Qantas 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

121

QANTAS ANNUAL REPORT 2013

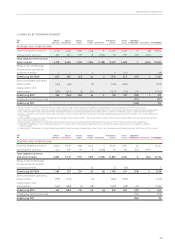

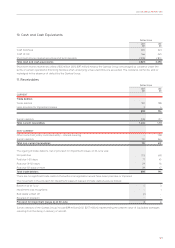

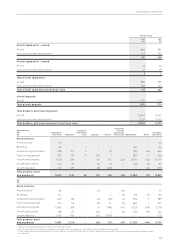

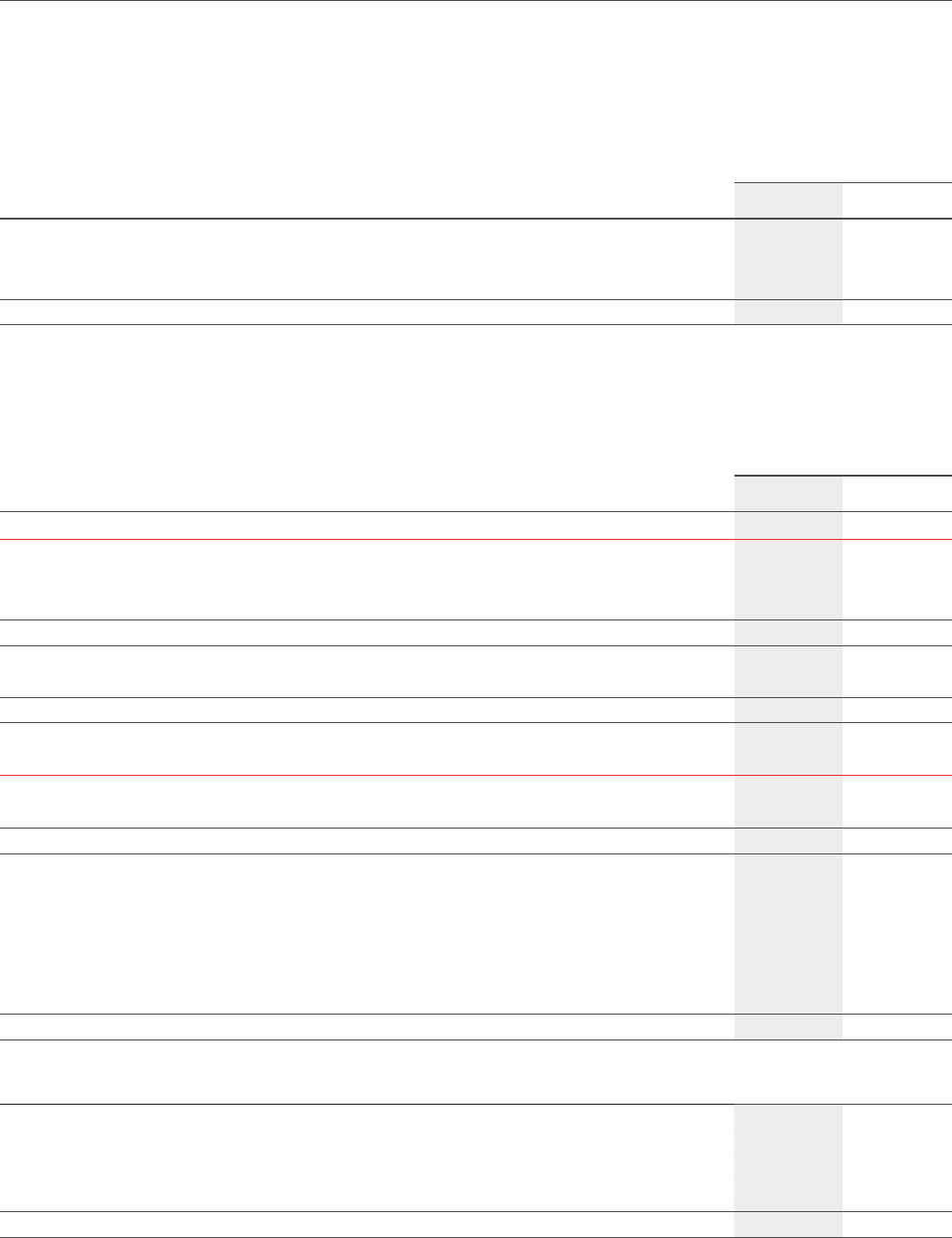

10. Cash and Cash Equivalents

Qantas Group

2013

$M

2012

$M

Cash balances 265 343

Cash at call 166 245

Short-term money market securities and term deposits 2,398 2,810

Total cash and cash equivalents 2,829 3,398

Short-term money market securities of $14 million (2012: $97 million) held by the Qantas Group are pledged as collateral under the

terms of certain operational nancing facilities when underlying unsecured limits are exceeded. The collateral cannot be sold or

repledged in the absence of default by the Qantas Group.

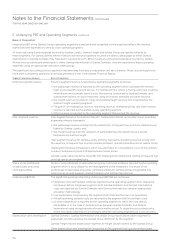

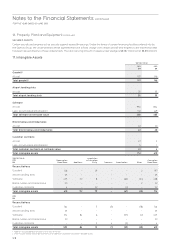

11. Receivables

Qantas Group

2013

$M

2012

$M

CURRENT

Trade debtors

Trade debtors 901 798

Less: provision for impairment losses 34

898 794

Sundry debtors 538 317

Total current receivables 1,436 1,111

NONCURRENT

Other loans from jointly controlled entity – interest-bearing –128

Sundry debtors 174 344

Total non-current receivables 174 472

The ageing of trade debtors, net of provision for impairment losses, at 30 June was:

Not past due 753 691

Past due 1–30 days 77 40

Past due 31–120 days 29 16

Past due 121 days or more 39 47

Total trade debtors 898 794

There are no signicant trade debtors that without renegotiation would have been past due or impaired.

The movement in the provision for impairment losses in respect of trade debtors was as follows:

Balance as at 1 July 43

Impairment loss recognised –1

Bad debts written off (1) –

Reversal of provision ––

Provision for impairment losses as at 30 June 34

Sundry debtors of the Qantas Group include $99 million (2012: $257 million), representing the present value of liquidated damages

resulting from the delay in delivery of aircraft.