Qantas 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

QANTAS ANNUAL REPORT 2013

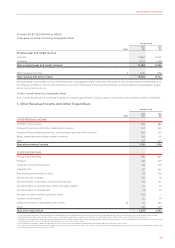

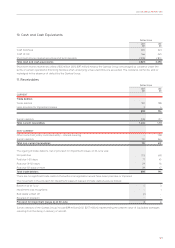

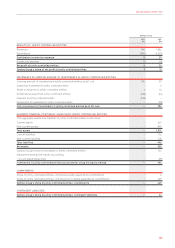

Non-cancellable aircraft

operating lease rentals

Qantas Domestic, Qantas International and Jetstar Group report non-cancellable aircraft

operating lease rentals for passenger aircraft externally leased by the Qantas Group and

own by the segment.

Qantas Freight reports non-cancellable aircraft operating lease rentals for freighter aircraft

externally leased by the Qantas Group.

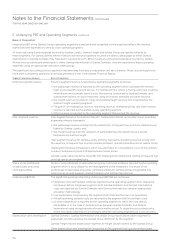

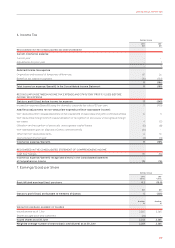

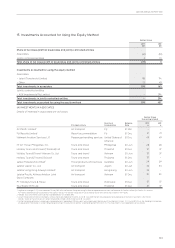

D DESCRIPTION OF UNDERLYING PBT AND RECONCILIATION

TO STATUTORY PROFIT/LOSS BEFORE TAX STATUTORY PBT

Underlying PBT is a non-statutory measure, and is the primary

reporting measure used by the Qantas Group’s chief operating

decision-making bodies, being the Chief Executive Ofcer,

Group Management Committee and the Board of Directors. The

objective of measuring and reporting Underlying PBT is to provide

a meaningful and consistent representation of the underlying

performance of the Group.

Underlying PBT is derived by adjusting Statutory PBT for

impacts of AASB 139: Financial Instruments: Recognition and

Measurement (AASB 139) which relate to other reporting periods

and identifying certain other items which are not included in

Underlying PBT.

(i) Adjusting for Impacts of AASB 139 which Relate to Other

Reporting Periods

All derivative transactions undertaken by the Qantas Group

represent economic hedges of underlying risk and exposures.

The Qantas Group does not enter into speculative derivative

transactions. Notwithstanding this, AASB 139 requires

certain mark-to-market movements in derivatives which are

classied as “ineffective” to be recognised immediately in the

Consolidated Income Statement. The recognition of derivative

valuation movements in reporting periods which differ from the

designated transaction causes volatility in statutory prot that

does not reect the hedging nature of these derivatives.

Underlying PBT reports all hedge derivative gains and losses

in the same reporting period as the underlying transaction by

adjusting the reporting period’s statutory prot for derivative

mark-to-market movements that relate to underlying exposures

in other reporting periods.

This adjustment is calculated as follows:

»Derivative mark-to-market movements recognised in the

current reporting period’s statutory prot that are associated

with current year exposures remain included in Underlying PBT

»Derivative mark-to-market movements recognised in the

current reporting period’s statutory prot that are associated

with underlying exposures which will occur in future reporting

periods are excluded from Underlying PBT

»Derivative mark-to-market movements recognised in the

current reporting period’s statutory prot that are associated

with capital expenditure are excluded from Underlying PBT

and subsequently included in Underlying PBT as an implied

adjustment to depreciation expense for the related assets

commencing when the assets are available for use

»Derivative mark-to-market movements recognised in previous

reporting periods statutory prot that are associated with

underlying exposures which occurred in the current year

are included in Underlying PBT

»Ineffectiveness and non-designated derivatives relating

to other reporting periods affecting net nance costs are

excluded from Underlying PBT

All derivative mark-to-market movements which have been

excluded from Underlying PBT will be recognised through

Underlying PBT in future periods when the underlying

transaction occurs.

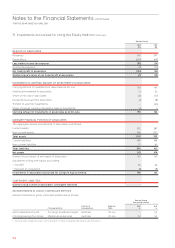

(ii) Other Items Not Included in Underlying PBT

Items which are identied by Management and reported to the

chief operating decision-making bodies as not representing

the underlying performance of the business are not included

in Underlying PBT. The determination of these items is made

after consideration of their nature and materiality and is applied

consistently from period to period.

Items not included in Underlying PBT primarily result from

revenues or expenses relating to business activities in other

reporting periods, major transformational/restructuring

initiatives, transactions involving investments and impairments

of assets outside the ordinary course of business.

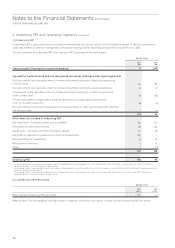

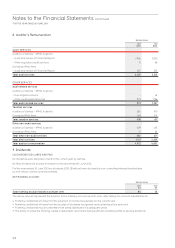

Segment Performance Measure Basis of Preparation