Safeway 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

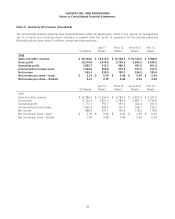

Notes to Consolidated Financial Statements

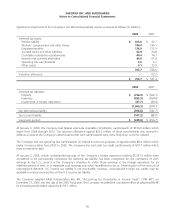

Note K: Commitments and Contingencies

Legal Matters On February 2, 2004, the Attorney General for the State of California filed an action in the United States

District Court for the Central District of California, entitled State of California, ex rel. Bill Lockyer (now ex. rel. Jerry Brown)

v. Safeway Inc. dba Vons, et al., against the Company; the Company’s subsidiary, The Vons Companies, Inc.; Albertsons,

Inc; and Ralphs Grocery Company, a division of The Kroger Co. The complaint alleges that certain provisions of a Mutual

Strike Assistance Agreement (“MSAA”) entered into by the defendants in connection with the Southern California

grocery strike that began on October 11, 2003 constituted a violation of Section 1 of the Sherman Antitrust Act. The

complaint seeks declaratory and injunctive relief. The Attorney General has also indicated that it will seek an order

requiring the return of any funds received pursuant to the MSAA. Pursuant to the MSAA, the Company received

$83.5 million of payments in 2004, which it recorded as reductions to cost of sales of $51.5 million and $32 million in the

fourth quarter of 2003 and the first quarter of 2004, respectively. Defendants’ motion for summary judgment based on

the federal non-statutory labor exemption to the antitrust laws was denied by the court on May 25, 2005 and again on

March 6, 2008. The Attorney General’s motion for summary judgment arguing that the MSAA was a per se antitrust

violation was denied by the court on December 7, 2006. On March 27, 2008, pursuant to a stipulation of the parties, the

court entered a final judgment in favor of the defendants. Under the stipulation and final judgment, the court also found

that the non-statutory labor exemption does not immunize the revenue sharing provisions of the MSAA from the antitrust

claims in the case. Both sides have appealed issues to the Ninth Circuit Court of Appeals. No date for argument of the

appeal has been set.

There are also pending against the Company various claims and lawsuits arising in the normal course of business, some of

which seek damages and other relief, which, if granted, would require very large expenditures.

It is management’s opinion that although the amount of liability with respect to all of the above matters cannot be

ascertained at this time, any resulting liability, including any punitive damages, will not have a material adverse effect on

the Company’s financial statements taken as a whole.

Commitments The Company has commitments under contracts for the purchase of property and equipment and for

the construction of buildings. Portions of such contracts not completed at year end are not reflected in the consolidated

financial statements. These purchase commitments were $245.4 million at year-end 2008.

66