Qantas 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

QANTAS ANNUAL REPORT 2013

The Board has determined that awards under the 2012/13 STIP

will be delivered per the plan’s design, that is:

»Two-thirds of the total award will be paid as a cash bonus, and

»One-third of the total award will be made in deferred shares

with atwo year restrictionperiod

More detail on the 2012/13 STIP scorecard outcomes and the

calculation of the CEO’s STIP award is provided on pages 86 to 87.

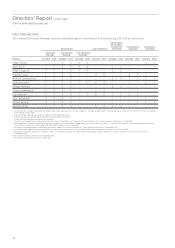

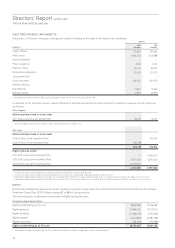

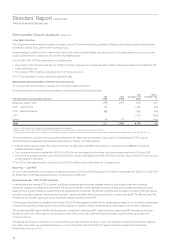

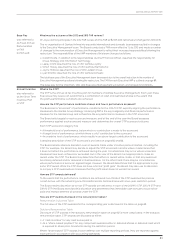

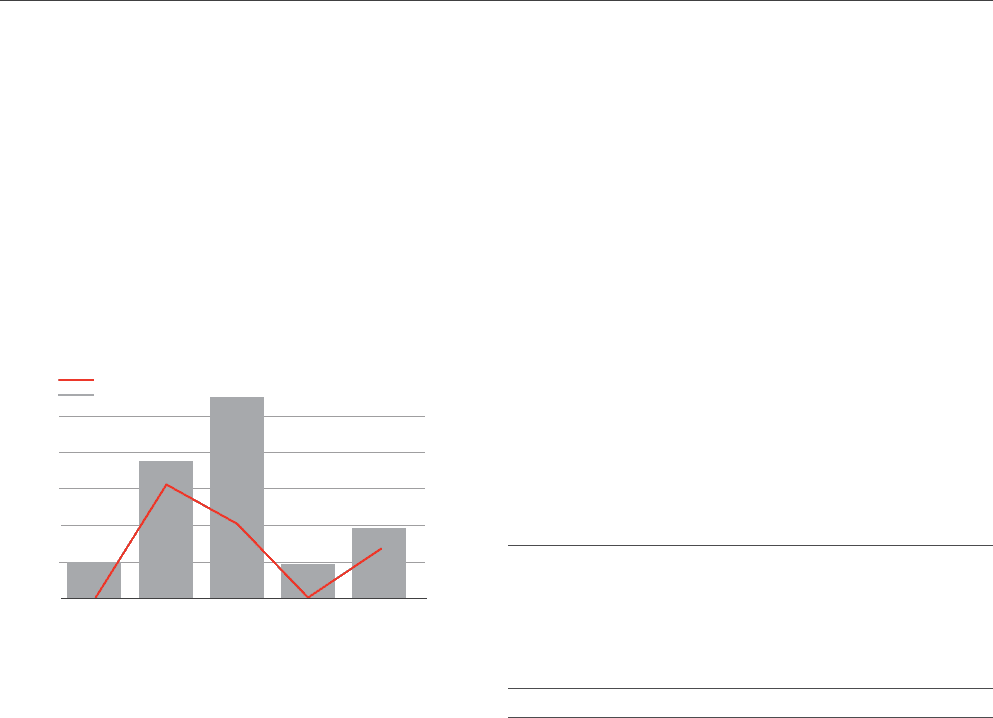

CEO Incentive Plan Outcome vs Qantas Prot Performance

$0

$100

$200

$300

$400

$500

2008/

2009 2009/

2010 2010/

2011 2011/

2012 2012/

2013

$100

$377

$552

$95

$192

0%

50%

100%

150%

Underlying PBT ($ million)

STIP Scorecard Outcome (%)

STIP Scorecard Outcome

Underlying PBT

Long Term Incentive – LTIP Outcome

The 2011–2013 LTIP was tested against the performance hurdles

as at 30 June 2013 and did not vest. All Rights in this grant

lapsed and the CEO did not receive any shares or payment

under this plan.

Therefore, the CEO’s remuneration outcome for 2012/2013 under

the long term incentivewas nil.

STATUTORY REMUNERATION DISCLOSURES FOR THE CEO

The statutory remuneration disclosures are prepared in

accordance with Australian Accounting Standards (AASBs) and

differ signicantly from the outcomes for the CEO resulting from

performance in 2012/2013 outlined on page 78.

These differences arise due to the accounting treatment of

share-based payments (such as the STIP and LTIP). The statutory

disclosures include an accounting remuneration value for:

»Prior and current years’ STIP awards

Accounting standards require STIP remuneration to be

expensed (and therefore included as remuneration) in

nancial years which differ from the year of scorecard

performance (although any cash bonus is expensed in the

year of scorecard performance). This creates a disconnect

between statutory remuneration and the remuneration

earned from the corresponding years’ nancial and non-

nancial scorecard performance.

»LTIP awards that have not vested

Accounting standards require LTIP awards be expensed

(and therefore included as remuneration) notwithstanding

that the Rights have not met the performance hurdles and

havelapsed.

No LTIP awards vested during 2012/2013 (under the 2011–2013

LTIP), however, a value is still required by accounting

standards to be included as statutory remuneration.

Additionally, LTIP awards that will be assessed for vesting in

future years are expensed over the three year testing period.

Therefore, the statutory remuneration table includes an

accounting value for part of the 2012–2014 and the 2013–2015 LTIP

awards.Testing will be undertaken as at 30 June 2014 and 30

June 2015 to determine whether Mr Joyce receives any shares

underthese awards.

As a result, an LTIP expense of $1.794 million is included in the

statutory remuneration table even though no LTIP awards

vested during 2012/2013. The following is a summary of the

statutory remuneration disclosures for the CEO (the full

statutory table is provided on page 82).

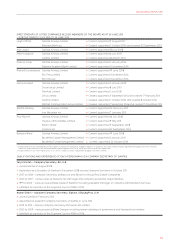

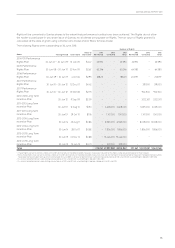

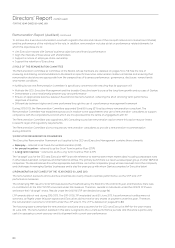

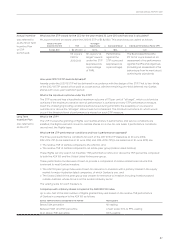

CEO Statutory

Remuneration Table 2013

$’000

2012

$’000

2013

“At Target” Pay

$’000

Base Pay (Cash FAR)12,109 2,109 2,125

STIP – Cash 775 – 1,700

STIP – Share Based 375 2,163 850

LTIP 1,794 1,134 1,700

Other259 171 n/a

Total 5,112 5,577 6,375

1 Reported Cash FAR is FAR of $2,125,000 (2012: $2,125,000) less superannuation

contributions of $16,470 (2012: $15,775).

2 Includes non-cash benets (such as travel), annual leave accruals, post-employment

and other long-term benets plus superannuation contributions of $16,470 (2012: $15,775).

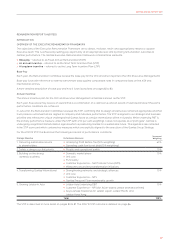

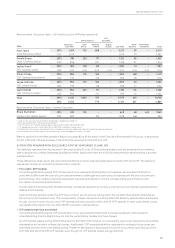

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2013

The Remuneration Report sets out remuneration information for

Non-Executive Directors, the CEO and Executive Management.

Section 300A of the Corporations Act 2001 requires disclosure

of remuneration information for Key Management Personnel

(KMP), with KMP dened in AASB 124 Related Party Disclosures

as those persons having authority and responsibility for

planning, directing and controlling the activities of the entity,

directly or indirectly, including any director (whether executive or

otherwise) of that entity.

The KMP for the 2012/2013 nancial year includes some

members of Executive Management.

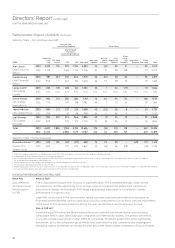

1 EXECUTIVE REMUNERATION OBJECTIVES AND APPROACH

In determining Executive remuneration, the Board aims to

do the following:

»Attract, retain and appropriately reward a capable

Executiveteam

»Motivate the Executive team to meet the unique challenges

the company faces as a major international airline based

inAustralia

»Link remuneration to performance