Qantas 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

QANTAS ANNUAL REPORT 2013

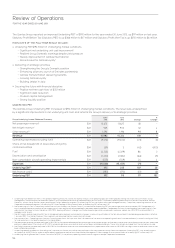

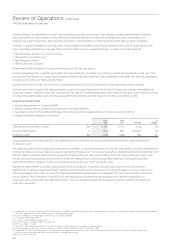

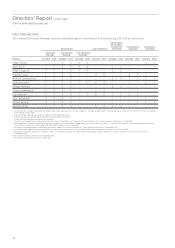

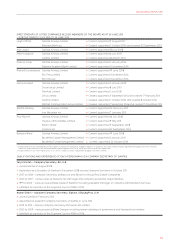

Reconciliation of Underlying to Statutory PBT June

2013

June

2012 Change

%

Change

Underlying PBT $M 192 95 97 >100

Items not included in Underlying PBT

– AASB 139 mark-to-market movements relating to other

reporting periods $M 32 (46) 78 >100

Items not included in Underlying PBT

– Net impairment of property, plant and equipment $M (86) (147) 61 41

– Redundancies and restructuring $M (118) (203) 85 42

– Net impairment of investments $M 2 (19) 21 >100

– Impairment of goodwill and other intangible assets $M (24) (18) (6) (33)

– Write down of inventory $M (4) (13) 9 69

– Net prot on disposal of investment $M 30 – 30 100

– Other $M (7) 2 (9) >(100)

Total items not included in Underlying PBT $M (175) (444) 269 61

Statutory PBT $M 17 (349) 366 >100

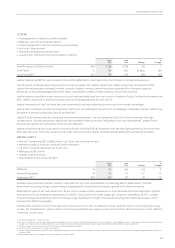

AASB 139 mark-to-market movements relating to other reporting periods

All derivative transactions undertaken by the Qantas Group represent economic hedges of underlying risk and exposures.

TheQantas Group does not enter into speculative derivative transactions. Notwithstanding this, AASB 139 requires

certain mark-to-market movements in derivatives which are classied as ’ineffective’ to be recognised immediately in the

ConsolidatedIncome Statement. The recognition of derivative valuation movements in reporting periods which differ from

thedesignated transaction causes volatility in statutory prot that does not reect the hedging nature of these derivatives.

Underlying PBT reports all hedge derivative gains and losses in the same reporting period as the underlying transaction by

adjusting the reporting period’s statutory prot for derivative mark-to-market movements that relate to underlying exposures

inother reporting periods.

All derivative mark-to-market movements which have been excluded from Underlying PBT will be recognised through

UnderlyingPBT in future periods when the underlying transaction occurs.

Other items not included in Underlying PBT

Items which are identied by Management and reported to the chief operating decision-making bodies as not representing

the underlying performance of the business are not included in Underlying PBT. The determination of these items is made

afterconsideration of their nature and materiality and is applied consistently from period to period.

Items not included in Underlying PBT primarily result from major transformational/restructuring initiatives, transactions involving

investments and impairments of assets outside the ordinary course of business.

Items not included in Underlying PBT in the 2012/2013 year were driven by the Qantas transformation. Costs include aircraft

impairment due to early retirement following strategic network changes, further consolidation of engineering and catering

facilities,the integration of Australian air Express offset by the gain on sale of the StarTrack joint venture in October 2012.