Safeway 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

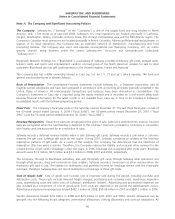

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

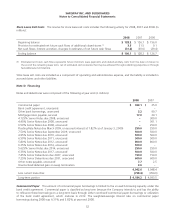

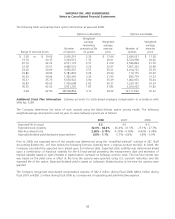

Employee Benefit Plans In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 158,

“Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment of FASB Statements

No. 87, 88, 106, and 132(R).” SFAS No. 158 requires an employer to recognize in its statement of financial position an

asset for a plan’s overfunded status or a liability for a plan’s underfunded status, measure a plan’s assets and its

obligations that determine its funded status as of the end of the employer’s fiscal year and recognize changes in the

funded status of a defined benefit postretirement plan in the year in which the changes occur. Additional disclosures are

also required. Safeway adopted SFAS No. 158 as of December 30, 2006, as required. See Note I.

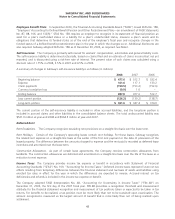

Self-Insurance The Company is primarily self-insured for workers’ compensation, automobile and general liability costs.

The self-insurance liability is determined actuarially, based on claims filed and an estimate of claims incurred but not yet

reported, and is discounted using a risk-free rate of interest. The present value of such claims was calculated using a

discount rate of 1.75% in 2008, 3.5% in 2007 and 4.5% in 2006.

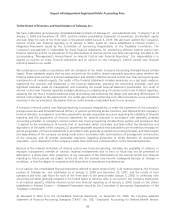

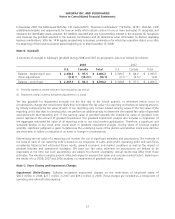

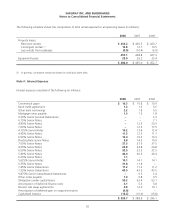

A summary of changes in Safeway’s self-insurance liability is as follows (in millions):

2008 2007 2006

Beginning balance $ 477.6 $ 512.7 $ 532.4

Expense 161.6 117.1 133.2

Claim payments (150.5) (153.2) (152.9)

Currency translation loss (0.9) 1.0 –

Ending balance 487.8 477.6 512.7

Less current portion (126.2) (130.2) (138.7)

Long-term portion $ 361.6 $ 347.4 $ 374.0

The current portion of the self-insurance liability is included in other accrued liabilities, and the long-term portion is

included in accrued claims and other liabilities in the consolidated balance sheets. The total undiscounted liability was

$531.0 million at year-end 2008 and $564.5 million at year-end 2007.

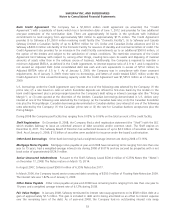

Deferred Rent

Rent Escalations. The Company recognizes escalating rent provisions on a straight-line basis over the lease term.

Rent Holidays. Certain of the Company’s operating leases contain rent holidays. For these leases, Safeway recognizes

the related rent expense on a straight-line basis at the earlier of the first rent payment or the date of possession of the

leased property. The difference between the amounts charged to expense and the rent paid is recorded as deferred lease

incentives and amortized over the lease term.

Construction Allowances. As part of certain lease agreements, the Company receives construction allowances from

landlords. The construction allowances are deferred and amortized on a straight-line basis over the life of the lease as a

reduction to rent expense.

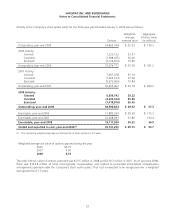

Income Taxes The Company provides income tax expense or benefit in accordance with Statement of Financial

Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes.” Deferred income taxes represent future net tax

effects resulting from temporary differences between the financial statement and tax basis of assets and liabilities using

enacted tax rates in effect for the year in which the differences are expected to reverse. Accrued interest on tax

deficiencies and refunds is included in the income tax expense or benefit.

The Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”) on

December 31, 2006, the first day of the 2007 fiscal year. FIN 48 prescribes a recognition threshold and measurement

attribute for the financial statement recognition and measurement of tax positions taken or expected to be taken in tax

returns. For benefits to be realized, a tax position must be more likely than not to be sustained upon examination. The

amount recognized is measured as the largest amount of benefit that is more likely than not of being realized upon

settlement.

48