. The Company’s counterparties have been major financial

institutions. In January 2008, Safeway terminated its interest rate swap agreements on its $500 million debt at a gain of

approximately $7.5 million. This gain is included in debt and is being amortized as an offset to interest expense through

July 2009, the remaining term of the underlying debt. As of year-end 2008, the Company had no outstanding interest

rate swap agreements.

33