Qantas 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

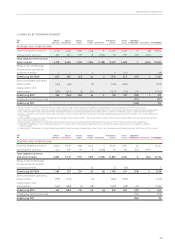

114

Basis of Preparation

Underlying EBIT of the Qantas Group’s operating segments is prepared and presented on the basis that reects the revenue

earned and the expenses incurred by each operating segment.

All revenues earned and expenses incurred by Qantas Loyalty, Qantas Freight and Jetstar Group are reported directly by

these segments. For Qantas Airlines where revenues earned and expenses incurred are directly attributable to either Qantas

International or Qantas Domestic they have been reported as such. Where revenues earned and expenses incurred by Qantas

Airlines are not individually attributable to either Qantas International or Qantas Domestic, they are reported by these operating

segments using an appropriate allocation methodology.

The signicant accounting policies applied in implementing this basis of preparation are set out below. These accounting policies

have been consistently applied to all periods presented in the Consolidated Financial Report.

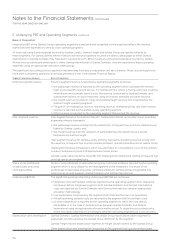

Segment Performance Measure Basis of Preparation

External segment revenue External segment revenue is reported by operating segments as follows:

»Net passenger revenue is reported by the operating segment which operated the relevant

ight or provided the relevant service. For Qantas Airlines, where a multi-sector ticket covering

international and domestic travel is sold, the revenue is reported by Qantas Domestic and

Qantas International on a pro-rata basis using an industry standard allocation process.

»Net freight revenue includes air cargo and express freight revenue and is reported by the

Qantas Freight operating segment.

»Frequent Flyer redemption revenue, marketing revenue, membership fees and other related

revenue is reported by the Qantas loyalty operating segment.

»Other revenue is reported by the operating segment that earned the revenue.

Inter-segment revenue Inter-segment revenue for Qantas Domestic, Qantas International and Jetstar Group operating

segments primarily represents:

»Net passenger revenue arising from the redemption of frequent yer points for Qantas Group

ights by Qantas Loyalty; and

»Net Freight revenue from the utilisation of Qantas Brands and Jetstar Group’s aircraft

bellyspace by Qantas Freight.

Inter-segment revenue for Qantas Loyalty primarily represents marketing revenue arising from

the issuance of frequent yer points to Qantas Domestic, Qantas International and Jetstar Group.

Intersegment revenue transactions, which are eliminated on consolidation, occur in the ordinary

course of business at prices that approximate market prices.

Qantas Loyalty does not derive net prot from intersegment transactions relating to frequent yer

point issuances and redemptions.

Share of net prot/(loss)

of associates and jointly

controlledentities

Share of net prot/(loss) of associates and jointly controlled entities is reported by the operating

segment which is accountable for the management of the investment. The share of net

prot/(loss) of associates and jointly controlled entities for Qantas Airlines investments has

been equally shared between Qantas Domestic and Qantas International.

Underlying EBITDAR The signicant expenses impacting Underlying EBITDAR are as follows:

»Manpower and staff related costs are reported by the operating segment that utilises the

manpower. Where manpower supports both Qantas Domestic and Qantas International,

costs are reported by Qantas Domestic and Qantas International using an appropriate

allocation methodology.

»Fuel expenditure is reported by the segment that consumes the fuel in its operations.

»Aircraft operating variable costs are reported by the segment that incurs these costs.

»All other expenditure is reported by the operating segment to which they are directly

attributable or in the case of Qantas Airlines between Qantas Domestic and Qantas

International using an appropriate allocation methodology. To apply this accounting policy,

where necessary expenditure is recharged between operating segments as a cost recovery.

Depreciation and amortisation Qantas Domestic, Qantas International and Jetstar Group report depreciation expense for

passenger aircraft owned by the Qantas Group and own by the segment.

Qantas Freight reports depreciation expense for freight aircraft owned by the Qantas Group.

Other depreciation and amortisation is reported by the segment that uses the related asset.

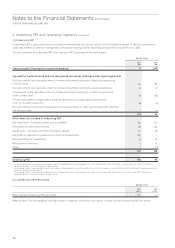

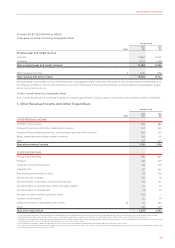

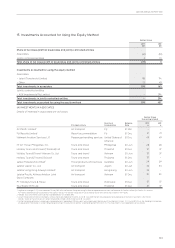

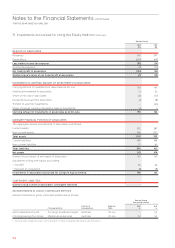

2. Underlying PBT and Operating Segments

continue

d

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013