Qantas 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

QANTAS ANNUAL REPORT 2013

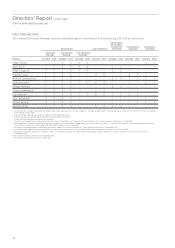

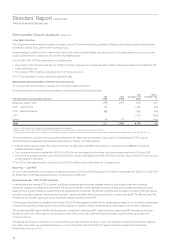

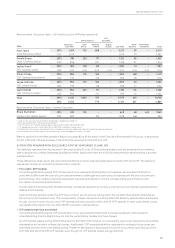

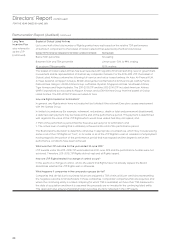

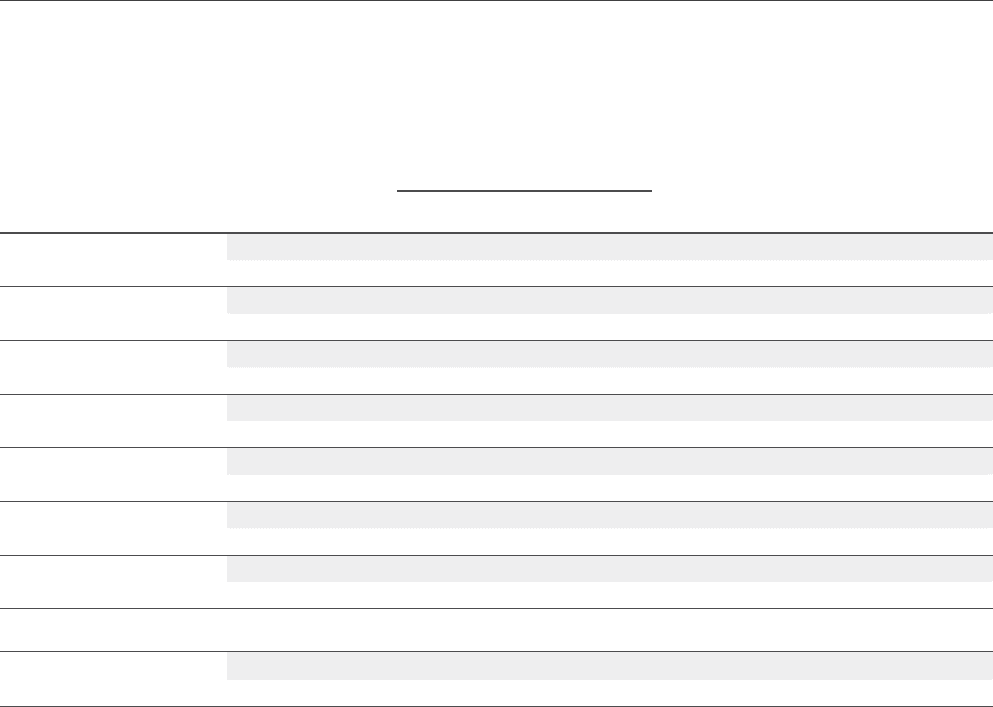

Remuneration Outcomes Table – CEO and Executive KMP (Non-statutory)1

$’000 Base Pay –

Cash FAR2

STIP Outcomes3

LTIP

Outcomes4

Sub-total

Other

Benets5

Termination

Payments Total

Cash

Bonus

Deferred

Award

Rights

Vested

Alan Joyce

Chief Executive Ofcer

2013 2,109 775 388 – 3,272 59 – 3,331

2012 2,109 – – – 2,109 171 – 2,280

Gareth Evans

Chief Financial Ofcer

2013 981 233 117 – 1,331 96 – 1,427

2012 906 – 220 – 1,126 117 – 1,243

Lesley Grant6

CEO Qantas Loyalty

2013 785 178 89 – 1,052 51 – 1,103

2012 n/a n/a n/a n/a n/a n/a n/a n/a

Simon Hickey

CEO Qantas International

2013 984 213 106 – 1,303 168 – 1,471

2012 770 – 173 – 943 131 – 1,074

Jayne Hrdlicka

CEO Jetstar Group

2013 984 213 106 – 1,303 63 – 1,366

2012 759 – 176 – 935 77 – 1,012

Lyell Strambi

CEO Qantas Domestic

2013 984 223 111 – 1,318 112 – 1,430

2012 909 – 210 – 1,119 141 – 1,260

Total 2013 6,827 1,835 917 – 9,579 549 – 10,128

2012 5,453 – 779 – 6,232 637 – 6,869

Remuneration Outcomes Table – Former Executive

Bruce Buchanan 2013 493 155 – – 648 68 649 1,365

Former CEO Jetstar Group 2012 849 – 159 – 1,008 (46) – 962

1 Detail of non-statutory remuneration methodology is explained on page 92.

2 Base pay, paid to each Executive during the year.

3 The full value of STIP awards made to each Executive during 2012/2013 and 2011/2012.

4 LTIP awards did not vest in either 2012/2013 or 2011/2012, therefore nil value shown.

5 Other Benets include non-cash benets, annual leave accrual, post-employment benets and other long-term benets.

6 Remuneration for Ms Grant reects her commencing in a key management role on 1 July 2012.

Refer to section 6 of the Remuneration Report on pages 82 to 90 for detail of the Executive Remuneration Structure, a description

ofFAR, STIP and LTIP and analysis of the 2012/2013 outcomes for the STIP and LTIP.

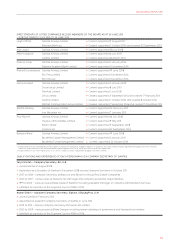

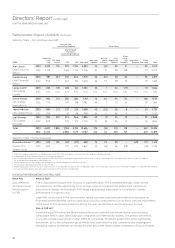

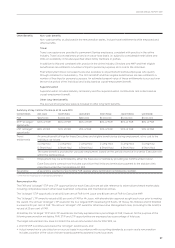

5 STATUTORY REMUNERATION DISCLOSURES FOR THE YEAR ENDED 30 JUNE 2013

The statutory remuneration disclosures for the year ended 30 June 2013 are detailed below and are prepared in accordance

with Australian Accounting Standards (AASBs) and differ signicantly from the 2012/2013 remuneration decisions and outcomes

outlinedabove.

These differences arise due to the accounting treatment of share-based payments (such as the STIP and LTIP). The statutory

disclosures include an accounting remuneration value for:

»Prior years’ STIP awards

Accounting standards require STIP remuneration to be expensed (and therefore included as remuneration) in nancial

years which differ from the year of scorecard performance (although any cash bonus is expensed in the year of scorecard

performance). This creates a disconnect between reported remuneration and the corresponding years’ nancial and

non-nancial scorecard performance.

In both 2010/2011 and 2011/2012, the Board made considered decisions to not pay a cash bonus and instead awarded entirely

deferred STIP awards.

Deferred shares granted under the STIP have a future service period, during which the recipient must remain employed by

theGroup for the awards to vest. The consequence of these decisions is that the 2012/2013 statutory remuneration disclosures

include a value

for part of prior year STIP awards and only a portion of the 2012/13 STIP awards. In most cases these values

aresignicantly higher than the 2012/13 STIP outcomes outlined above.

»LTIP awards that have not vested

Accounting standards require LTIP remuneration to be expensed (and therefore included as statutory remuneration)

notwithstanding that the Rights have not met the performance hurdles and have lapsed.

No LTIP awards vested during 2012/2013 (under the 2011-2013 LTIP), however, an accounting value is still required by accounting

standards to be included in these disclosures. Additionally, LTIP awards that will be assessed for vesting in future years are

expensed over the three year testing period. Therefore, the statutory disclosures include an accounting value for part of the

2012–2014 and the 2013–2015 LTIP awards, even though no LTIP awards vested during 2012/2013.