Qantas 2013 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

QANTAS ANNUAL REPORT 2013

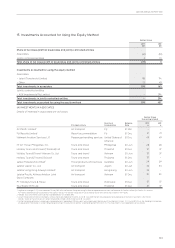

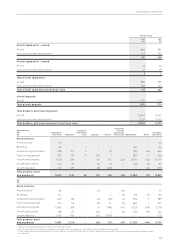

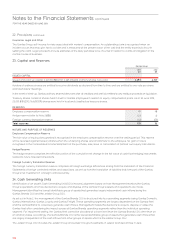

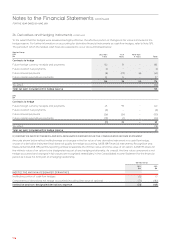

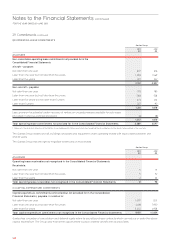

The Qantas Brands CGU and the Jetstar Group CGU have goodwill and other intangible assets with indenite useful lives as follows:

Qantas Group

2013

$M

2012

$M

Goodwill

Qantas Brands 66 17

Jetstar Group 131 129

197 146

Other intangible assets with indenite useful lives

Qantas Brands 35

35

Jetstar Group 22

20

57 55

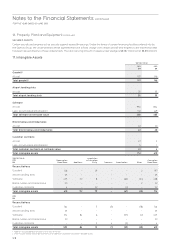

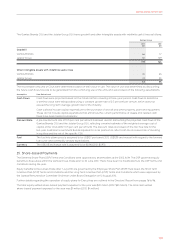

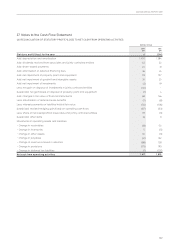

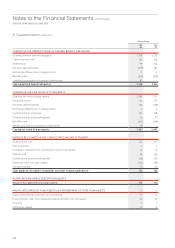

The recoverable amounts of CGUs were determined based on their value in use. The value in use was determined by discounting

the future cash ows forecast to be generated from the continuing use of the units and were based on the following assumptions:

Assumption How Determined

Cash Flows Cash ows were projected based on the Financial Plan covering a three-year period. Cash ows to determine

a terminal value were extrapolated using a constant growth rate of 2.5 per cent per annum, which does not

exceed the long-term average growth rate for the industry.

Cash outows include capital expenditure for the purchase of aircraft and other property, plant and equipment.

These do not include capital expenditure that enhances the current performance of assets and related cash

ows have been treated consistently.

Discount Rate A pre-tax discount rate of 10.5 per cent per annum has been used in discounting the projected cash ows of the

Qantas Brands CGU and the Jetstar Group CGU, reecting a market estimate of the weighted average cost of

capital of the CGUs (2012: 10.5 per cent per annum). The discount rates are based on the risk-free rate for the

ten-year Australian Government Bonds adjusted for a risk premium to reect both the increased risk of investing

in equities and the risk of the specic CGU.

Fuel The fuel into-plane price is assumed to be US$127 per barrel (2012: US$129) and was set with regard to the forward

fuel curve and commodity analyst expectations.

Currency The US$:A$ exchange rate is assumed to be $0.96 (2012: $0.97).

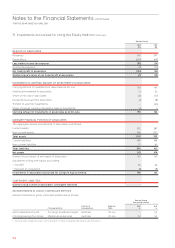

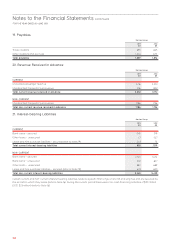

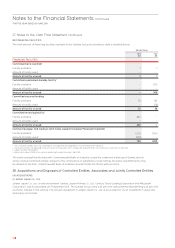

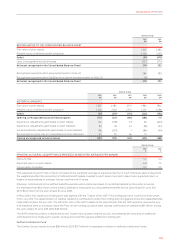

25. Share-based Payments

The Deferred Share Plan (DSP) Terms and Conditions were approved by shareholders at the 2002 AGM. The DSP governed equity

benets to Executives within the Qantas Group made prior to 30 June 2010. There have been no modications to the DSP Terms and

Conditions during the year.

Equity benets to Executives made after 1 July 2010 are governed by the Employee Share Plan (ESP) Trust Deed, the Short Term

Incentive Plan (STIP) Terms and Conditions and the Long Term Incentive Plan (LTIP) Terms and Conditions which were approved by

the Qantas Remuneration Committee Chairman under Board Delegation on 12 August 2010.

Further details regarding the operation of equity plans for Executives are outlined in the Directors’ Report from pages 76 to 96.

The total equity settled share-based payment expense for the year was $20 million (2012: $31 million). The total cash settled

share-based payment expense for the year was $1 million (2012: $4 million).