Qantas 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

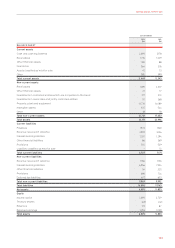

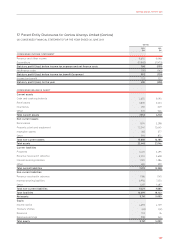

156

Qantas Group

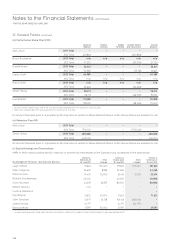

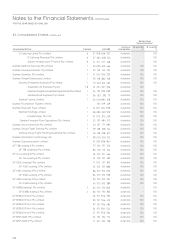

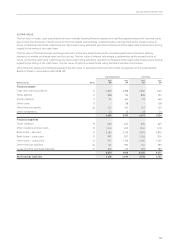

Prot Before Tax Hedge Reserve

2013

$M

2012

$M

2013

$M

2012

$M

100bps increase in interest rates

Variable rate interest-bearing instruments (net of cash) (25) (29) – –

Derivatives designated in a cash ow hedge relationship ––3034

Derivatives and xed rate debt in a fair value hedge relationship (14) 5 – –

100bps decrease in interest rates

Variable rate interest-bearing instruments (net of cash) 25 29 – –

Derivatives designated in a cash ow hedge relationship – – (32) (36)

Derivatives and xed rate debt in a fair value hedge relationship 15 (5) – –

20% movement in foreign currency pairs

20% (2012: 20%) USD depreciation (101) (27) (350) (205)

20% (2012: 20%) USD appreciation 101 60 728 422

20% movement in fuel indices

20% (2012: 20%) increase per barrel in fuel indices 60 88 200 70

20% (2012: 20%) decrease per barrel in fuel indices (70) (45) (51) (82)

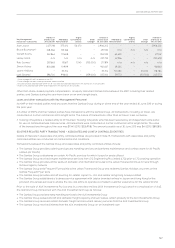

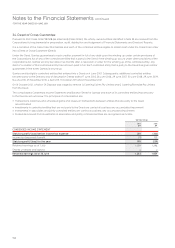

C CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by the counterparty during the term of the transaction

oron settlement of the transaction. Credit exposure is measured as the cost to replace existing transactions should a

counterpartydefault.

The Qantas Group conducts transactions with the following major types of counterparties:

»Trade debtor counterparties – the credit risk is the recognised amount, net of any impairment losses. As at 30 June 2013 trade

debtors amounted to $898 million (2012: $794 million). The Qantas Group has credit risk associated with travel agents, industry

settlement organisations and credit provided to direct customers. The Qantas Group minimises this credit risk through the

application of stringent credit policies and accreditation of travel agents through industry programs.

»Other nancial asset counterparties – the Qantas Group restricts its dealings to counterparties that have acceptable credit

ratings. Should the rating of a counterparty fall below certain levels, internal policy dictates that approval by the Board is required

to maintain the level of the counterparty exposure.

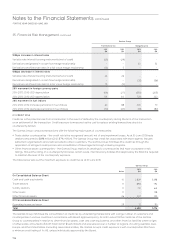

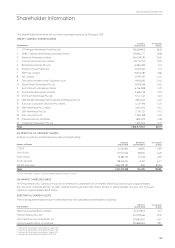

The table below sets out the maximum exposure to credit risk as at 30 June 2013:

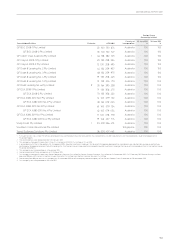

Qantas Group

Notes

2013

$M

2012

$M

On Consolidated Balance Sheet

Cash and cash equivalents 10 2,829 3,398

Trade debtors 11 898 794

Sundry debtors 11 712 661

Other loans 11 – 128

Other nancial assets 26 207 105

Off Consolidated Balance Sheet

Operating leases as lessor 29 12 90

Total 4,658 5,176

The Qantas Group minimises the concentration of credit risk by undertaking transactions with a large number of customers and

counterparties in various countries in accordance with Board approved policy. As at 30 June 2013 the credit risk of the Qantas

Group to counterparties in relation to other nancial assets, cash and cash equivalents, and other nancial liabilities where a right

of offset exists, amounted to $3,037 million (2012: $3,423 million) and was spread over a number of regions, including Australia, Asia,

Europe and the United States. Excluding associated entities, the Qantas Group’s credit exposure is with counterparties that have

a minimum credit rating of A-/A3, unless individually approved by the Board.

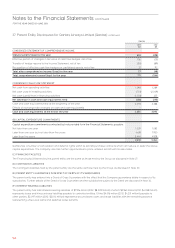

35. Financial Risk Management

continue

d

Notes to the Financial Statements continued

FOR THE YEAR ENDED 30 JUNE 2013